Jeweller - December 2020

• Survival lessons: Essential business tips learned from a year of upheaval • Full state of play: a comprehensive report into the Australian jewellery industry in 2020 • Show stoppers: standout jewellery pieces from local talents

• Survival lessons: Essential business tips learned from a year of upheaval

• Full state of play: a comprehensive report into the Australian jewellery industry in 2020

• Show stoppers: standout jewellery pieces from local talents

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STATE OF THE INDUSTRY<br />

Chains through the Decade<br />

CHAIN REACTIONS<br />

Australian jewellery retailing has undergone significant evolution over the past<br />

decade, but, surprisingly, the changes are very different to what was expected when<br />

<strong>Jeweller</strong> published its last State of the Industry Report in 2010.<br />

A<br />

decade on from <strong>Jeweller</strong>’s first State of<br />

the Industry Report, the jewellery retail<br />

industry – mirroring the broader retail<br />

sector – has undergone momentous change. Yet<br />

over the past 10 years, fine jewellery chain stores<br />

have remained relatively resilient, at least in<br />

terms of store numbers.<br />

However, the same cannot be said for the fashion<br />

jewellery category!<br />

There were 21 fine jewellery chain store ‘brands’ in 2010,<br />

operating a total of 977 stores nationally. On a Like-By-Like<br />

basis, by <strong>2020</strong> that number had declined by 125 stores to 852,<br />

representing a 13 per cent reduction in total store count.<br />

That contraction could be considered small when compared<br />

with the performance of other consumer categories.<br />

Some fine jewellery chains – such as Prouds and Michael Hill<br />

– managed to increase overall store numbers, while others<br />

marginally decreased.<br />

Only two ‘names’ entirely disappeared from the list: Blue<br />

Spirit, a lesser-known small franchise, which operated six<br />

stores in 2010, and the high-profile Thomas <strong>Jeweller</strong>s, with<br />

nine stores.<br />

James Thomas founded Thomas <strong>Jeweller</strong>s in 1896 in<br />

Ballarat. After 121 years of operation, the Thomas family<br />

decided to close its iconic Bourke Street Mall store in<br />

Melbourne in October 2017, as well as the Warnambool,<br />

Wagga Wagga, Albury, Shepparton, Bendigo, Ballarat and<br />

Geelong stores.<br />

In contrast, of the seven fashion jewellery chains listed in the<br />

State of the Industry Report (SOIR) 10 years ago, only one<br />

remains – six closed their physical stores.<br />

The proverbial ‘last man standing’, Lovisa, has grown from 35<br />

locations in Australia to 152 over the past decade, following<br />

the liquidation and closure of major competitors and smaller<br />

fashion jewellery chains alike – including its sister chain Diva.<br />

The ‘downfall’ of the six fashion jewellery chains means<br />

that of the 378 stores that were operating in 2010, 343 no<br />

longer exist.<br />

Demise of fashion chains<br />

For the purpose of research and a report, it is necessary<br />

to create definitions in order to accurately measure and<br />

compare results across categories and over time.<br />

Therefore, a ‘chain’ is defined as a group of five or more<br />

BY THE NUMBERS<br />

Chain Insights<br />

In this report, a ‘chain’<br />

is defined as a group of<br />

five or more jewellery<br />

stores trading under<br />

the one (brand) name,<br />

with one ownership<br />

entity – a person or<br />

company –<br />

co-ordinating buying<br />

and marketing<br />

activities across the<br />

group. It could include a<br />

franchise operation.<br />

1164<br />

fine jewellery<br />

chain stores<br />

remain open as<br />

at <strong>December</strong> <strong>2020</strong><br />

343<br />

of 378 fashion<br />

jewellery chain<br />

stores have closed<br />

since 2010<br />

50%<br />

chains in<br />

Australia are<br />

owned and / or<br />

controlled by New<br />

Zealand entities<br />

jewellery stores trading under the one (brand) name, with<br />

one ownership entity – a person or company – co-ordinating<br />

buying and marketing activities across the group. It could<br />

include a franchise operation.<br />

In addition, <strong>Jeweller</strong> notes that a chain store usually has<br />

central management and standardised business methods<br />

and practices and will purchase product from both local<br />

suppliers and/or import its own product.<br />

In <strong>2020</strong>, Lovisa is the largest fashion jewellery chain<br />

operating in Australia. The ASX-listed BB Retail Capital,<br />

founded by retail entrepreneur Brett Blundy, owns it.<br />

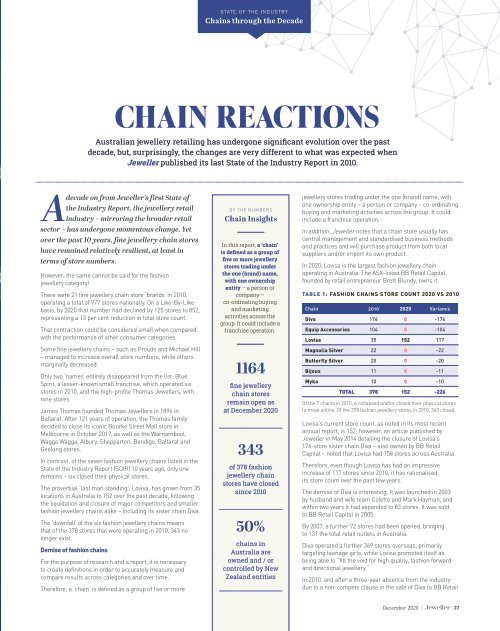

TABLE 1: FASHION CHAINS STORE COUNT <strong>2020</strong> VS 2010<br />

Chain 2010 <strong>2020</strong> Variance<br />

Diva 176 0 -176<br />

Equip Accessories 104 0 -104<br />

Lovisa 35 152 117<br />

Magnolia Silver 22 0 -22<br />

Butterfly Silver 20 0 -20<br />

Bijoux 11 0 -11<br />

Myka 10 0 -10<br />

TOTAL 378 152 -226<br />

Of the 7 chains in 2010, 6 collapsed and/or closed their physical stores<br />

to move online. Of the 378 fashion jewellery stores in 2010, 343 closed.<br />

Lovisa’s current store count, as noted in its most recent<br />

annual report, is 152; however, an article published by<br />

<strong>Jeweller</strong> in May 2014 detailing the closure of Lovisa’s<br />

176-store sister chain Diva – also owned by BB Retail<br />

Capital – noted that Lovisa had 158 stores across Australia.<br />

Therefore, even though Lovisa has had an impressive<br />

increase of 117 stores since 2010, it has rationalised<br />

its store count over the past few years.<br />

The demise of Diva is interesting. It was launched in 2003<br />

by husband and wife team Colette and Mark Hayman, and<br />

within two years it had expanded to 83 stores. It was sold<br />

to BB Retail Capital in 2005.<br />

By 2007, a further 72 stores had been opened, bringing<br />

to 131 the total retail outlets in Australia.<br />

Diva operated a further 369 stores overseas, primarily<br />

targeting teenage girls, while Lovisa promoted itself as<br />

being able to “fill the void for high quality, fashion forward<br />

and directional jewellery.”<br />

In 2010, and after a three-year absence from the industry<br />

due to a non-compete clause in the sale of Diva to BB Retail<br />

<strong>December</strong> <strong>2020</strong> | 37