Jeweller - December 2020

• Survival lessons: Essential business tips learned from a year of upheaval • Full state of play: a comprehensive report into the Australian jewellery industry in 2020 • Show stoppers: standout jewellery pieces from local talents

• Survival lessons: Essential business tips learned from a year of upheaval

• Full state of play: a comprehensive report into the Australian jewellery industry in 2020

• Show stoppers: standout jewellery pieces from local talents

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Brand-only stores | STATE OF THE INDUSTRY<br />

OV ER V IE W<br />

Rise & Fall<br />

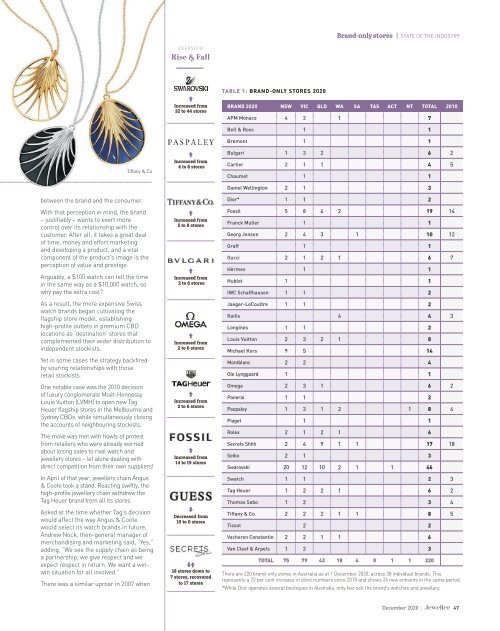

TABLE 1: BRAND-ONLY STORES <strong>2020</strong><br />

Increased from<br />

32 to 44 stores<br />

BRAND <strong>2020</strong> NSW VIC QLD WA SA TAS ACT NT TOTAL 2010<br />

APM Monaco 4 2 1 7<br />

Tiffany & Co<br />

between the brand and the consumer.<br />

With that perception in mind, the brand<br />

– justifiably – wants to exert more<br />

control over its relationship with the<br />

customer. After all, it takes a great deal<br />

of time, money and effort marketing<br />

and developing a product, and a vital<br />

component of the product’s image is the<br />

perception of value and prestige.<br />

Arguably, a $100 watch can tell the time<br />

in the same way as a $10,000 watch, so<br />

why pay the extra cost?<br />

As a result, the more expensive Swiss<br />

watch brands began cultivating the<br />

flagship store model, establishing<br />

high-profile outlets in premium CBD<br />

locations as ‘destination’ stores that<br />

complemented their wider distribution to<br />

independent stockists.<br />

Yet in some cases the strategy backfired<br />

by souring relationships with those<br />

retail stockists.<br />

One notable case was the 2010 decision<br />

of luxury conglomerate Moët-Hennessy<br />

Louis Vuitton (LVMH) to open new Tag<br />

Heuer flagship stores in the Melbourne and<br />

Sydney CBDs, while simultaneously closing<br />

the accounts of neighbouring stockists.<br />

The move was met with howls of protest<br />

from retailers who were already worried<br />

about losing sales to rival watch and<br />

jewellery stores – let alone dealing with<br />

direct competition from their own suppliers!<br />

In April of that year, jewellery chain Angus<br />

& Coote took a stand. Reacting swiftly, the<br />

high-profile jewellery chain withdrew the<br />

Tag Heuer brand from all its stores.<br />

Asked at the time whether Tag’s decision<br />

would affect the way Angus & Coote<br />

would select its watch brands in future,<br />

Andrew Nock, then-general manager of<br />

merchandising and marketing said, “Yes,”<br />

adding, “We see the supply chain as being<br />

a partnership; we give respect and we<br />

expect respect in return. We want a winwin<br />

situation for all involved.”<br />

There was a similar uproar in 2007 when<br />

Increased from<br />

4 to 8 stores<br />

Increased from<br />

5 to 8 stores<br />

Increased from<br />

2 to 6 stores<br />

Increased from<br />

2 to 6 stores<br />

Increased from<br />

2 to 6 stores<br />

Increased from<br />

14 to 19 stores<br />

Decreased from<br />

10 to 0 stores<br />

18 stores down to<br />

7 stores, recovered<br />

to 17 stores<br />

Bell & Ross 1 1<br />

Bremont 1 1<br />

Bulgari 1 3 2 6 2<br />

Cartier 2 1 1 4 5<br />

Chaumet 1 1<br />

Daniel Wellington 2 1 3<br />

Dior* 1 1 2<br />

Fossil 5 8 4 2 19 14<br />

Franck Muller 1 1<br />

Georg Jensen 2 4 3 1 10 12<br />

Graff 1 1<br />

Gucci 2 1 2 1 6 7<br />

Hèrmes 1 1<br />

Hublot 1 1<br />

IWC Schaffhausen 1 1 2<br />

Jaeger-LeCoultre 1 1 2<br />

Kailis 4 4 3<br />

Longines 1 1 2<br />

Louis Vuitton 2 3 2 1 8<br />

Michael Kors 9 5 14<br />

Montblanc 2 2 4<br />

Ole Lynggaard 1 1<br />

Omega 2 3 1 6 2<br />

Panerai 1 1 2<br />

Paspaley 1 3 1 2 1 8 4<br />

Piaget 1 1<br />

Rolex 2 1 2 1 6<br />

Secrets Shhh 2 4 9 1 1 17 18<br />

Seiko 2 1 3<br />

Swarovski 20 12 10 2 1 1 46<br />

Swatch 1 1 2 3<br />

Tag Heuer 1 2 2 1 6 2<br />

Thomas Sabo 1 2 3 4<br />

Tiffany & Co. 2 2 2 1 1 8 5<br />

Tissot 2 2<br />

Vacheron Constantin 2 2 1 1 6<br />

Van Cleef & Arpels 1 2 3<br />

TOTAL 75 79 42 18 4 0 1 1 220<br />

There are 220 brand-only stores in Australia as at 1 <strong>December</strong> <strong>2020</strong>, across 38 individual brands. This<br />

represents a 72 per cent increase in store numbers since 2010 and shows 24 new entrants in the same period.<br />

*While Dior operates several boutiques in Australia, only two sell the brand’s watches and jewellery.<br />

<strong>December</strong> <strong>2020</strong> | 47