Jeweller - December 2020

• Survival lessons: Essential business tips learned from a year of upheaval • Full state of play: a comprehensive report into the Australian jewellery industry in 2020 • Show stoppers: standout jewellery pieces from local talents

• Survival lessons: Essential business tips learned from a year of upheaval

• Full state of play: a comprehensive report into the Australian jewellery industry in 2020

• Show stoppers: standout jewellery pieces from local talents

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

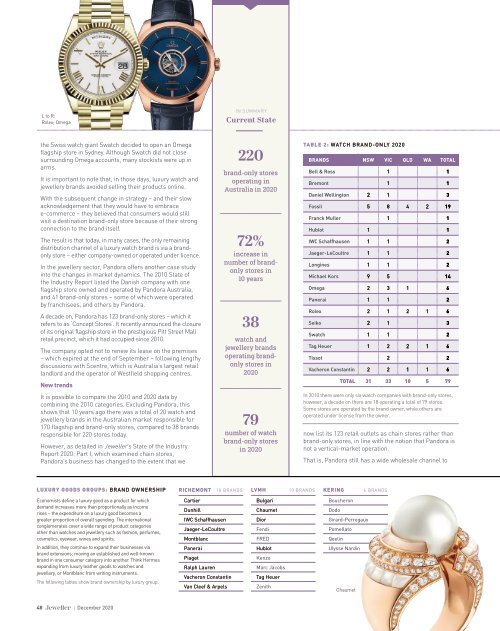

L to R:<br />

Rolex; Omega<br />

IN SUMM A RY<br />

Current State<br />

the Swiss watch giant Swatch decided to open an Omega<br />

flagship store in Sydney. Although Swatch did not close<br />

surrounding Omega accounts, many stockists were up in<br />

arms.<br />

It is important to note that, in those days, luxury watch and<br />

jewellery brands avoided selling their products online.<br />

With the subsequent change in strategy – and their slow<br />

acknowledgement that they would have to embrace<br />

e-commerce – they believed that consumers would still<br />

visit a destination brand-only store because of their strong<br />

connection to the brand itself.<br />

The result is that today, in many cases, the only remaining<br />

distribution channel of a luxury watch brand is via a brandonly<br />

store – either company-owned or operated under licence.<br />

In the jewellery sector, Pandora offers another case study<br />

into the changes in market dynamics. The 2010 State of<br />

the Industry Report listed the Danish company with one<br />

flagship store owned and operated by Pandora Australia,<br />

and 41 brand-only stores – some of which were operated<br />

by franchisees, and others by Pandora.<br />

A decade on, Pandora has 123 brand-only stores – which it<br />

refers to as ‘Concept Stores’. It recently announced the closure<br />

of its original flagship store in the prestigious Pitt Street Mall<br />

retail precinct, which it had occupied since 2010.<br />

The company opted not to renew its lease on the premises<br />

– which expired at the end of September – following lengthy<br />

discussions with Scentre, which is Australia’s largest retail<br />

landlord and the operator of Westfield shopping centres.<br />

New trends<br />

It is possible to compare the 2010 and <strong>2020</strong> data by<br />

combining the 2010 categories. Excluding Pandora, this<br />

shows that 10 years ago there was a total of 20 watch and<br />

jewellery brands in the Australian market responsible for<br />

170 flagship and brand-only stores, compared to 38 brands<br />

responsible for 220 stores today.<br />

However, as detailed in <strong>Jeweller</strong>’s State of the Industry<br />

Report <strong>2020</strong>: Part I, which examined chain stores,<br />

Pandora’s business has changed to the extent that we<br />

220<br />

brand-only stores<br />

operating in<br />

Australia in <strong>2020</strong><br />

72%<br />

increase in<br />

number of brandonly<br />

stores in<br />

10 years<br />

38<br />

watch and<br />

jewellery brands<br />

operating brandonly<br />

stores in<br />

<strong>2020</strong><br />

79<br />

number of watch<br />

brand-only stores<br />

in <strong>2020</strong><br />

TABLE 2: WATCH BRAND-ONLY <strong>2020</strong><br />

BRANDS NSW VIC QLD WA TOTAL<br />

Bell & Ross 1 1<br />

Bremont 1 1<br />

Daniel Wellington 2 1 3<br />

Fossil 5 8 4 2 19<br />

Franck Muller 1 1<br />

Hublot 1 1<br />

IWC Schaffhausen 1 1 2<br />

Jaeger-LeCoultre 1 1 2<br />

Longines 1 1 2<br />

Michael Kors 9 5 14<br />

Omega 2 3 1 6<br />

Panerai 1 1 2<br />

Rolex 2 1 2 1 6<br />

Seiko 2 1 3<br />

Swatch 1 1 2<br />

Tag Heuer 1 2 2 1 6<br />

Tissot 2 2<br />

Vacheron Constantin 2 2 1 1 6<br />

TOTAL 31 33 10 5 79<br />

In 2010 there were only six watch companies with brand-only stores,<br />

however, a decade on there are 18 operating a total of 79 stores.<br />

Some stores are operated by the brand owner, while others are<br />

operated under license from the owner.<br />

now list its 123 retail outlets as chain stores rather than<br />

brand-only stores, in line with the notion that Pandora is<br />

not a vertical-market operation.<br />

That is, Pandora still has a wide wholesale channel to<br />

LUXURY GOODS GROUPS: BRAND OWNERSHIP<br />

RICHEMONT 10 BRANDS<br />

LVMH<br />

10 BRANDS<br />

KERING<br />

6 BRANDS<br />

Economists define a luxury good as a product for which<br />

demand increases more than proportionally as income<br />

rises – the expenditure on a luxury good becomes a<br />

greater proportion of overall spending. The international<br />

conglomerates cover a wide range of product categories<br />

other than watches and jewellery such as fashion, perfumes,<br />

cosmetics, eyewear, wines and spirits.<br />

Cartier<br />

Dunhill<br />

IWC Schaffhausen<br />

Jaeger-LeCoultre<br />

Montblanc<br />

Bulgari<br />

Chaumet<br />

Dior<br />

Fendi<br />

FRED<br />

Boucheron<br />

Dodo<br />

Girard-Perregaux<br />

Pomellato<br />

Qeelin<br />

In addition, they continue to expand their businesses via<br />

brand extensions; moving an established and well-known<br />

brand in one consumer category into another. Think Hermes<br />

expanding from luxury leather goods to watches and<br />

jewellery, or Montblanc from writing instruments.<br />

The following tables show brand ownership by luxury group.<br />

Panerai<br />

Piaget<br />

Ralph Lauren<br />

Vacheron Constantin<br />

Van Cleef & Arpels<br />

Hublot<br />

Kenzo<br />

Marc Jacobs<br />

Tag Heuer<br />

Zenith<br />

Ulysse Nardin<br />

Chaumet<br />

48 | <strong>December</strong> <strong>2020</strong>