Jeweller - December 2020

• Survival lessons: Essential business tips learned from a year of upheaval • Full state of play: a comprehensive report into the Australian jewellery industry in 2020 • Show stoppers: standout jewellery pieces from local talents

• Survival lessons: Essential business tips learned from a year of upheaval

• Full state of play: a comprehensive report into the Australian jewellery industry in 2020

• Show stoppers: standout jewellery pieces from local talents

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STATE OF THE INDUSTRY<br />

Buying Groups Report<br />

STRENGTH in NUMBERS<br />

Following a year of unprecedented upheaval, <strong>Jeweller</strong> revisited the four jewellery industry buying groups<br />

profiled in our March report to explore how they have adapted and supported members throughout COVID-19.<br />

It feels as if it’s every second day that we read<br />

about another retailer closing its doors.<br />

Economic and financial causes aren’t the<br />

only issues at play; Australia has also had to<br />

contend with drought, floods, fires and now the<br />

coronavirus, all of which have taken their toll on<br />

the already fragile retail industry.<br />

In March, Colin Pocklington, managing director Nationwide<br />

<strong>Jeweller</strong>s – Australia and New Zealand’s largest buying group<br />

– told <strong>Jeweller</strong>, “The conservative spending of consumers<br />

continues to adversely affect the industry. Until we see real<br />

growth in incomes and an easing in cost of living, we are<br />

unlikely to see growth of sales.”<br />

Yet in the wake of the pandemic, he struck a more optimistic<br />

tone: “Obviously the last few months have been stressful for<br />

everyone – particularly our Melbourne and Victorian members<br />

and suppliers. That said, trading is very buoyant at the<br />

moment. Consumers appear to be confident, with the virus<br />

now under control.<br />

“An increasing demand for custom design continues to<br />

grow, with Australians who would normally be overseas now<br />

spending their money domestically,” he explained.<br />

That insight was echoed by Carson Webb, general manager<br />

Showcase <strong>Jeweller</strong>s, who said, “Consumers have very limited<br />

travel plans and are more confident to remain local, support<br />

local businesses, and enjoy the simple things around the again.<br />

This is also true for our New Zealand members – and this is<br />

true for many retail businesses, not just jewellery.”<br />

He added, “I’d even go as far as to say this has seen the<br />

resurgence of the independent jeweller, and many would be<br />

booked out for weeks with makes and repairs.”<br />

At Australia’s newest jewellery buying group, Independent<br />

<strong>Jeweller</strong>s Collective (IJC) – which launched in the first three<br />

months of the year – the pandemic had an unexpectedly<br />

unifying effect, according to CEO Josh Zarb.<br />

“The uncertainty in the early days of COVID-19 was just as hard<br />

for us a anyone, and it took hold just as we were launching IJC.<br />

What it did do, which inadvertently worked in our favour, was to<br />

pull a group of retailers together very quickly.<br />

“[Our members] formed a very tight bond from the onset,<br />

which gave us a great sense of community.”<br />

Zarb also noted an uptick in sales for members, saying, “The<br />

most pleasing thing to note throughout the last six months was<br />

just how strong regional retail trade has been and almost all of<br />

our members’ stores have been trading very strongly.”<br />

By July, IJC had surpassed its initial member target of 40<br />

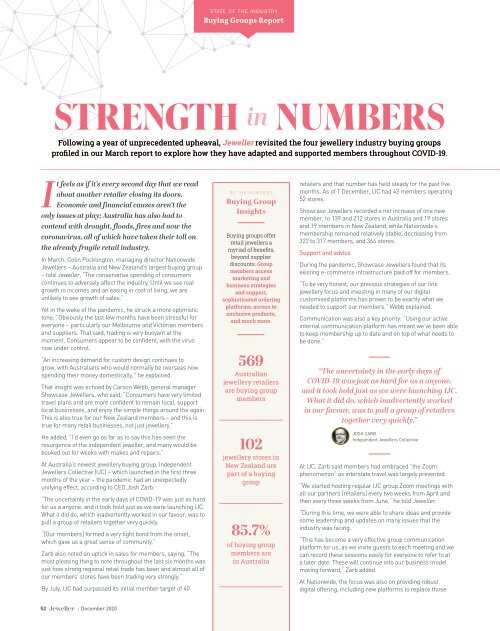

BY THE NUMBERS<br />

Buying Group<br />

Insights<br />

Buying groups offer<br />

retail jewellers a<br />

myriad of benefits,<br />

beyond supplier<br />

discounts. Group<br />

members access<br />

marketing and<br />

business strategies<br />

and support,<br />

sophisticated ordering<br />

platforms, access to<br />

exclusive products,<br />

and much more.<br />

569<br />

Australian<br />

jewellery retailers<br />

are buying group<br />

members<br />

102<br />

jewellery stores in<br />

New Zealand are<br />

part of a buying<br />

group<br />

85.7%<br />

of buying group<br />

members are<br />

in Australia<br />

retailers and that number has held steady for the past five<br />

months. As of 1 <strong>December</strong>, IJC had 43 members operating<br />

52 stores.<br />

Showcase <strong>Jeweller</strong>s recorded a net increase of one new<br />

member, to 139 and 212 stores in Australia and 19 stores<br />

and 19 members in New Zealand, while Nationwide’s<br />

membership remained relatively stable, decreasing from<br />

322 to 317 members, and 364 stores.<br />

Support and advice<br />

During the pandemic, Showcase <strong>Jeweller</strong>s found that its<br />

existing e-commerce infrastructure paid off for members.<br />

“To be very honest, our previous strategies of our fine<br />

jewellery focus and investing in many of our digital<br />

customised platforms has proven to be exactly what we<br />

needed to support our members,” Webb explained.<br />

Communication was also a key priority: “Using our active<br />

internal communication platform has meant we’ve been able<br />

to keep membership up to date and on top of what needs to<br />

be done.”<br />

“The uncertainty in the early days of<br />

COVID-19 was just as hard for us a anyone,<br />

and it took hold just as we were launching IJC.<br />

What it did do, which inadvertently worked<br />

in our favour, was to pull a group of retailers<br />

together very quickly.”<br />

JOSH ZARB<br />

Independent <strong>Jeweller</strong>s Collective<br />

At IJC, Zarb said members had embraced “the Zoom<br />

phenomenon” as interstate travel was largely prevented.<br />

“We started hosting regular IJC group Zoom meetings with<br />

all our partners [retailers] every two weeks from April and<br />

then every three weeks from June,” he told <strong>Jeweller</strong>.<br />

“During this time, we were able to share ideas and provide<br />

some leadership and updates on many issues that the<br />

industry was facing.<br />

“This has become a very effective group communication<br />

platform for us, as we invite guests to each meeting and we<br />

can record these sessions easily for everyone to refer to at<br />

a later date. These will continue into our business model<br />

moving forward,” Zarb added.<br />

At Nationwide, the focus was also on providing robust<br />

digital offering, including new platforms to replace those<br />

52 | <strong>December</strong> <strong>2020</strong>