Jeweller - December 2020

• Survival lessons: Essential business tips learned from a year of upheaval • Full state of play: a comprehensive report into the Australian jewellery industry in 2020 • Show stoppers: standout jewellery pieces from local talents

• Survival lessons: Essential business tips learned from a year of upheaval

• Full state of play: a comprehensive report into the Australian jewellery industry in 2020

• Show stoppers: standout jewellery pieces from local talents

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STATE OF THE INDUSTRY | Chains through the decade<br />

<strong>2020</strong><br />

STORE COUNT<br />

Top 5<br />

Largest Fine<br />

<strong>Jeweller</strong>y<br />

Chains<br />

Capital, Colette Hayman launched a new<br />

fashion jewellery and accessories store,<br />

eponymously named Colette Accessories.<br />

The first Colette Accessories store opened<br />

in Sydney’s CBD and, at the time, Hayman<br />

boasted that they would have 120 stores<br />

within three years. By 2014, the store count<br />

had reached 102 across Australia, with a<br />

further 18 overseas.<br />

In contrast, of the seven fashion<br />

jewellery chains listed in the State<br />

of the Industry Report (SOIR) 10<br />

years ago, only one remains – six<br />

closed their physical stores...<br />

The ‘downfall’ of the six fashion<br />

jewellery chains means that of the<br />

378 stores that were operating in<br />

2010, 343 no longer exist.<br />

However in February, the company – which<br />

had been renamed Colette By Colette<br />

Hayman – was placed into administration.<br />

At the time of publication, it had emerged<br />

from the administration process with<br />

35 stores.<br />

Diva and Colette are not the only large<br />

fashion jewellery chains to have found<br />

the going tough over the past decade.<br />

Other closures<br />

Butterfly Silver, a fashion jewellery business<br />

established in 2002, operated 20 stores in<br />

2010. It collapsed in March 2018 closing<br />

all locations.<br />

However, Hoskings subsequently acquired<br />

the e-commerce business butterflysilver.<br />

com.au.<br />

Equip Accessories, which featured in the<br />

2010 SOIR with 104 stores, was liquidated<br />

in 2017. It had expanded to 110 Australian<br />

stores, all of which were closed.<br />

The other three fashion chains that didn’t<br />

survive the decade with bricks and mortar<br />

locations were Magnolia Silver, Bijoux,<br />

and Myka.<br />

In total, and along with Butterfly Silver,<br />

they represented 63 store closures.<br />

Magnolia Silver and Bijoux now operate<br />

as online-only businesses.<br />

On the other hand, Silvershop, which<br />

was founded in 1999, has now expanded<br />

to seven stores in Queensland making it<br />

a small chain.<br />

This collapse of 343 fashion jewellery<br />

stores, along with Colette’s 64-store<br />

closure as a result of administration,<br />

leads to the question: why has the retail<br />

landscape changed so drastically over<br />

the past decade for the lower end of<br />

the market?<br />

The answer likely lies in more strenuous<br />

competition from online incumbents<br />

and new entrants, given that low-margin,<br />

high-volume fashion jewellery is more<br />

suited to internet sales than higher-value,<br />

low-volume fine jewellery.<br />

Further, and more importantly, the<br />

continual increase in shopping centre<br />

tenancy costs – particularly persquare-metre<br />

rents – has resulted in an<br />

unsustainable business model, especially<br />

when ‘rent’ includes a sales percentage.<br />

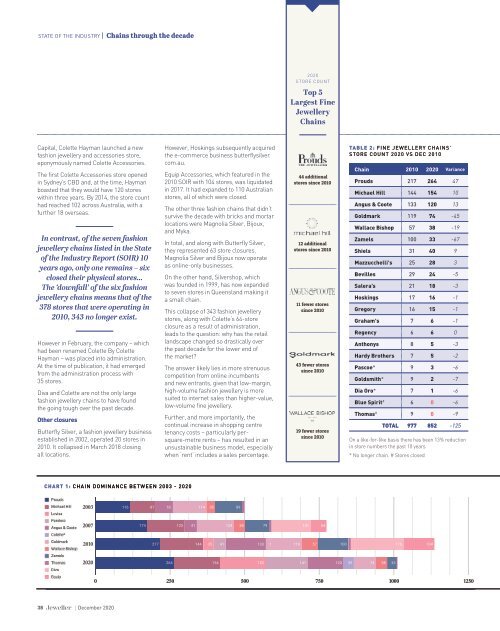

44 additional<br />

stores since 2010<br />

12 additional<br />

stores since 2010<br />

11 fewer stores<br />

since 2010<br />

43 fewer stores<br />

since 2010<br />

19 fewer stores<br />

since 2010<br />

TABLE 2: FINE JEWELLERY CHAINS’<br />

STORE COUNT <strong>2020</strong> VS DEC 2010<br />

Chain 2010 <strong>2020</strong> Variance<br />

Prouds 217 264 47<br />

Michael Hill 144 154 10<br />

Angus & Coote 133 120 13<br />

Goldmark 119 74 -45<br />

Wallace Bishop 57 38 -19<br />

Zamels 100 33 -67<br />

Shiels 31 40 9<br />

Mazzucchelli's 25 28 3<br />

Bevilles 29 24 -5<br />

Salera’s 21 18 -3<br />

Hoskings 17 16 -1<br />

Gregory 16 15 -1<br />

Graham's 7 6 -1<br />

Regency 6 6 0<br />

Anthonys 8 5 -3<br />

Hardy Brothers 7 5 -2<br />

Pascoe* 9 3 -6<br />

Goldsmith* 9 2 -7<br />

Dia Oro* 7 1 -6<br />

Blue Spirit # 6 0 -6<br />

Thomas # 9 0 -9<br />

TOTAL 977 852 -125<br />

On a like-for-like basis there has been 13% reduction<br />

in store numbers the past 10 years<br />

* No longer chain. # Stores closed<br />

CHART 1: CHAIN DOMINANCE BETWEEN 2003 - <strong>2020</strong><br />

2003<br />

2007<br />

2010<br />

<strong>2020</strong><br />

0 250 500 750 1000 1250<br />

38 | <strong>December</strong> <strong>2020</strong>