Jeweller - December 2020

• Survival lessons: Essential business tips learned from a year of upheaval • Full state of play: a comprehensive report into the Australian jewellery industry in 2020 • Show stoppers: standout jewellery pieces from local talents

• Survival lessons: Essential business tips learned from a year of upheaval

• Full state of play: a comprehensive report into the Australian jewellery industry in 2020

• Show stoppers: standout jewellery pieces from local talents

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STATE OF THE INDUSTRY | Chains through the decade<br />

IN SUMM A RY<br />

History<br />

Pandora<br />

Meanwhile, 13 Angus & Coote stores got the chop. Myles<br />

Norman, general manager JPL, confirmed that some<br />

of the Angus & Coote and Goldmark ‘closures’ were stores<br />

that were converted to, and re-branded as, Prouds.<br />

Decline of Zamels<br />

However, the story is not as positive when it comes to The<br />

<strong>Jeweller</strong>y Group, which owns Zamels and Mazzuchelli’s.<br />

In 2010 Zamels was Australia’s third-largest jewellery chain<br />

with 100 retail stores; however, by June <strong>2020</strong>, a whopping<br />

63 Zamels stores had closed. By <strong>December</strong>, four more had<br />

closed. During the same period The <strong>Jeweller</strong>y Group also<br />

closed two single store ‘brands’, Vivien’s and Budgens.<br />

On a brighter note, Mazzucchelli’s had increased from 25<br />

stores in 2010 to 28 in <strong>December</strong> <strong>2020</strong>, most of which are new<br />

locations, with one Zamels store (Chadstone, in Melbourne)<br />

being converted to Mazzucchelli’s. As a result, The <strong>Jeweller</strong>y<br />

In 2003 we asked:<br />

are there too many<br />

jewellery stores in<br />

the major shopping<br />

centre?<br />

After extensive<br />

research we found:<br />

71<br />

The number of<br />

major shopping<br />

centres in capital<br />

cities<br />

Group is now less than half the size it was in 2010, operating<br />

61 stores, down from 127 (see chart 3).<br />

Many of the problems facing Zamels can be traced to the<br />

2007 sale of the 53-year-old family business to Quadrant<br />

Private Equity. At the time, speculation valued the deal at<br />

between $75 million and $100 million.<br />

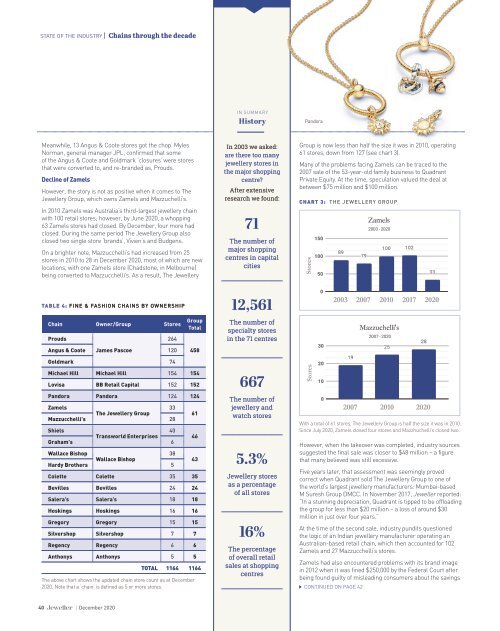

CHART 3: THE JEWELLERY GROUP<br />

Stores<br />

Zamels<br />

TABLE 4: FINE & FASHION CHAINS BY OWNERSHIP<br />

Chain Owner/Group Stores<br />

Prouds<br />

264<br />

Angus & Coote James Pascoe<br />

120<br />

Group<br />

Total<br />

458<br />

12,561<br />

The number of<br />

specialty stores<br />

in the 71 centres<br />

2003 2007 2010 2017 <strong>2020</strong><br />

Mazzuchelli's<br />

Goldmark 74<br />

Michael Hill Michael Hill 154 154<br />

Lovisa BB Retail Capital 152 152<br />

Pandora Pandora 124 124<br />

Zamels<br />

33<br />

The <strong>Jeweller</strong>y Group<br />

Mazzucchelli's 28<br />

Shiels<br />

40<br />

Transworld Enterprises<br />

Graham's 6<br />

Wallace Bishop<br />

38<br />

Wallace Bishop<br />

Hardy Brothers 5<br />

Colette Colette 35 35<br />

Bevilles Bevilles 24 24<br />

Salera’s Salera’s 18 18<br />

Hoskings Hoskings 16 16<br />

Gregory Gregory 15 15<br />

Silvershop Silvershop 7 7<br />

Regency Regency 6 6<br />

Anthonys Anthonys 5 5<br />

61<br />

46<br />

43<br />

TOTAL 1164 1164<br />

The above chart shows the updated chain store count as at <strong>December</strong><br />

<strong>2020</strong>. Note that a ‘chain’ is defined as 5 or more stores.<br />

667<br />

The number of<br />

jewellery and<br />

watch stores<br />

5.3%<br />

<strong>Jeweller</strong>y stores<br />

as a percentage<br />

of all stores<br />

16%<br />

The percentage<br />

of overall retail<br />

sales at shopping<br />

centres<br />

Stores<br />

2007 2010 <strong>2020</strong><br />

With a total of 61 stores, The <strong>Jeweller</strong>y Group is half the size it was in 2010.<br />

Since July <strong>2020</strong>, Zamels closed four stores and Mazzhuchelli’s closed two.<br />

However, when the takeover was completed, industry sources<br />

suggested the final sale was closer to $48 million – a figure<br />

that many believed was still excessive.<br />

Five years later, that assessment was seemingly proved<br />

correct when Quadrant sold The <strong>Jeweller</strong>y Group to one of<br />

the world’s largest jewellery manufacturers: Mumbai-based<br />

M Suresh Group DMCC. In November 2017, <strong>Jeweller</strong> reported:<br />

“In a stunning depreciation, Quadrant is tipped to be offloading<br />

the group for less than $20 million – a loss of around $30<br />

million in just over four years.”<br />

At the time of the second sale, industry pundits questioned<br />

the logic of an Indian jewellery manufacturer operating an<br />

Australian-based retail chain, which then accounted for 102<br />

Zamels and 27 Mazzucchelli’s stores.<br />

Zamels had also encountered problems with its brand image<br />

in 2012 when it was fined $250,000 by the Federal Court after<br />

being found guilty of misleading consumers about the savings<br />

CONTINUED ON PAGE 42<br />

40 | <strong>December</strong> <strong>2020</strong>