Jeweller - December 2020

• Survival lessons: Essential business tips learned from a year of upheaval • Full state of play: a comprehensive report into the Australian jewellery industry in 2020 • Show stoppers: standout jewellery pieces from local talents

• Survival lessons: Essential business tips learned from a year of upheaval

• Full state of play: a comprehensive report into the Australian jewellery industry in 2020

• Show stoppers: standout jewellery pieces from local talents

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STATE OF THE INDUSTRY<br />

Brand-Only Stores<br />

BRAND and DELIVER<br />

Part two of <strong>Jeweller</strong>’s analysis of the jewellery and watch industries explores how international<br />

brands have expanded their presence in the Australian market – and how the brand-only store<br />

model has increased competition with retailers.<br />

The trend of jewellery retailing moving<br />

towards two distinct ‘types’ has<br />

continued over the past decade with<br />

few surprises in store numbers. However, there<br />

have been some very significant changes to the<br />

mix of the Brand-Only retail category.<br />

When <strong>Jeweller</strong> published the 2010 State of The Industry<br />

Report there were 153 brand-only stores along with 17<br />

flagship stores operating in Australia – a total of 170<br />

outlets. And while the number is similar a decade later,<br />

the structure and mix is not.<br />

In 2010 <strong>Jeweller</strong> defined a brand-only retailer as a fine<br />

or fashion jewellery store – or group of stores – that sells<br />

and markets its own brand of jewellery and/or watches.<br />

It is usually a vertical-market operation, does not utilise<br />

local suppliers, and does not distribute to third-party<br />

stockists on a large scale.<br />

Brand-only stores are often owned and operated by the<br />

proprietor of the brand, or they can be operated under<br />

license. Before we look at the state of play in <strong>2020</strong> it’s<br />

important to recognise and acknowledge a few issues.<br />

Firstly, as markets and industries evolve, the consumer’s<br />

perception of products and brands changes, which in<br />

turn alters the market via different shopping habits.<br />

Therefore, to develop and collate industry information in a<br />

consistent manner, it’s vital to define categories so that the<br />

data can be measured and analysed fairly and accurately,<br />

allowing meaningful comparisons to be drawn.<br />

In other words, to count something you must first define it.<br />

It should be noted that we did not classify airport stores<br />

or shop-in-shop arrangements, such as concessions, as<br />

brand-only stores in either the 2010 or <strong>2020</strong> reports. Under<br />

the concession model, brands occupy space within a host<br />

store like Myer or David Jones, in return for paying a lease<br />

and/or a percentage of their sales to the larger store.<br />

A decade ago we considered that flagship stores were<br />

different to brand-only stores in that they were owned<br />

and operated by the brand itself, rather than a third<br />

party. These outlets usually stock the largest range of the<br />

brand’s merchandise and are regarded as a ‘landmark<br />

store’ or ‘face’ of the brand.<br />

Flagship stores take their name from a nautical term,<br />

referring to the headship in a fleet of vessels – one<br />

determined as the fastest, largest, newest, and mostheavily<br />

armed or the best known.<br />

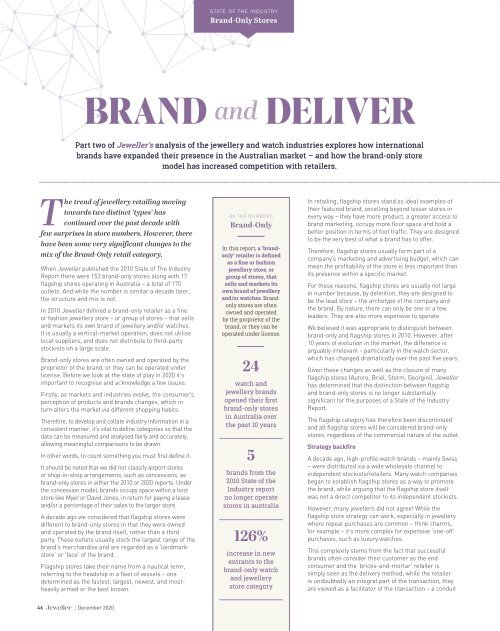

BY THE NUMBERS<br />

Brand-Only<br />

In this report, a ‘brandonly’<br />

retailer is defined<br />

as a fine or fashion<br />

jewellery store, or<br />

group of stores, that<br />

sells and markets its<br />

own brand of jewellery<br />

and/or watches. Brandonly<br />

stores are often<br />

owned and operated<br />

by the proprietor of the<br />

brand, or they can be<br />

operated under license.<br />

24<br />

watch and<br />

jewellery brands<br />

opened their first<br />

brand-only stores<br />

in Australia over<br />

the past 10 years<br />

5<br />

brands from the<br />

2010 State of the<br />

Industry report<br />

no longer operate<br />

stores in australia<br />

126%<br />

increase in new<br />

entrants to the<br />

brand-only watch<br />

and jewellery<br />

store category<br />

In retailing, flagship stores stand as ideal examples of<br />

their featured brand, excelling beyond lesser stores in<br />

every way – they have more product, a greater access to<br />

brand marketing, occupy more floor space and hold a<br />

better position in terms of foot traffic. They are designed<br />

to be the very best of what a brand has to offer.<br />

Therefore, flagship stores usually form part of a<br />

company’s marketing and advertising budget, which can<br />

mean the profitability of the store is less important than<br />

its presence within a specific market.<br />

For these reasons, flagship stores are usually not large<br />

in number because, by definition, they are designed to<br />

be the lead store – the archetype of the company and<br />

the brand. By nature, there can only be one or a few<br />

leaders. They are also more expensive to operate.<br />

We believed it was appropriate to distinguish between<br />

brand-only and flagship stores in 2010. However, after<br />

10 years of evolution in the market, the difference is<br />

arguably irrelevant – particularly in the watch sector,<br />

which has changed dramatically over the past five years.<br />

Given these changes as well as the closure of many<br />

flagship stores (Autore, Briel, Storm, Georgini), <strong>Jeweller</strong><br />

has determined that the distinction between flagship<br />

and brand-only stores is no longer substantially<br />

significant for the purposes of a State of the Industry<br />

Report.<br />

The flagship category has therefore been discontinued<br />

and all flagship stores will be considered brand-only<br />

stores, regardless of the commercial nature of the outlet.<br />

Strategy backfire<br />

A decade ago, high-profile watch brands – mainly Swiss<br />

– were distributed via a wide wholesale channel to<br />

independent stockists/retailers. Many watch companies<br />

began to establish flagship stores as a way to promote<br />

the brand, while arguing that the flagship store itself<br />

was not a direct competitor to its independent stockists.<br />

However, many jewellers did not agree! While the<br />

flagship store strategy can work, especially in jewellery<br />

where repeat purchases are common – think charms,<br />

for example – it’s more complex for expensive ‘one-off’<br />

purchases, such as luxury watches.<br />

This complexity stems from the fact that successful<br />

brands often consider their customer as the end<br />

consumer and the ‘bricks-and-mortar’ retailer is<br />

simply seen as the delivery method; while the retailer<br />

is undoubtedly an integral part of the transaction, they<br />

are viewed as a facilitator of the transaction – a conduit<br />

46 | <strong>December</strong> <strong>2020</strong>