Jeweller - December 2020

• Survival lessons: Essential business tips learned from a year of upheaval • Full state of play: a comprehensive report into the Australian jewellery industry in 2020 • Show stoppers: standout jewellery pieces from local talents

• Survival lessons: Essential business tips learned from a year of upheaval

• Full state of play: a comprehensive report into the Australian jewellery industry in 2020

• Show stoppers: standout jewellery pieces from local talents

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

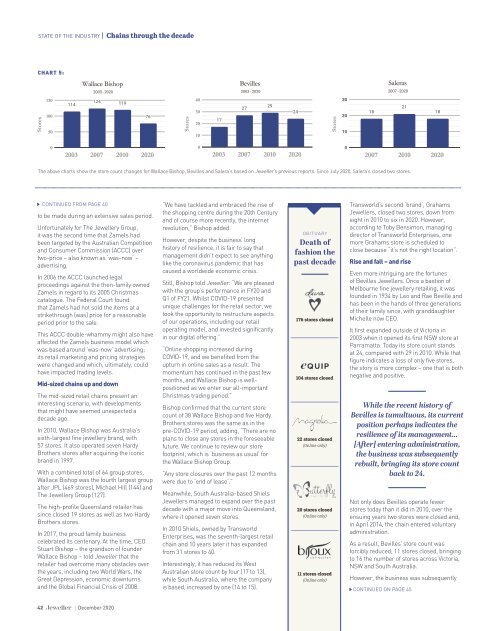

STATE OF THE INDUSTRY | Chains through the decade<br />

CHART 5:<br />

Wallace Bishop<br />

Bevilles<br />

Saleras<br />

150<br />

40<br />

Stores<br />

100<br />

50<br />

Stores<br />

30<br />

20<br />

10<br />

Stores<br />

0<br />

2003 2007 2010 <strong>2020</strong><br />

0<br />

2003 2007 2010 <strong>2020</strong><br />

2007 2010 <strong>2020</strong><br />

The above charts show the store count changes for Wallace Bishop, Bevilles and Salera’s based on <strong>Jeweller</strong>’s previous reports. Since July <strong>2020</strong>, Salera’s closed two stores.<br />

CONTINUED FROM PAGE 40<br />

to be made during an extensive sales period.<br />

Unfortunately for The <strong>Jeweller</strong>y Group,<br />

it was the second time that Zamels had<br />

been targeted by the Australian Competition<br />

and Consumer Commission (ACCC) over<br />

two-price – also known as ‘was-now’ –<br />

advertising.<br />

In 2006 the ACCC launched legal<br />

proceedings against the then-family owned<br />

Zamels in regard to its 2005 Christmas<br />

catalogue. The Federal Court found<br />

that Zamels had not sold the items at a<br />

strikethrough (was) price for a reasonable<br />

period prior to the sale.<br />

This ACCC double-whammy might also have<br />

affected the Zamels business model which<br />

was based around ‘was-now’ advertising;<br />

its retail marketing and pricing strategies<br />

were changed and which, ultimately, could<br />

have impacted trading levels.<br />

Mid-sized chains up and down<br />

The mid-sized retail chains present an<br />

interesting scenario, with developments<br />

that might have seemed unexpected a<br />

decade ago.<br />

In 2010, Wallace Bishop was Australia’s<br />

sixth-largest fine jewellery brand, with<br />

57 stores. It also operated seven Hardy<br />

Brothers stores after acquiring the iconic<br />

brand in 1997.<br />

With a combined total of 64 group stores,<br />

Wallace Bishop was the fourth largest group<br />

after JPL (469 stores), Michael Hill (144) and<br />

The <strong>Jeweller</strong>y Group (127).<br />

The high-profile Queensland retailer has<br />

since closed 19 stores as well as two Hardy<br />

Brothers stores.<br />

In 2017, the proud family business<br />

celebrated its centenary. At the time, CEO<br />

Stuart Bishop – the grandson of founder<br />

Wallace Bishop – told <strong>Jeweller</strong> that the<br />

retailer had overcome many obstacles over<br />

the years, including two World Wars, the<br />

Great Depression, economic downturns<br />

and the Global Financial Crisis of 2008.<br />

“We have tackled and embraced the rise of<br />

the shopping centre during the 20th Century<br />

and of course more recently, the internet<br />

revolution,” Bishop added.<br />

However, despite the business’ long<br />

history of resilience, it is fair to say that<br />

management didn’t expect to see anything<br />

like the coronavirus pandemic that has<br />

caused a worldwide economic crisis.<br />

Still, Bishop told <strong>Jeweller</strong>: “We are pleased<br />

with the group’s performance in FY20 and<br />

Q1 of FY21. Whilst COVID-19 presented<br />

unique challenges for the retail sector, we<br />

took the opportunity to restructure aspects<br />

of our operations, including our retail<br />

operating model, and invested significantly<br />

in our digital offering.”<br />

“Online shopping increased during<br />

COVID-19, and we benefited from the<br />

upturn in online sales as a result. The<br />

momentum has continued in the past few<br />

months, and Wallace Bishop is wellpositioned<br />

as we enter our all-important<br />

Christmas trading period.”<br />

Bishop confirmed that the current store<br />

count of 38 Wallace Bishop and five Hardy<br />

Brothers stores was the same as in the<br />

pre-COVID-19 period, adding, “There are no<br />

plans to close any stores in the foreseeable<br />

future. We continue to review our store<br />

footprint, which is ‘business as usual’ for<br />

the Wallace Bishop Group.<br />

“Any store closures over the past 12 months<br />

were due to ‘end of lease’.”<br />

Meanwhile, South Australia-based Shiels<br />

<strong>Jeweller</strong>s managed to expand over the past<br />

decade with a major move into Queensland,<br />

where it opened seven stores.<br />

In 2010 Shiels, owned by Transworld<br />

Enterprises, was the seventh-largest retail<br />

chain and 10 years later it has expanded<br />

from 31 stores to 40.<br />

Interestingly, it has reduced its West<br />

Australian store count by four (17 to 13),<br />

while South Australia, where the company<br />

is based, increased by one (14 to 15).<br />

OBITUA RY<br />

Death of<br />

fashion the<br />

past decade<br />

176 stores closed<br />

104 stores closed<br />

22 stores closed<br />

(Online only)<br />

20 stores closed<br />

(Online only)<br />

11 stores closed<br />

(Online only)<br />

Transworld’s second ‘brand’, Grahams<br />

<strong>Jeweller</strong>s, closed two stores, down from<br />

eight in 2010 to six in <strong>2020</strong>. However,<br />

according to Toby Bensimon, managing<br />

director of Transworld Enterprises, one<br />

more Grahams store is scheduled to<br />

close because “it’s not the right location”.<br />

Rise and fall – and rise<br />

Even more intriguing are the fortunes<br />

of Bevilles <strong>Jeweller</strong>s. Once a bastion of<br />

Melbourne fine jewellery retailing, it was<br />

founded in 1934 by Leo and Rae Beville and<br />

has been in the hands of three generations<br />

of their family since, with granddaughter<br />

Michelle now CEO.<br />

It first expanded outside of Victoria in<br />

2003 when it opened its first NSW store at<br />

Parramatta. Today its store count stands<br />

at 24, compared with 29 in 2010. While that<br />

figure indicates a loss of only five stores,<br />

the story is more complex – one that is both<br />

negative and positive.<br />

While the recent history of<br />

Bevilles is tumultuous, its current<br />

position perhaps indicates the<br />

resilience of its management...<br />

[After] entering administration,<br />

the business was subsequently<br />

rebuilt, bringing its store count<br />

back to 24.<br />

Not only does Bevilles operate fewer<br />

stores today than it did in 2010, over the<br />

ensuing years two stores were closed and,<br />

in April 2014, the chain entered voluntary<br />

administration.<br />

As a result, Bevilles’ store count was<br />

forcibly reduced; 11 stores closed, bringing<br />

to 16 the number of stores across Victoria,<br />

NSW and South Australia.<br />

However, the business was subsequently<br />

CONTINUED ON PAGE 45<br />

42 | <strong>December</strong> <strong>2020</strong>