2010Annual Report - Schneider Electric CZ, s.r.o.

2010Annual Report - Schneider Electric CZ, s.r.o.

2010Annual Report - Schneider Electric CZ, s.r.o.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

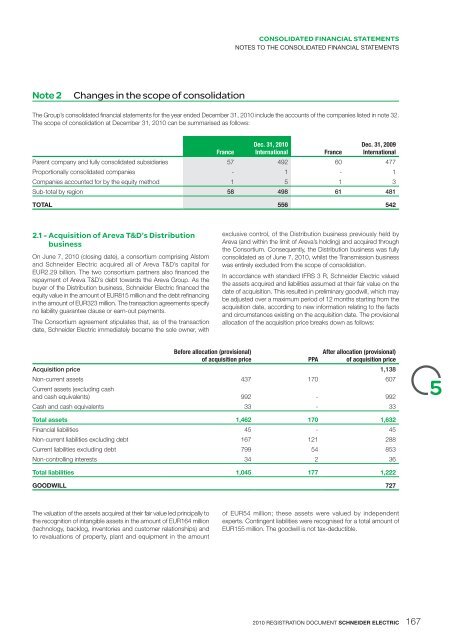

Note 2 Changes in the scope of consolidation<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

The Group’s consolidated fi nancial statements for the year ended December 31, 2010 include the accounts of the companies listed in note 32.<br />

The scope of consolidation at December 31, 2010 can be summarised as follows:<br />

Dec. 31, 2010<br />

Dec. 31, 2009<br />

Number of companies France International France International<br />

Parent company and fully consolidated subsidiaries 57 492 60 477<br />

Proportionally consolidated companies - 1 - 1<br />

Companies accounted for by the equity method 1 5 1 3<br />

Sub-total by region 58 498 61 481<br />

TOTAL 556 542<br />

2.1 - Acquisition of Areva T&D’s Distribution<br />

business<br />

On June 7, 2010 (closing date), a consortium comprising Alstom<br />

and <strong>Schneider</strong> <strong>Electric</strong> acquired all of Areva T&D’s capital for<br />

EUR2.29 billion. The two consortium partners also fi nanced the<br />

repayment of Areva T&D’s debt towards the Areva Group. As the<br />

buyer of the Distribution business, <strong>Schneider</strong> <strong>Electric</strong> fi nanced the<br />

equity value in the amount of EUR815 million and the debt refi nancing<br />

in the amount of EUR323 million. The transaction agreements specify<br />

no liability guarantee clause or earn-out payments.<br />

The Consortium agreement stipulates that, as of the transaction<br />

date, <strong>Schneider</strong> <strong>Electric</strong> immediately became the sole owner, with<br />

exclusive control, of the Distribution business previously held by<br />

Areva (and within the limit of Areva’s holding) and acquired through<br />

the Consortium. Consequently, the Distribution business was fully<br />

consolidated as of June 7, 2010, whilst the Transmission business<br />

was entirely excluded from the scope of consolidation.<br />

In accordance with standard IFRS 3 R, <strong>Schneider</strong> <strong>Electric</strong> valued<br />

the assets acquired and liabilities assumed at their fair value on the<br />

date of acquisition. This resulted in preliminary goodwill, which may<br />

be adjusted over a maximum period of 12 months starting from the<br />

acquisition date, according to new information relating to the facts<br />

and circumstances existing on the acquisition date. The provisional<br />

allocation of the acquisition price breaks down as follows:<br />

Before allocation (provisional)<br />

of acquisition price PPA<br />

After allocation (provisional)<br />

of acquisition price<br />

Acquisition price 1,138<br />

Non-current assets<br />

Current assets (excluding cash<br />

437 170 607<br />

and cash equivalents) 992 - 992<br />

Cash and cash equivalents 33 - 33<br />

Total assets 1,462 170 1,632<br />

Financial liabilities 45 - 45<br />

Non-current liabilities excluding debt 167 121 288<br />

Current liabilities excluding debt 799 54 853<br />

Non-controlling interests 34 2 36<br />

Total liabilities 1,045 177 1,222<br />

GOODWILL 727<br />

The valuation of the assets acquired at their fair value led principally to<br />

the recognition of intangible assets in the amount of EUR164 million<br />

(technology, backlog, inventories and customer relationships) and<br />

to revaluations of property, plant and equipment in the amount<br />

of EUR54 million; these assets were valued by independent<br />

experts. Contingent liabilities were recognised for a total amount of<br />

EUR155 million. The goodwill is not tax-deductible.<br />

2010 REGISTRATION DOCUMENT SCHNEIDER ELECTRIC 167<br />

5