U6509-3104 ABM Fire Fighting Package Tender ... - Bharat Petroleum

U6509-3104 ABM Fire Fighting Package Tender ... - Bharat Petroleum

U6509-3104 ABM Fire Fighting Package Tender ... - Bharat Petroleum

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

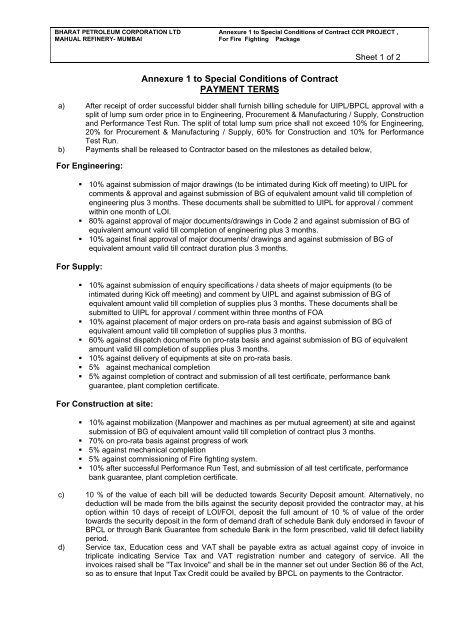

BHARAT PETROLEUM CORPORATION LTD Annexure 1 to Special Conditions of Contract CCR PROJECT ,<br />

MAHUAL REFINERY- MUMBAI For <strong>Fire</strong> <strong>Fighting</strong> <strong>Package</strong><br />

Annexure 1 to Special Conditions of Contract<br />

PAYMENT TERMS<br />

Sheet 1 of 2<br />

a) After receipt of order successful bidder shall furnish billing schedule for UIPL/BPCL approval with a<br />

split of lump sum order price in to Engineering, Procurement & Manufacturing / Supply, Construction<br />

and Performance Test Run. The split of total lump sum price shall not exceed 10% for Engineering,<br />

20% for Procurement & Manufacturing / Supply, 60% for Construction and 10% for Performance<br />

Test Run.<br />

b) Payments shall be released to Contractor based on the milestones as detailed below,<br />

For Engineering:<br />

� 10% against submission of major drawings (to be intimated during Kick off meeting) to UIPL for<br />

comments & approval and against submission of BG of equivalent amount valid till completion of<br />

engineering plus 3 months. These documents shall be submitted to UIPL for approval / comment<br />

within one month of LOI.<br />

� 80% against approval of major documents/drawings in Code 2 and against submission of BG of<br />

equivalent amount valid till completion of engineering plus 3 months.<br />

� 10% against final approval of major documents/ drawings and against submission of BG of<br />

equivalent amount valid till contract duration plus 3 months.<br />

For Supply:<br />

� 10% against submission of enquiry specifications / data sheets of major equipments (to be<br />

intimated during Kick off meeting) and comment by UIPL and against submission of BG of<br />

equivalent amount valid till completion of supplies plus 3 months. These documents shall be<br />

submitted to UIPL for approval / comment within three months of FOA<br />

� 10% against placement of major orders on pro-rata basis and against submission of BG of<br />

equivalent amount valid till completion of supplies plus 3 months.<br />

� 60% against dispatch documents on pro-rata basis and against submission of BG of equivalent<br />

amount valid till completion of supplies plus 3 months.<br />

� 10% against delivery of equipments at site on pro-rata basis.<br />

� 5% against mechanical completion<br />

� 5% against completion of contract and submission of all test certificate, performance bank<br />

guarantee, plant completion certificate.<br />

For Construction at site:<br />

� 10% against mobilization (Manpower and machines as per mutual agreement) at site and against<br />

submission of BG of equivalent amount valid till completion of contract plus 3 months.<br />

� 70% on pro-rata basis against progress of work<br />

� 5% against mechanical completion<br />

� 5% against commissioning of <strong>Fire</strong> fighting system.<br />

� 10% after successful Performance Run Test, and submission of all test certificate, performance<br />

bank guarantee, plant completion certificate.<br />

c) 10 % of the value of each bill will be deducted towards Security Deposit amount. Alternatively, no<br />

deduction will be made from the bills against the security deposit provided the contractor may, at his<br />

option within 10 days of receipt of LOI/FOI, deposit the full amount of 10 % of value of the order<br />

towards the security deposit in the form of demand draft of schedule Bank duly endorsed in favour of<br />

BPCL or through Bank Guarantee from schedule Bank in the form prescribed, valid till defect liability<br />

period.<br />

d) Service tax, Education cess and VAT shall be payable extra as actual against copy of invoice in<br />

triplicate indicating Service Tax and VAT registration number and category of service. All the<br />

invoices raised shall be "Tax Invoice" and shall be in the manner set out under Section 86 of the Act,<br />

so as to ensure that Input Tax Credit could be availed by BPCL on payments to the Contractor.