UN World Investment Report 2010 - Office of Trade Negotiations

UN World Investment Report 2010 - Office of Trade Negotiations

UN World Investment Report 2010 - Office of Trade Negotiations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHAPTER I Global Trends in FDI 15<br />

centrated on developed countries in North<br />

America and the EU. In 2009 and the first<br />

five months <strong>of</strong> <strong>2010</strong>, SWFs increased their<br />

FDI in Asia, 25 which had been much less<br />

affected by the financial market crisis and<br />

the economic downturn.<br />

SWFs’ investment prospects are also influenced<br />

by other considerations. Their growing<br />

foreign investment activities have raised<br />

concerns that they could be a possible threat<br />

to national security and to the market-based<br />

economies <strong>of</strong> host developed countries.<br />

Some recipient countries have tightened their<br />

investment regimes, or otherwise regulated<br />

FDI (chapter III). 26 SWFs have responded<br />

by making efforts to improve transparency,<br />

by adopting a set <strong>of</strong> rules known as the<br />

Santiago Principles. A study <strong>of</strong> the 10 largest<br />

SWFs carried out by RiskMetrics found<br />

that they fully complied with a total <strong>of</strong> 60<br />

per cent <strong>of</strong> these Principles (RiskMetrics,<br />

2009). This could help reduce concerns in<br />

host countries about the implications <strong>of</strong> their<br />

investments.<br />

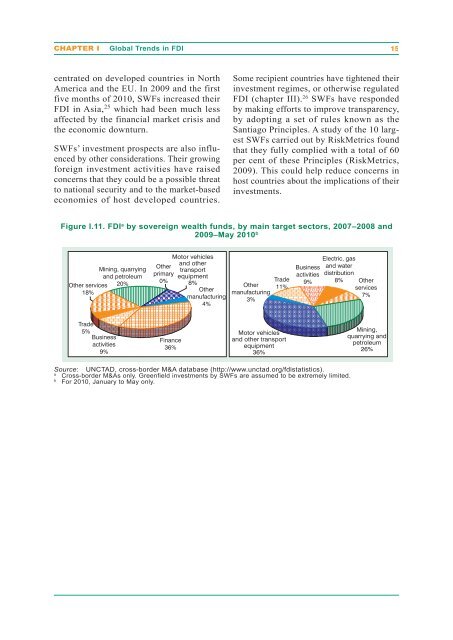

Figure I.11. FDI a by sovereign wealth funds, by main target sectors, 2007–2008 and<br />

2009–May <strong>2010</strong> b<br />

Other services<br />

18%<br />

<strong>Trade</strong><br />

5% Business<br />

activities<br />

9%<br />

Mining, quarrying<br />

and petroleum<br />

20%<br />

Other<br />

primary<br />

0%<br />

Finance<br />

36%<br />

Motor vehicles<br />

and other<br />

transport<br />

equipment<br />

8%<br />

Other<br />

manufacturing<br />

4%<br />

Other<br />

manufacturing<br />

3%<br />

<strong>Trade</strong><br />

11%<br />

Motor vehicles<br />

and other transport<br />

equipment<br />

36%<br />

Business<br />

activities<br />

9%<br />

Electric, gas<br />

and water<br />

distribution<br />

8% Other<br />

services<br />

7%<br />

Source: <strong>UN</strong>CTAD, cross-border M&A database (http://www.unctad.org/fdistatistics).<br />

a Cross-border M&As only. Greenfield investments by SWFs are assumed to be extremely limited.<br />

b For <strong>2010</strong>, January to May only.<br />

Mining,<br />

quarrying and<br />

petroleum<br />

26%