UN World Investment Report 2010 - Office of Trade Negotiations

UN World Investment Report 2010 - Office of Trade Negotiations

UN World Investment Report 2010 - Office of Trade Negotiations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHAPTER I Global Trends in FDI 17<br />

I.5). This relative resilience might be explained<br />

by the fact that foreign sales started<br />

to pick up again in the latter half <strong>of</strong> 2009.<br />

In addition, many TNCs are thought to have<br />

slowed their downsizing programmes as<br />

economic activity rebounded – especially<br />

in developing Asia. In spite <strong>of</strong> the setback<br />

in 2008 and 2009, an estimated 80 million<br />

workers were employed in TNCs’ foreign<br />

affiliates in 2009, accounting for about 4<br />

per cent <strong>of</strong> the global workforce.<br />

Dynamics vary across countries and sectors,<br />

but employment in foreign affiliates has been<br />

shifting from developed to developing countries<br />

over the past few years (chapter II); the<br />

majority <strong>of</strong> foreign affiliates’ employment<br />

is now located in developing economies. 28<br />

The largest number <strong>of</strong> foreign-affiliate employees<br />

is now in China (with 16 million<br />

workers in 2008, accounting for some 20<br />

per cent <strong>of</strong> the world’s total employees in<br />

foreign affiliates). Employment in foreign<br />

affiliates in the United States, on the other<br />

hand, shrank by half a million between 2001<br />

and 2008.<br />

In addition, the share <strong>of</strong> foreign affiliates’<br />

employment in manufacturing has declined<br />

in favour <strong>of</strong> services. In developed countries,<br />

employment in foreign affiliates in the manufacturing<br />

sector dropped sharply between<br />

1999 and 2007, while in services it gained<br />

importance as a result <strong>of</strong> structural changes<br />

in the economies (OECD, <strong>2010</strong>).<br />

Foreign affiliates’ assets grew at a rate <strong>of</strong><br />

7.5 per cent in 2009. The increase is largely<br />

attributable to the 15 per cent rise in inward<br />

FDI stock due to a significant rebound on<br />

the global stock markets (section A).<br />

The regional shift in international production<br />

is also reflected in the TNC landscape.<br />

Although the composition <strong>of</strong> the world’s top<br />

100 TNCs confirms that the triad countries<br />

remain dominant, their share has been slowly<br />

decreasing over the years. Developing and<br />

transition-economy TNCs now occupy seven<br />

positions among the top 100. And while<br />

more than 90 per cent <strong>of</strong> all TNCs were<br />

headquartered in developed countries in the<br />

early 1990s, parent TNCs from developing<br />

and transition economies accounted for more<br />

than a quarter <strong>of</strong> the 82,000 TNCs (28 per<br />

cent) worldwide in 2008 (fig. I.12), a share<br />

that was still two percentage points higher<br />

than that in 2006, the year before the crisis.<br />

As a result, TNCs headquartered in developing<br />

and transition economies now account<br />

for nearly one tenth <strong>of</strong> the foreign sales and<br />

foreign assets <strong>of</strong> the top 5,000 TNCs in the<br />

world, compared to only 1–2 per cent in 1995<br />

(table I.6) (see http://www.unctad.org/wir<br />

for the list <strong>of</strong> the 100 biggest TNCs).<br />

Other sources point to an even larger presence<br />

<strong>of</strong> firms from developing and transition<br />

economies among the top global TNCs. The<br />

Financial Times, for instance, includes 124<br />

companies from developing and transition<br />

economies in the top 500 largest firms in the<br />

world, and 18 in the top 100. 29 Fortune ranks<br />

85 companies from developing and transition<br />

economies in the top 500 largest global<br />

corporations, and 15 in the top 100. 30<br />

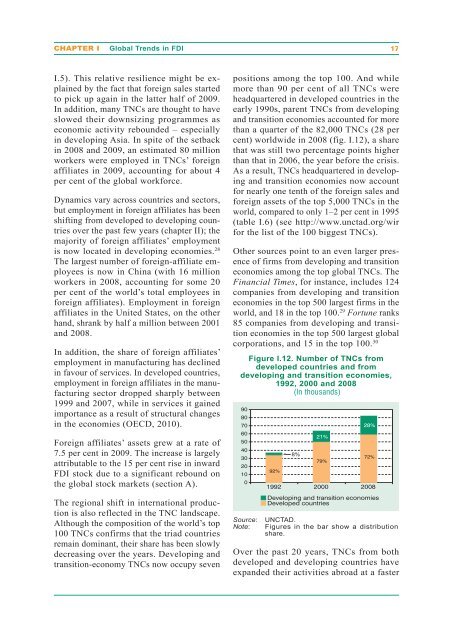

Figure I.12. Number <strong>of</strong> TNCs from<br />

developed countries and from<br />

developing and transition economies,<br />

1992, 2000 and 2008<br />

(In thousands)<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

92%<br />

8%<br />

21%<br />

79%<br />

28%<br />

72%<br />

1992 2000 2008<br />

Developing and transition economies<br />

Developed countries<br />

Source: <strong>UN</strong>CTAD.<br />

Note: Figures in the bar show a distribution<br />

share.<br />

Over the past 20 years, TNCs from both<br />

developed and developing countries have<br />

expanded their activities abroad at a faster