UN World Investment Report 2010 - Office of Trade Negotiations

UN World Investment Report 2010 - Office of Trade Negotiations

UN World Investment Report 2010 - Office of Trade Negotiations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

36<br />

$ million<br />

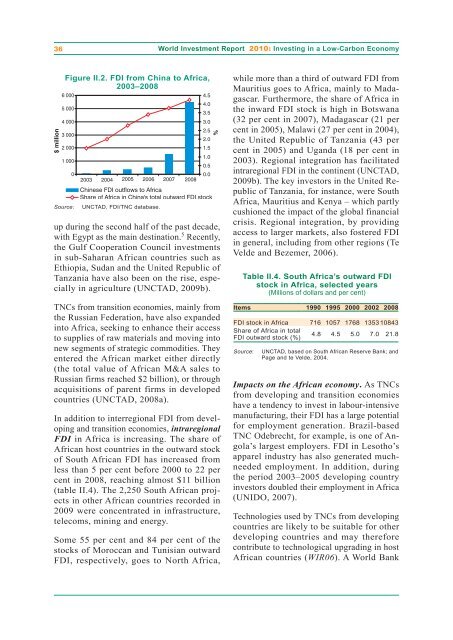

Figure II.2. FDI from China to Africa,<br />

2003–2008<br />

6 000<br />

5 000<br />

4 000<br />

3 000<br />

2 000<br />

1 000<br />

0<br />

2003 2004 2005 2006 2007 2008<br />

Source: <strong>UN</strong>CTAD, FDI/TNC database.<br />

<strong>World</strong> <strong>Investment</strong> <strong>Report</strong> <strong>2010</strong>: Investing in a Low-Carbon Economy<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

Chinese FDI outflows to Africa<br />

Share <strong>of</strong> Africa in China's total outward FDI stock<br />

%<br />

up during the second half <strong>of</strong> the past decade,<br />

with Egypt as the main destination. 5 Recently,<br />

the Gulf Cooperation Council investments<br />

in sub-Saharan African countries such as<br />

Ethiopia, Sudan and the United Republic <strong>of</strong><br />

Tanzania have also been on the rise, especially<br />

in agriculture (<strong>UN</strong>CTAD, 2009b).<br />

TNCs from transition economies, mainly from<br />

the Russian Federation, have also expanded<br />

into Africa, seeking to enhance their access<br />

to supplies <strong>of</strong> raw materials and moving into<br />

new segments <strong>of</strong> strategic commodities. They<br />

entered the African market either directly<br />

(the total value <strong>of</strong> African M&A sales to<br />

Russian firms reached $2 billion), or through<br />

acquisitions <strong>of</strong> parent firms in developed<br />

countries (<strong>UN</strong>CTAD, 2008a).<br />

In addition to interregional FDI from developing<br />

and transition economies, intraregional<br />

FDI in Africa is increasing. The share <strong>of</strong><br />

African host countries in the outward stock<br />

<strong>of</strong> South African FDI has increased from<br />

less than 5 per cent before 2000 to 22 per<br />

cent in 2008, reaching almost $11 billion<br />

(table II.4). The 2,250 South African projects<br />

in other African countries recorded in<br />

2009 were concentrated in infrastructure,<br />

telecoms, mining and energy.<br />

Some 55 per cent and 84 per cent <strong>of</strong> the<br />

stocks <strong>of</strong> Moroccan and Tunisian outward<br />

FDI, respectively, goes to North Africa,<br />

while more than a third <strong>of</strong> outward FDI from<br />

Mauritius goes to Africa, mainly to Madagascar.<br />

Furthermore, the share <strong>of</strong> Africa in<br />

the inward FDI stock is high in Botswana<br />

(32 per cent in 2007), Madagascar (21 per<br />

cent in 2005), Malawi (27 per cent in 2004),<br />

the United Republic <strong>of</strong> Tanzania (43 per<br />

cent in 2005) and Uganda (18 per cent in<br />

2003). Regional integration has facilitated<br />

intraregional FDI in the continent (<strong>UN</strong>CTAD,<br />

2009b). The key investors in the United Republic<br />

<strong>of</strong> Tanzania, for instance, were South<br />

Africa, Mauritius and Kenya – which partly<br />

cushioned the impact <strong>of</strong> the global financial<br />

crisis. Regional integration, by providing<br />

access to larger markets, also fostered FDI<br />

in general, including from other regions (Te<br />

Velde and Bezemer, 2006).<br />

Table II.4. South Africa’s outward FDI<br />

stock in Africa, selected years<br />

(Millions <strong>of</strong> dollars and per cent)<br />

Items 1990 1995 2000 2002 2008<br />

FDI stock in Africa 716 1057 1768 135310843<br />

Share <strong>of</strong> Africa in total<br />

FDI outward stock (%)<br />

4.8 4.5 5.0 7.0 21.8<br />

Source: <strong>UN</strong>CTAD, based on South African Reserve Bank; and<br />

Page and te Velde, 2004.<br />

Impacts on the African economy. As TNCs<br />

from developing and transition economies<br />

have a tendency to invest in labour-intensive<br />

manufacturing, their FDI has a large potential<br />

for employment generation. Brazil-based<br />

TNC Odebrecht, for example, is one <strong>of</strong> Angola’s<br />

largest employers. FDI in Lesotho’s<br />

apparel industry has also generated muchneeded<br />

employment. In addition, during<br />

the period 2003–2005 developing country<br />

investors doubled their employment in Africa<br />

(<strong>UN</strong>IDO, 2007).<br />

Technologies used by TNCs from developing<br />

countries are likely to be suitable for other<br />

developing countries and may therefore<br />

contribute to technological upgrading in host<br />

African countries (WIR06). A <strong>World</strong> Bank