UN World Investment Report 2010 - Office of Trade Negotiations

UN World Investment Report 2010 - Office of Trade Negotiations

UN World Investment Report 2010 - Office of Trade Negotiations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHAPTER II Regional Trends in FDI 31<br />

This chapter analyses regional trends in<br />

FDI, with some additions to the coverage<br />

and changes in presentation as compared<br />

to previous <strong>World</strong> <strong>Investment</strong> <strong>Report</strong>s. It<br />

first focuses on the traditional regions (four<br />

developing-country regions, South-East<br />

Europe and the Commonwealth <strong>of</strong> Independent<br />

States (CIS), and developed countries).<br />

Then it goes on to discuss FDI in special<br />

groups <strong>of</strong> economies with similar common<br />

geographical or organizational features, such<br />

as structurally weak, vulnerable and small<br />

FDI flows to developed countries experienced<br />

the largest decline (44 per cent) in<br />

2009 among all regions and subregions.<br />

Among the developing economies – which<br />

as a whole registered a 24 per cent fall in<br />

inflows – South, East and South-East Asia<br />

showed the smallest decline (17 per cent) and<br />

remained the largest recipient, accounting<br />

for almost half <strong>of</strong> the total inflows. Africa<br />

recorded a decrease <strong>of</strong> 19 per cent in 2009.<br />

In terms <strong>of</strong> the decline rate, flows to Latin<br />

America and the Caribbean and West Asia<br />

fell more. However, all developing regions<br />

saw their shares rise in global FDI inflows<br />

(table II.1). This is not the case for transition<br />

economies <strong>of</strong> South-East Europe and the<br />

A. Regional trends<br />

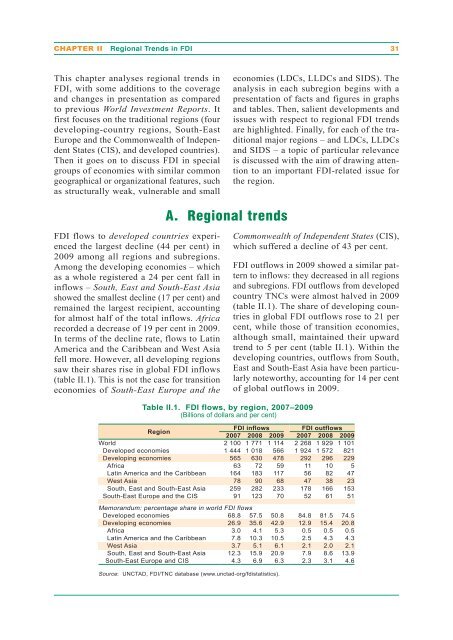

Table II.1. FDI flows, by region, 2007–2009<br />

(Billions <strong>of</strong> dollars and per cent)<br />

economies (LDCs, LLDCs and SIDS). The<br />

analysis in each subregion begins with a<br />

presentation <strong>of</strong> facts and figures in graphs<br />

and tables. Then, salient developments and<br />

issues with respect to regional FDI trends<br />

are highlighted. Finally, for each <strong>of</strong> the traditional<br />

major regions – and LDCs, LLDCs<br />

and SIDS – a topic <strong>of</strong> particular relevance<br />

is discussed with the aim <strong>of</strong> drawing attention<br />

to an important FDI-related issue for<br />

the region.<br />

Region<br />

FDI inflows<br />

2007 2008 2009<br />

FDI outflows<br />

2007 2008 2009<br />

<strong>World</strong> 2 100 1 771 1 114 2 268 1 929 1 101<br />

Developed economies 1 444 1 018 566 1 924 1 572 821<br />

Developing economies 565 630 478 292 296 229<br />

Africa 63 72 59 11 10 5<br />

Latin America and the Caribbean 164 183 117 56 82 47<br />

West Asia 78 90 68 47 38 23<br />

South, East and South-East Asia 259 282 233 178 166 153<br />

South-East Europe and the CIS 91 123 70 52 61 51<br />

Memorandum: percentage share in world FDI flows<br />

Developed economies 68.8 57.5 50.8 84.8 81.5 74.5<br />

Developing economies 26.9 35.6 42.9 12.9 15.4 20.8<br />

Africa 3.0 4.1 5.3 0.5 0.5 0.5<br />

Latin America and the Caribbean 7.8 10.3 10.5 2.5 4.3 4.3<br />

West Asia 3.7 5.1 6.1 2.1 2.0 2.1<br />

South, East and South-East Asia 12.3 15.9 20.9 7.9 8.6 13.9<br />

South-East Europe and CIS 4.3 6.9 6.3 2.3 3.1 4.6<br />

Source: <strong>UN</strong>CTAD, FDI/TNC database (www.unctad-org/fdistatistics).<br />

Commonwealth <strong>of</strong> Independent States (CIS),<br />

which suffered a decline <strong>of</strong> 43 per cent.<br />

FDI outflows in 2009 showed a similar pattern<br />

to inflows: they decreased in all regions<br />

and subregions. FDI outflows from developed<br />

country TNCs were almost halved in 2009<br />

(table II.1). The share <strong>of</strong> developing countries<br />

in global FDI outflows rose to 21 per<br />

cent, while those <strong>of</strong> transition economies,<br />

although small, maintained their upward<br />

trend to 5 per cent (table II.1). Within the<br />

developing countries, outflows from South,<br />

East and South-East Asia have been particularly<br />

noteworthy, accounting for 14 per cent<br />

<strong>of</strong> global outflows in 2009.