ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5 Earnings<br />

COMMENTS ON THE <strong>2011</strong> FINANCIAL YEAR<br />

by division<br />

5.2 EARNINGS BY DIVISION<br />

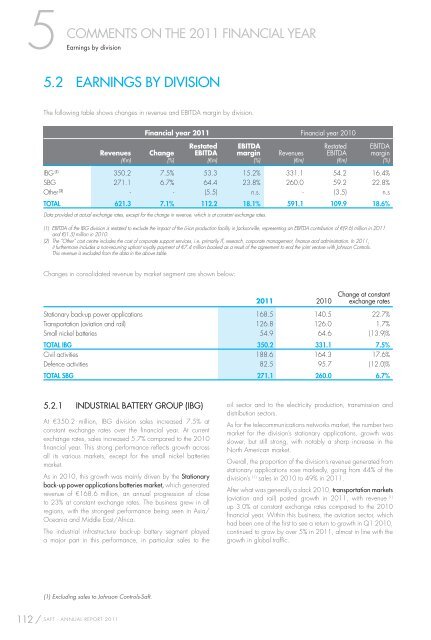

The following table shows changes in revenue and EBITDA margin by division.<br />

Revenues<br />

(€m)<br />

112 / SAFT - <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong><br />

Financial year <strong>2011</strong> Financial year 2010<br />

Change<br />

(%)<br />

Restated<br />

EBITDA<br />

(€m)<br />

EBITDA<br />

margin<br />

(%)<br />

Revenues<br />

(€m)<br />

Restated<br />

EBITDA<br />

(€m)<br />

EBITDA<br />

margin<br />

(%)<br />

IBG (1) 350.2 7.5% 53.3 15.2% 331.1 54.2 16.4%<br />

SBG 271.1 6.7% 64.4 23.8% 260.0 59.2 22.8%<br />

Other (2) - - (5.5) n.s. - (3.5) n.s<br />

TOTAL 621.3 7.1% 112.2 18.1% 591.1 109.9 18.6%<br />

Data provided at actual exchange rates, except for the change in revenue, which is at constant exchange rates.<br />

(1) EBITDA of the IBG division is restated to exclude the impact of the Li-ion production facility in Jacksonville, representing an EBITDA contribution of €(9.6) million in <strong>2011</strong><br />

and €(1.5) million in 2010.<br />

(2) The “Other” cost centre includes the cost of corporate support services, i.e. primarily IT, research, corporate management, fi nance and administration. In <strong>2011</strong>,<br />

it furthermore includes a non-recurring upfront royalty payment of €7.4 million booked as a result of the agreement to end the joint venture with Johnson Controls.<br />

This revenue is excluded from the data in the above table.<br />

Changes in consolidated revenue by market segment are shown below:<br />

<strong>2011</strong> 2010<br />

Change at constant<br />

exchange rates<br />

Stationary back-up power applications 168.5 140.5 22.7%<br />

Transportation (aviation and rail) 126.8 126.0 1.7%<br />

Small nickel batteries 54.9 64.6 (13.9)%<br />

TOTAL IBG 350.2 331.1 7.5%<br />

Civil activities 188.6 164.3 17.6%<br />

Defence activities 82.5 95.7 (12.0)%<br />

TOTAL SBG 271.1 260.0 6.7%<br />

5.2.1 INDUSTRIAL BATTERY GROUP (IBG)<br />

At €350.2 million, IBG division sales increased 7.5% at<br />

constant exchange rates over the fi nancial year. At current<br />

exchange rates, sales increased 5.7% compared to the 2010<br />

fi nancial year. This strong performance refl ects growth across<br />

all its various markets, except for the small nickel batteries<br />

market.<br />

As in 2010, this growth was mainly driven by the Stationary<br />

back-up power applications batteries market, which generated<br />

revenue of €168.6 million, an annual progression of close<br />

to 23% at constant exchange rates. The business grew in all<br />

regions, with the strongest performance being seen in Asia/<br />

Oceania and Middle East/Africa.<br />

The industrial infrastructure back-up battery segment played<br />

a major part in this performance, in particular sales to the<br />

(1) Excluding sales to Johnson Controls-<strong>Saft</strong>.<br />

oil sector and to the electricity production, transmission and<br />

distribution sectors.<br />

As for the telecommunications networks market, the number two<br />

market for the division’s stationary applications, growth was<br />

slower, but still strong, with notably a sharp increase in the<br />

North American market.<br />

Overall, the proportion of the division’s revenue generated from<br />

stationary applications rose markedly, going from 44% of the<br />

division’s (1) sales in 2010 to 49% in <strong>2011</strong>.<br />

After what was generally a slack 2010, transportation markets<br />

(aviation and rail) posted growth in <strong>2011</strong>, with revenue (1)<br />

up 3.0% at constant exchange rates compared to the 2010<br />

fi nancial year. Within this business, the aviation sector, which<br />

had been one of the fi rst to see a return to growth in Q1 2010,<br />

continued to grow by over 5% in <strong>2011</strong>, almost in line with the<br />

growth in global traffi c.