ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

8<br />

INFORMATION ABOUT THE COMPANY AND ITS SHARE CAPITAL<br />

Group history<br />

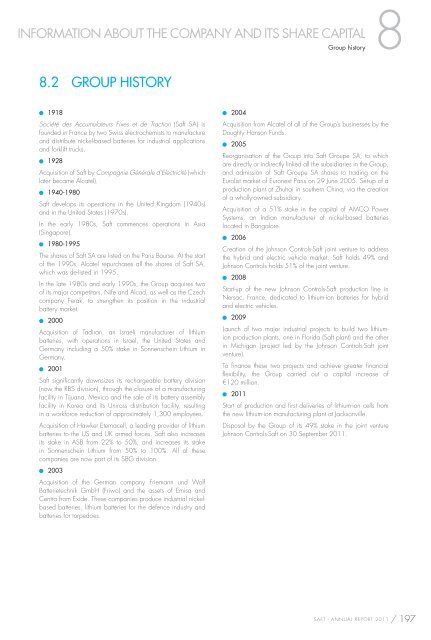

8.2 GROUP HISTORY<br />

� 1918<br />

Société des Accumulateurs Fixes et de Traction (<strong>Saft</strong> SA) is<br />

founded in France by two Swiss electrochemists to manufacture<br />

and distribute nickel-based batteries for industrial applications<br />

and forklift trucks.<br />

� 1928<br />

Acquisition of <strong>Saft</strong> by Compagnie Générale d’Electricité (which<br />

later became Alcatel).<br />

� 1940-1980<br />

<strong>Saft</strong> develops its operations in the United Kingdom (1940s)<br />

and in the United States (1970s).<br />

In the early 1980s, <strong>Saft</strong> commences operations in Asia<br />

(Singapore).<br />

� 1980-1995<br />

The shares of <strong>Saft</strong> SA are listed on the Paris Bourse. At the start<br />

of the 1990s, Alcatel repurchases all the shares of <strong>Saft</strong> SA,<br />

which was de-listed in 1995.<br />

In the late 1980s and early 1990s, the Group acquires two<br />

of its major competitors, Nife and Alcad, as well as the Czech<br />

company Ferak, to strengthen its position in the industrial<br />

battery market.<br />

� 2000<br />

Acquisition of Tadiran, an Israeli manufacturer of lithium<br />

batteries, with operations in Israel, the United States and<br />

Germany including a 50% stake in Sonnenschein Lithium in<br />

Germany.<br />

� 2001<br />

<strong>Saft</strong> signifi cantly downsizes its rechargeable battery division<br />

(now the RBS division), through the closure of a manufacturing<br />

facility in Tijuana, Mexico and the sale of its battery assembly<br />

facility in Korea and its Uniross distribution facility, resulting<br />

in a workforce reduction of approximately 1,300 employees.<br />

Acquisition of Hawker Eternacell, a leading provider of lithium<br />

batteries to the US and UK armed forces. <strong>Saft</strong> also increases<br />

its stake in ASB from 22% to 50%, and increases its stake<br />

in Sonnenschein Lithium from 50% to 100%. All of these<br />

companies are now part of its SBG division.<br />

� 2003<br />

Acquisition of the German company Friemann und Wolf<br />

Batterietechnik GmbH (Friwo) and the assets of Emisa and<br />

Centra from Exide. These companies produce industrial nickelbased<br />

batteries, lithium batteries for the defence industry and<br />

batteries for torpedoes.<br />

� 2004<br />

Acquisition from Alcatel of all of the Group’s businesses by the<br />

Doughty Hanson Funds.<br />

� 2005<br />

Reorganisation of the Group into <strong>Saft</strong> Groupe SA, to which<br />

are directly or indirectly linked all the subsidiaries in the Group,<br />

and admission of <strong>Saft</strong> Groupe SA shares to trading on the<br />

Eurolist market of Euronext Paris on 29 June 2005. Set-up of a<br />

production plant at Zhuhai in southern China, via the creation<br />

of a wholly-owned subsidiary.<br />

Acquisition of a 51% stake in the capital of AMCO Power<br />

Systems, an Indian manufacturer of nickel-based batteries<br />

located in Bangalore.<br />

� 2006<br />

Creation of the Johnson Controls-<strong>Saft</strong> joint venture to address<br />

the hybrid and electric vehicle market. <strong>Saft</strong> holds 49% and<br />

Johnson Controls holds 51% of the joint venture.<br />

� 2008<br />

Start-up of the new Johnson Controls-<strong>Saft</strong> production line in<br />

Nersac, France, dedicated to lithium-ion batteries for hybrid<br />

and electric vehicles.<br />

� 2009<br />

Launch of two major industrial projects to build two lithiumion<br />

production plants, one in Florida (<strong>Saft</strong> plant) and the other<br />

in Michigan (project led by the Johnson Controls-<strong>Saft</strong> joint<br />

venture).<br />

To fi nance these two projects and achieve greater fi nancial<br />

fl exibility, the Group carried out a capital increase of<br />

€120 million.<br />

� <strong>2011</strong><br />

Start of production and fi rst deliveries of lithium-ion cells from<br />

the new lithium-ion manufacturing plant at Jacksonville.<br />

Disposal by the Group of its 49% stake in the joint venture<br />

Johnson Controls-<strong>Saft</strong> on 30 September <strong>2011</strong>.<br />

SAFT - <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong> / 197