ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6 Notes<br />

<strong>2011</strong> CONSOLIDATED FINANCIAL STATEMENTS<br />

to the Consolidated Financial Statements<br />

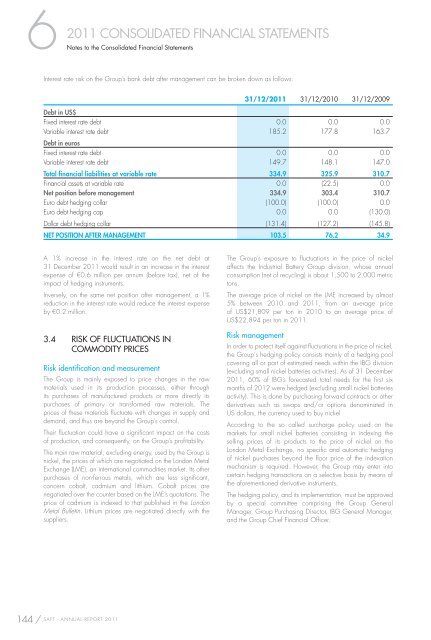

Interest rate risk on the Group’s bank debt after management can be broken down as follows:<br />

144 / SAFT - <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong><br />

31/12/<strong>2011</strong> 31/12/2010 31/12/2009<br />

Debt in US$<br />

Fixed interest rate debt 0.0 0.0 0.0<br />

Variable interest rate debt<br />

Debt in euros<br />

185.2 177.8 163.7<br />

Fixed interest rate debt 0.0 0.0 0.0<br />

Variable interest rate debt 149.7 148.1 147.0<br />

Total fi nancial liabilities at variable rate 334.9 325.9 310.7<br />

Financial assets at variable rate 0.0 (22.5) 0.0<br />

Net position before management 334.9 303.4 310.7<br />

Euro debt hedging collar (100.0) (100.0) 0.0<br />

Euro debt hedging cap 0.0 0.0 (130.0)<br />

Dollar debt hedging collar (131.4) (127.2) (145.8)<br />

NET POSITION AFTER MANAGEMENT 103.5 76.2 34.9<br />

A 1% increase in the interest rate on the net debt at<br />

31 December <strong>2011</strong> would result in an increase in the interest<br />

expense of €0.6 million per annum (before tax), net of the<br />

impact of hedging instruments.<br />

Inversely, on the same net position after management, a 1%<br />

reduction in the interest rate would reduce the interest expense<br />

by €0.2 million.<br />

3.4 RISK OF FLUCTUATIONS IN<br />

COMMODITY PRICES<br />

Risk identification and measurement<br />

The Group is mainly exposed to price changes in the raw<br />

materials used in its production processes, either through<br />

its purchases of manufactured products or more directly its<br />

purchases of primary or transformed raw materials. The<br />

prices of these materials fl uctuate with changes in supply and<br />

demand, and thus are beyond the Group’s control.<br />

Their fl uctuation could have a signifi cant impact on the costs<br />

of production, and consequently, on the Group’s profi tability.<br />

The main raw material, excluding energy, used by the Group is<br />

nickel, the prices of which are negotiated on the London Metal<br />

Exchange (LME), an international commodities market. Its other<br />

purchases of non-ferrous metals, which are less signifi cant,<br />

concern cobalt, cadmium and lithium. Cobalt prices are<br />

negotiated over the counter based on the LME’s quotations. The<br />

price of cadmium is indexed to that published in the London<br />

Metal Bulletin. Lithium prices are negotiated directly with the<br />

suppliers.<br />

The Group’s exposure to fl uctuations in the price of nickel<br />

affects the Industrial Battery Group division, whose annual<br />

consumption (net of recycling) is about 1,500 to 2,000 metric<br />

tons.<br />

The average price of nickel on the LME increased by almost<br />

5% between 2010 and <strong>2011</strong>, from an average price<br />

of US$21,809 per ton in 2010 to an average price of<br />

US$22,894 per ton in <strong>2011</strong>.<br />

Risk management<br />

In order to protect itself against fl uctuations in the price of nickel,<br />

the Group‘s hedging policy consists mainly of a hedging pool<br />

covering all or part of estimated needs within the IBG division<br />

(excluding small nickel batteries activities). As of 31 December<br />

<strong>2011</strong>, 60% of IBG’s forecasted total needs for the fi rst six<br />

months of 2012 were hedged (excluding small nickel batteries<br />

activity). This is done by purchasing forward contracts or other<br />

derivatives such as swaps and/or options denominated in<br />

US dollars, the currency used to buy nickel<br />

According to the so called surcharge policy used on the<br />

markets for small nickel batteries consisting in indexing the<br />

selling prices of its products to the price of nickel on the<br />

London Metal Exchange, no specifi c and automatic hedging<br />

of nickel purchases beyond the fl oor price of the indexation<br />

mechanism is required. However, the Group may enter into<br />

certain hedging transactions on a selective basis by means of<br />

the aforementioned derivative instruments.<br />

The hedging policy, and its implementation, must be approved<br />

by a special committee comprising the Group General<br />

Manager, Group Purchasing Director, IBG General Manager,<br />

and the Group Chief Financial Offi cer.