ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

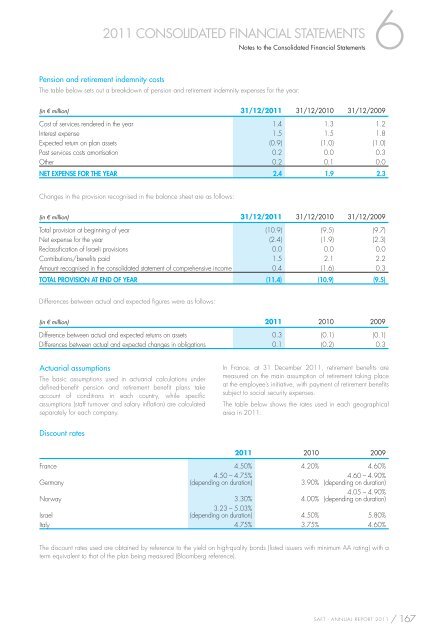

Pension and retirement indemnity costs<br />

6<br />

<strong>2011</strong> CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes to the Consolidated Financial Statements<br />

The table below sets out a breakdown of pension and retirement indemnity expenses for the year:<br />

(in € million) 31/12/<strong>2011</strong> 31/12/2010 31/12/2009<br />

Cost of services rendered in the year 1.4 1.3 1.2<br />

Interest expense 1.5 1.5 1.8<br />

Expected return on plan assets (0.9) (1.0) (1.0)<br />

Past services costs amortisation 0.2 0.0 0.3<br />

Other 0.2 0.1 0.0<br />

NET EXPENSE FOR THE YEAR 2.4 1.9 2.3<br />

Changes in the provision recognised in the balance sheet are as follows:<br />

(in € million) 31/12/<strong>2011</strong> 31/12/2010 31/12/2009<br />

Total provision at beginning of year (10.9) (9.5) (9.7)<br />

Net expense for the year (2.4) (1.9) (2.3)<br />

Reclassifi cation of Israeli provisions 0.0 0.0 0.0<br />

Contributions/benefi ts paid 1.5 2.1 2.2<br />

Amount recognised in the consolidated statement of comprehensive income 0.4 (1.6) 0.3<br />

TOTAL PROVISION AT END OF YEAR (11.4) (10.9) (9.5)<br />

Differences between actual and expected fi gures were as follows:<br />

(in € million) <strong>2011</strong> 2010 2009<br />

Difference between actual and expected returns on assets 0.3 (0.1) (0.1)<br />

Differences between actual and expected changes in obligations 0.1 (0.2) 0.3<br />

Actuarial assumptions<br />

The basic assumptions used in actuarial calculations under<br />

defi ned-benefi t pension and retirement benefi t plans take<br />

account of conditions in each country, while specifi c<br />

assumptions (staff turnover and salary infl ation) are calculated<br />

separately for each company.<br />

Discount rates<br />

In France, at 31 December <strong>2011</strong>, retirement benefi ts are<br />

measured on the main assumption of retirement taking place<br />

at the employee’s initiative, with payment of retirement benefi ts<br />

subject to social security expenses.<br />

The table below shows the rates used in each geographical<br />

area in <strong>2011</strong>:<br />

<strong>2011</strong> 2010 2009<br />

France 4.50% 4.20% 4.60%<br />

4.50 – 4.75%<br />

4.60 – 4.90%<br />

Germany<br />

(depending on duration) 3.90% (depending on duration)<br />

4.05 – 4.90%<br />

Norway 3.30%<br />

3.23 – 5.03%<br />

4.00% (depending on duration)<br />

Israel<br />

(depending on duration) 4.50% 5.80%<br />

Italy 4.75% 3.75% 4.60%<br />

The discount rates used are obtained by reference to the yield on high-quality bonds (listed issuers with minimum AA rating) with a<br />

term equivalent to that of the plan being measured (Bloomberg reference).<br />

SAFT - <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong> / 167