ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6 Notes<br />

<strong>2011</strong> CONSOLIDATED FINANCIAL STATEMENTS<br />

to the Consolidated Financial Statements<br />

31.1 GUARANTEES<br />

<strong>Saft</strong> has given various guarantees to customers concerning the<br />

execution of contracts awarded to the Group (performance<br />

bonds, customer prepayment guarantees, refunds, etc.). The<br />

total amount of such commitments at 31 December <strong>2011</strong> was<br />

€12.7 million. This represents the maximum potential amount<br />

(undiscounted) that the Group could be required to pay under<br />

these guarantees, and has not been reduced to refl ect any<br />

sums that the Group might be able to recover through legal<br />

proceedings or via counter-guarantees received.<br />

The other guarantees given, for an amount of €4.8 million,<br />

principally consist of guarantees given to fi nancial institutions in<br />

the United States in relation with the implementation of Standby<br />

Letters of Credit.<br />

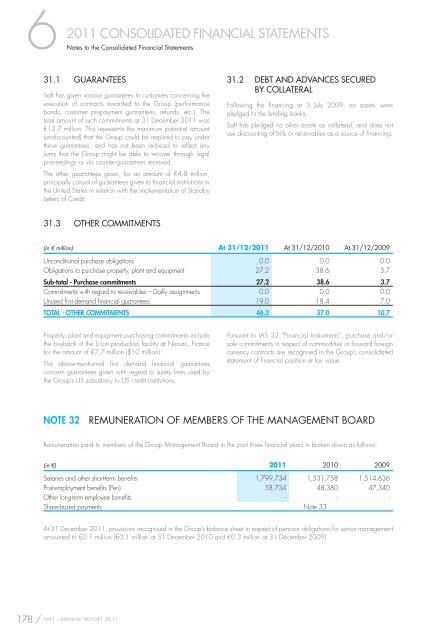

31.3 OTHER COMMITMENTS<br />

178 / SAFT - <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong><br />

31.2 DEBT AND ADVANCES SECURED<br />

BY COLLATERAL<br />

Following the fi nancing at 3 July 2009, no assets were<br />

pledged to the lending banks.<br />

<strong>Saft</strong> has pledged no other assets as collateral, and does not<br />

use discounting of bills or receivables as a source of fi nancing.<br />

(in € million) At 31/12/<strong>2011</strong> At 31/12/2010 At 31/12/2009<br />

Unconditional purchase obligations 0.0 0.0 0.0<br />

Obligations to purchase property, plant and equipment 27.2 38.6 3.7<br />

Sub-total - Purchase commitments 27.2 38.6 3.7<br />

Commitments with regard to receivables – Dailly assignments 0.0 0.0 0.0<br />

Unused fi rst demand fi nancial guarantees 19.0 18.4 7.0<br />

TOTAL - OTHER COMMITMENTS 46.2 57.0 10.7<br />

Property, plant and equipment purchasing commitments include<br />

the buyback of the Li-ion production facility at Nersac, France<br />

for the amount of €7.7 million ($10 million).<br />

The above-mentioned fi rst demand fi nancial guarantees<br />

concern guarantees given with regard to surety lines used by<br />

the Group’s US subsidiary to US credit institutions.<br />

Pursuant to IAS 32 “Financial Instruments”, purchase and/or<br />

sale commitments in respect of commodities or forward foreign<br />

currency contracts are recognised in the Group’s consolidated<br />

statement of fi nancial position at fair value.<br />

NOTE 32 REMUNERATION OF MEMBERS OF THE MANAGEMENT BOARD<br />

Remuneration paid to members of the Group Management Board in the past three fi nancial years is broken down as follows:<br />

(in €) <strong>2011</strong> 2010 2009<br />

Salaries and other short-term benefi ts 1,799,734 1,531,758 1,514,636<br />

Post-employment benefi ts (Peri) 58,734 48,380 47,340<br />

Other long-term employee benefi ts - - -<br />

Share-based payments Note 33<br />

At 31 December <strong>2011</strong>, provisions recognised in the Group’s balance sheet in respect of pension obligations for senior management<br />

amounted to €0.1 million (€0.1 million at 31 December 2010 and €0.3 million at 31 December 2009).