ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6<br />

<strong>2011</strong> CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes to the Consolidated Financial Statements<br />

The general principles for the accounting treatment of derivatives<br />

used to hedge the risks of fl uctuations in commodities prices are<br />

explained above in Note 2.29 to the Consolidated Financial<br />

Statements in the paragraph relating to cash fl ow hedges.<br />

Gains and losses resulting from hedging contracts are<br />

recognised in cost of sales of the division whose future needs<br />

are hedged when these contracts satisfy the criteria for hedge<br />

accounting under IAS 39.<br />

If these contracts are not eligible for hedge accounting under<br />

IAS 39, then the realised gains and losses are recorded in<br />

“Other operating income and expenses”.<br />

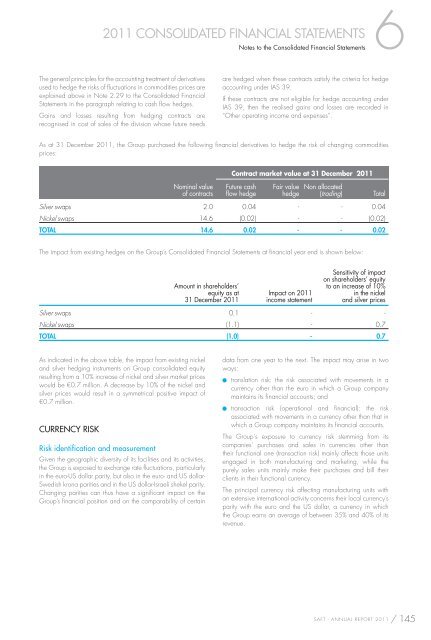

As at 31 December <strong>2011</strong>, the Group purchased the following fi nancial derivatives to hedge the risk of changing commodities<br />

prices:<br />

Nominal value<br />

of contracts<br />

Contract market value at 31 December <strong>2011</strong><br />

Future cash<br />

fl ow hedge<br />

Fair value<br />

hedge<br />

Non allocated<br />

(trading) Total<br />

Silver swaps 2.0 0.04 - - 0.04<br />

Nickel swaps 14.6 (0.02) - - (0.02)<br />

TOTAL 14.6 0.02 - - 0.02<br />

The impact from existing hedges on the Group’s Consolidated Financial Statements at fi nancial year end is shown below:<br />

Amount in shareholders’<br />

equity as at<br />

31 December <strong>2011</strong><br />

Impact on <strong>2011</strong><br />

income statement<br />

Sensitivity of impact<br />

on shareholders’ equity<br />

to an increase of 10%<br />

in the nickel<br />

and silver prices<br />

Silver swaps 0.1 - -<br />

Nickel swaps (1.1) - 0.7<br />

TOTAL (1.0) - 0.7<br />

As indicated in the above table, the impact from existing nickel<br />

and silver hedging instruments on Group consolidated equity<br />

resulting from a 10% increase of nickel and silver market prices<br />

would be €0.7 million. A decrease by 10% of the nickel and<br />

silver prices would result in a symmetrical positive impact of<br />

€0.7 million.<br />

CURRENCY RISK<br />

Risk identification and measurement<br />

Given the geographic diversity of its facilities and its activities,<br />

the Group is exposed to exchange rate fl uctuations, particularly<br />

in the euro-US dollar parity, but also in the euro- and US dollar-<br />

Swedish krona parities and in the US dollar-Israeli shekel parity.<br />

Changing parities can thus have a signifi cant impact on the<br />

Group’s fi nancial position and on the comparability of certain<br />

data from one year to the next. The impact may arise in two<br />

ways:<br />

� translation risk: the risk associated with movements in a<br />

currency other than the euro in which a Group company<br />

maintains its fi nancial accounts; and<br />

� transaction risk (operational and fi nancial): the risk<br />

associated with movements in a currency other than that in<br />

which a Group company maintains its fi nancial accounts.<br />

The Group‘s exposure to currency risk stemming from its<br />

companies’ purchases and sales in currencies other than<br />

their functional one (transaction risk) mainly affects those units<br />

engaged in both manufacturing and marketing, while the<br />

purely sales units mainly make their purchases and bill their<br />

clients in their functional currency.<br />

The principal currency risk affecting manufacturing units with<br />

an extensive international activity concerns their local currency’s<br />

parity with the euro and the US dollar, a currency in which<br />

the Group earns an average of between 35% and 40% of its<br />

revenue.<br />

SAFT - <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong> / 145