ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6<br />

<strong>2011</strong> CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes to the Consolidated Financial Statements<br />

NOTE 6 INFORMATION BY BUSINESS SEGMENT AND GEOGRAPHICAL<br />

SEGMENT<br />

6.1 INFORMATION BY BUSINESS<br />

SEGMENT<br />

The Group’s Management Board defi ned the business segments<br />

based on the reporting which it regularly examines in order to<br />

make decisions regarding allocation of resources to segments<br />

and evaluation of their performance.<br />

Since 1 July 2009, Group reporting has been structured based<br />

on the following business segments:<br />

� the Specialty Battery Group (SBG) division, which<br />

manufactures batteries for applications including water, gas<br />

and electricity utility meters, automated meter readers and<br />

road tolling systems, computer memory back-up systems,<br />

satellites, radios and other portable systems for military use,<br />

missiles, and torpedoes;<br />

� the Industrial Battery Group (IBG) division, which<br />

manufactures batteries used for standby power supplies<br />

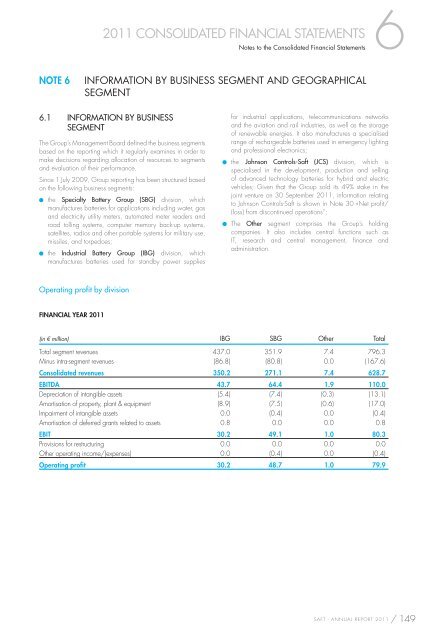

Operating profit by division<br />

FINANCIAL YEAR <strong>2011</strong><br />

for industrial applications, telecommunications networks<br />

and the aviation and rail industries, as well as the storage<br />

of renewable energies. It also manufactures a specialised<br />

range of rechargeable batteries used in emergency lighting<br />

and professional electronics;<br />

� the Johnson Controls-<strong>Saft</strong> (JCS) division, which is<br />

specialised in the development, production and selling<br />

of advanced technology batteries for hybrid and electric<br />

vehicles; Given that the Group sold its 49% stake in the<br />

joint venture on 30 September <strong>2011</strong>, information relating<br />

to Johnson Controls-<strong>Saft</strong> is shown in Note 30 «Net profi t/<br />

(loss) from discontinued operations”;<br />

� The Other segment comprises the Group’s holding<br />

companies. It also includes central functions such as<br />

IT, research and central management, fi nance and<br />

administration.<br />

(in € million) IBG SBG Other Total<br />

Total segment revenues 437.0 351.9 7.4 796.3<br />

Minus intra-segment revenues (86.8) (80.8) 0.0 (167.6)<br />

Consolidated revenues 350.2 271.1 7.4 628.7<br />

EBITDA 43.7 64.4 1.9 110.0<br />

Depreciation of intangible assets (5.4) (7.4) (0.3) (13.1)<br />

Amortisation of property, plant & equipment (8.9) (7.5) (0.6) (17.0)<br />

Impairment of intangible assets 0.0 (0.4) 0.0 (0.4)<br />

Amortisation of deferred grants related to assets 0.8 0.0 0.0 0.8<br />

EBIT 30.2 49.1 1.0 80.3<br />

Provisions for restructuring 0.0 0.0 0.0 0.0<br />

Other operating income/(expenses) 0.0 (0.4) 0.0 (0.4)<br />

Operating profi t 30.2 48.7 1.0 79.9<br />

SAFT - <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong> / 149