ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

5<br />

COMMENTS ON THE <strong>2011</strong> FINANCIAL YEAR<br />

Activity of <strong>Saft</strong> Groupe SA subsidiaries and controlled entities<br />

5.13 SAFT GROUPE SA ACTIVITY AND RESULTS<br />

<strong>Saft</strong> Groupe SA is a fi nancial holding company. It owns 100%<br />

of the shares of <strong>Saft</strong> Finance Sarl which owns, directly or<br />

indirectly, the different subsidiaries of the <strong>Saft</strong> Group.<br />

Revenue for the <strong>2011</strong> fi nancial year totalled €6.5 million,<br />

compared to revenue of €6.4 million in 2010. This was<br />

mainly generated from the different services provided by the<br />

Company to the various <strong>Saft</strong> Group subsidiaries.<br />

Operating expenses amounted to €5.4 million, compared to<br />

€5.3 million in 2010. They primarily consisted of fees and<br />

the cost of services provided by <strong>Saft</strong> SAS. At €1.1 million,<br />

operating profi t was unchanged on the previous fi nancial year.<br />

Net fi nancial revenue was €29.8 million and was mainly<br />

comprised of dividends received from Group subsidiaries. The<br />

dividends received in the 2010 fi nancial year amounted to<br />

€7.5 million.<br />

Extraordinary items constituted a net expense of €0.3 million,<br />

unchanged from the net amount for the 2010 fi nancial year.<br />

These expenses represented the cost of trading in <strong>Saft</strong> shares<br />

under the liquidity contract.<br />

<strong>Saft</strong> Groupe SA recognised tax income of €0.4 million in the<br />

fi nancial year.<br />

<strong>Saft</strong> Groupe SA’s <strong>2011</strong> net profi t totalled €31.0 million,<br />

compared to a net profi t of €11.4 million in 2010.<br />

Total assets amounted to €372.1 million, virtually unchanged<br />

on the previous fi nancial year.<br />

Non-current assets primarily comprised <strong>Saft</strong> Finance Sàrl shares<br />

valued at €309 million, unchanged on the previous fi nancial<br />

year.<br />

Current assets were mainly composed of various receivables<br />

plus cash of €43.4 million at the end of the <strong>2011</strong> fi nancial<br />

year, compared to cash of €35.7 million as of 31 December<br />

2010.<br />

As detailed in the notes, a capital increase was carried out<br />

in the <strong>2011</strong> fi nancial year for a total amount, including share<br />

premiums, of €1.2 million as a result of the exercise of stock<br />

options.<br />

Total liabilities were comprised of equity of €361.1 million<br />

after taking into account the profi t for the period, with current<br />

liabilities amounting to €11.0 million.<br />

5.14 ACTIVITY OF SAFT GROUPE SA SUBSIDIARIES<br />

AND CONTROLLED ENTITIES<br />

Revenue posted in <strong>2011</strong> by consolidated subsidiaries of the <strong>Saft</strong> Groupe SA is as follows:<br />

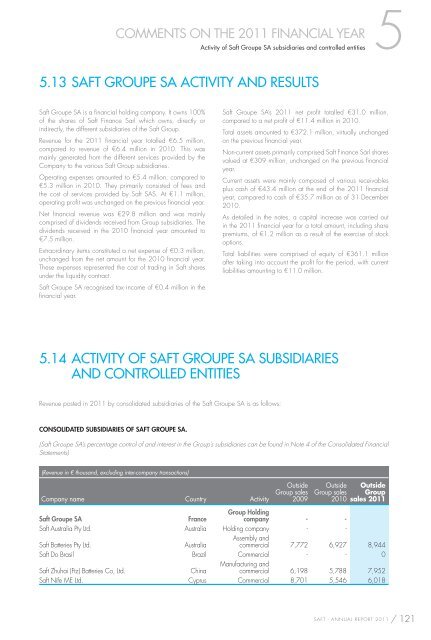

CONSOLIDATED SUBSIDIARIES OF SAFT GROUPE SA.<br />

(<strong>Saft</strong> Groupe SA’s percentage control of and interest in the Group’s subsidiaries can be found in Note 4 of the Consolidated Financial<br />

Statements)<br />

(Revenue in € thousand, excluding inter-company transactions)<br />

Company name Country Activity<br />

Outside<br />

Group sales<br />

2009<br />

Outside<br />

Group sales<br />

2010<br />

Outside<br />

Group<br />

sales <strong>2011</strong><br />

<strong>Saft</strong> Groupe SA France<br />

Group Holding<br />

company - -<br />

<strong>Saft</strong> Australia Pty Ltd. Australia Holding company<br />

Assembly and<br />

- -<br />

<strong>Saft</strong> Batteries Pty Ltd. Australia<br />

commercial 7,772 6,927 8,944<br />

<strong>Saft</strong> Do Brasil Brazil Commercial<br />

Manufacturing and<br />

- - 0<br />

<strong>Saft</strong> Zhuhai (Ftz) Batteries Co, Ltd. China<br />

commercial 6,198 5,788 7,952<br />

<strong>Saft</strong> Nife ME Ltd. Cyprus Commercial 8,701 5,546 6,018<br />

SAFT - <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong> / 121