ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6 Notes<br />

<strong>2011</strong> CONSOLIDATED FINANCIAL STATEMENTS<br />

to the Consolidated Financial Statements<br />

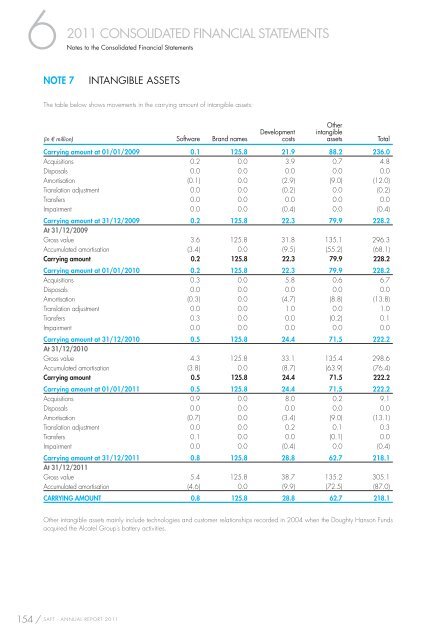

NOTE 7 INTANGIBLE ASSETS<br />

The table below shows movements in the carrying amount of intangible assets:<br />

(in € million) Software Brand names<br />

154 / SAFT - <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong><br />

Development<br />

costs<br />

Other<br />

intangible<br />

assets Total<br />

Carrying amount at 01/01/2009 0.1 125.8 21.9 88.2 236.0<br />

Acquisitions 0.2 0.0 3.9 0.7 4.8<br />

Disposals 0.0 0.0 0.0 0.0 0.0<br />

Amortisation (0.1) 0.0 (2.9) (9.0) (12.0)<br />

Translation adjustment 0.0 0.0 (0.2) 0.0 (0.2)<br />

Transfers 0.0 0.0 0.0 0.0 0.0<br />

Impairment 0.0 0.0 (0.4) 0.0 (0.4)<br />

Carrying amount at 31/12/2009<br />

At 31/12/2009<br />

0.2 125.8 22.3 79.9 228.2<br />

Gross value 3.6 125.8 31.8 135.1 296.3<br />

Accumulated amortisation (3.4) 0.0 (9.5) (55.2) (68.1)<br />

Carrying amount 0.2 125.8 22.3 79.9 228.2<br />

Carrying amount at 01/01/2010 0.2 125.8 22.3 79.9 228.2<br />

Acquisitions 0.3 0.0 5.8 0.6 6.7<br />

Disposals 0.0 0.0 0.0 0.0 0.0<br />

Amortisation (0.3) 0.0 (4.7) (8.8) (13.8)<br />

Translation adjustment 0.0 0.0 1.0 0.0 1.0<br />

Transfers 0.3 0.0 0.0 (0.2) 0.1<br />

Impairment 0.0 0.0 0.0 0.0 0.0<br />

Carrying amount at 31/12/2010<br />

At 31/12/2010<br />

0.5 125.8 24.4 71.5 222.2<br />

Gross value 4.3 125.8 33.1 135.4 298.6<br />

Accumulated amortisation (3.8) 0.0 (8.7) (63.9) (76.4)<br />

Carrying amount 0.5 125.8 24.4 71.5 222.2<br />

Carrying amount at 01/01/<strong>2011</strong> 0.5 125.8 24.4 71.5 222.2<br />

Acquisitions 0.9 0.0 8.0 0.2 9.1<br />

Disposals 0.0 0.0 0.0 0.0 0.0<br />

Amortisation (0.7) 0.0 (3.4) (9.0) (13.1)<br />

Translation adjustment 0.0 0.0 0.2 0.1 0.3<br />

Transfers 0.1 0.0 0.0 (0.1) 0.0<br />

Impairment 0.0 0.0 (0.4) 0.0 (0.4)<br />

Carrying amount at 31/12/<strong>2011</strong><br />

At 31/12/<strong>2011</strong><br />

0.8 125.8 28.8 62.7 218.1<br />

Gross value 5.4 125.8 38.7 135.2 305.1<br />

Accumulated amortisation (4.6) 0.0 (9.9) (72.5) (87.0)<br />

CARRYING AMOUNT 0.8 125.8 28.8 62.7 218.1<br />

Other intangible assets mainly include technologies and customer relationships recorded in 2004 when the Doughty Hanson Funds<br />

acquired the Alcatel Group’s battery activities.