ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

ANNUAL REPORT 2011 REGISTRATION DOCUMENT - Saft

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6<br />

<strong>2011</strong> CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes to the Consolidated Financial Statements<br />

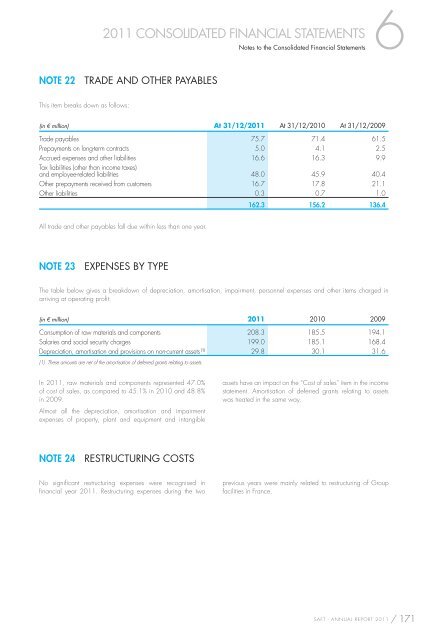

NOTE 22 TRADE AND OTHER PAYABLES<br />

This item breaks down as follows:<br />

(in € million) At 31/12/<strong>2011</strong> At 31/12/2010 At 31/12/2009<br />

Trade payables 75.7 71.4 61.5<br />

Prepayments on long-term contracts 5.0 4.1 2.5<br />

Accrued expenses and other liabilities<br />

Tax liabilities (other than income taxes)<br />

16.6 16.3 9.9<br />

and employee-related liabilities 48.0 45.9 40.4<br />

Other prepayments received from customers 16.7 17.8 21.1<br />

Other liabilities 0.3 0.7 1.0<br />

162.3 156.2 136.4<br />

All trade and other payables fall due within less than one year.<br />

NOTE 23 EXPENSES BY TYPE<br />

The table below gives a breakdown of depreciation, amortisation, impairment, personnel expenses and other items charged in<br />

arriving at operating profi t:<br />

(in € million) <strong>2011</strong> 2010 2009<br />

Consumption of raw materials and components 208.3 185.5 194.1<br />

Salaries and social security charges 199.0 185.1 168.4<br />

Depreciation, amortisation and provisions on non-current assets (1) 29.8 30.1 31.6<br />

(1) These amounts are net of the amortisation of deferred grants relating to assets.<br />

In <strong>2011</strong>, raw materials and components represented 47.0%<br />

of cost of sales, as compared to 45.1% in 2010 and 48.8%<br />

in 2009.<br />

Almost all the depreciation, amortisation and impairment<br />

expenses of property, plant and equipment and intangible<br />

NOTE 24 RESTRUCTURING COSTS<br />

No signifi cant restructuring expenses were recognised in<br />

fi nancial year <strong>2011</strong>. Restructuring expenses during the two<br />

assets have an impact on the “Cost of sales” item in the income<br />

statement. Amortisation of deferred grants relating to assets<br />

was treated in the same way.<br />

previous years were mainly related to restructuring of Group<br />

facilities in France.<br />

SAFT - <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong> / 171