Full annual report - African Bank - Investoreports

Full annual report - African Bank - Investoreports

Full annual report - African Bank - Investoreports

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

accountability<br />

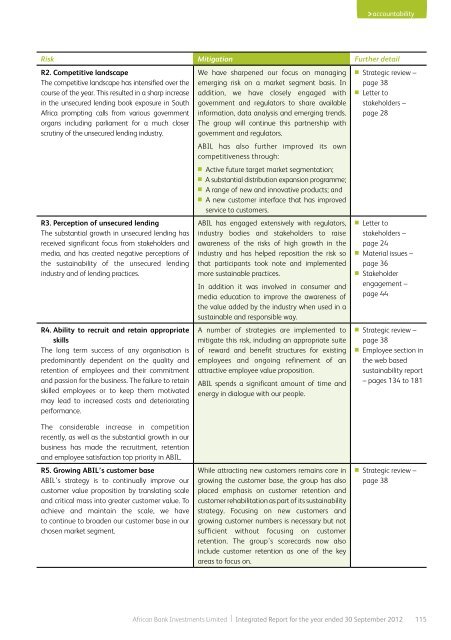

Risk Mitigation Further detail<br />

R2. Competitive landscape<br />

The competitive landscape has intensified over the<br />

course of the year. This resulted in a sharp increase<br />

in the unsecured lending book exposure in South<br />

Africa prompting calls from various government<br />

organs including parliament for a much closer<br />

scrutiny of the unsecured lending industry.<br />

R3. Perception of unsecured lending<br />

The substantial growth in unsecured lending has<br />

received significant focus from stakeholders and<br />

media, and has created negative perceptions of<br />

the sustainability of the unsecured lending<br />

industry and of lending practices.<br />

R4. Ability to recruit and retain appropriate<br />

skills<br />

The long term success of any organisation is<br />

predominantly dependent on the quality and<br />

retention of employees and their commitment<br />

and passion for the business. The failure to retain<br />

skilled employees or to keep them motivated<br />

may lead to increased costs and deteriorating<br />

performance.<br />

The considerable increase in competition<br />

recently, as well as the substantial growth in our<br />

business has made the recruitment, retention<br />

and employee satisfaction top priority in ABIL.<br />

R5. Growing ABIL’s customer base<br />

ABIL’s strategy is to continually improve our<br />

customer value proposition by translating scale<br />

and critical mass into greater customer value. To<br />

achieve and maintain the scale, we have<br />

to continue to broaden our customer base in our<br />

chosen market segment.<br />

We have sharpened our focus on managing<br />

emerging risk on a market segment basis. In<br />

addition, we have closely engaged with<br />

government and regulators to share available<br />

information, data analysis and emerging trends.<br />

The group will continue this partnership with<br />

government and regulators.<br />

ABIL has also further improved its own<br />

competitiveness through:<br />

■ Active future target market segmentation;<br />

■ A substantial distribution expansion programme;<br />

■ A range of new and innovative products; and<br />

■ A new customer interface that has improved<br />

service to customers.<br />

ABIL has engaged extensively with regulators,<br />

industry bodies and stakeholders to raise<br />

awareness of the risks of high growth in the<br />

industry and has helped reposition the risk so<br />

that participants took note and implemented<br />

more sustainable practices.<br />

In addition it was involved in consumer and<br />

media education to improve the awareness of<br />

the value added by the industry when used in a<br />

sustainable and responsible way.<br />

A number of strategies are implemented to<br />

mitigate this risk, including an appropriate suite<br />

of reward and benefit structures for existing<br />

employees and ongoing refinement of an<br />

attractive employee value proposition.<br />

ABIL spends a significant amount of time and<br />

energy in dialogue with our people.<br />

While attracting new customers remains core in<br />

growing the customer base, the group has also<br />

placed emphasis on customer retention and<br />

customer rehabilitation as part of its sustainability<br />

strategy. Focusing on new customers and<br />

growing customer numbers is necessary but not<br />

sufficient without focusing on customer<br />

retention. The group’s scorecards now also<br />

include customer retention as one of the key<br />

areas to focus on.<br />

■ Strategic review –<br />

page 38<br />

■ Letter to<br />

stakeholders –<br />

page 28<br />

■ Letter to<br />

stakeholders –<br />

page 24<br />

■ Material issues –<br />

page 36<br />

■ Stakeholder<br />

engagement –<br />

page 44<br />

■ Strategic review –<br />

page 38<br />

■ Employee section in<br />

the web based<br />

sustainability <strong>report</strong><br />

– pages 134 to 181<br />

■ Strategic review –<br />

page 38<br />

<strong>African</strong> <strong>Bank</strong> Investments Limited | Integrated Report for the year ended 30 September 2012 115