Full annual report - African Bank - Investoreports

Full annual report - African Bank - Investoreports

Full annual report - African Bank - Investoreports

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>annual</strong> financial statements<br />

practice which indicates that amounts have been offset. Management also evaluates whether the customers<br />

accounts are managed on a net basis which would support the view that there is an intention to settle on a net basis.<br />

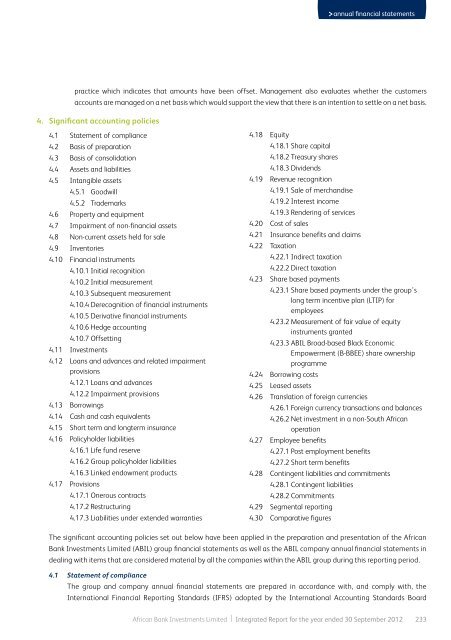

4. Significant accounting policies<br />

4.1 Statement of compliance<br />

4.2 Basis of preparation<br />

4.3 Basis of consolidation<br />

4.4 Assets and liabilities<br />

4.5 Intangible assets<br />

4.5.1 Goodwill<br />

4.5.2 Trademarks<br />

4.6 Property and equipment<br />

4.7 Impairment of non-financial assets<br />

4.8 Non-current assets held for sale<br />

4.9 Inventories<br />

4.10 Financial instruments<br />

4.10.1 Initial recognition<br />

4.10.2 Initial measurement<br />

4.10.3 Subsequent measurement<br />

4.10.4 Derecognition of financial instruments<br />

4.10.5 Derivative financial instruments<br />

4.10.6 Hedge accounting<br />

4.10.7 Offsetting<br />

4.11 Investments<br />

4.12 Loans and advances and related impairment<br />

provisions<br />

4.12.1 Loans and advances<br />

4.12.2 Impairment provisions<br />

4.13 Borrowings<br />

4.14 Cash and cash equivalents<br />

4.15 Short term and longterm insurance<br />

4.16 Policyholder liabilities<br />

4.16.1 Life fund reserve<br />

4.16.2 Group policyholder liabilities<br />

4.16.3 Linked endowment products<br />

4.17 Provisions<br />

4.17.1 Onerous contracts<br />

4.17.2 Restructuring<br />

4.17.3 Liabilities under extended warranties<br />

4.18 Equity<br />

4.18.1 Share capital<br />

4.18.2 Treasury shares<br />

4.18.3 Dividends<br />

4.19 Revenue recognition<br />

4.19.1 Sale of merchandise<br />

4.19.2 Interest income<br />

4.19.3 Rendering of services<br />

4.20 Cost of sales<br />

4.21 Insurance benefits and claims<br />

4.22 Taxation<br />

4.22.1 Indirect taxation<br />

4.22.2 Direct taxation<br />

4.23 Share based payments<br />

4.23.1 Share based payments under the group’s<br />

long term incentive plan (LTIP) for<br />

employees<br />

4.23.2 Measurement of fair value of equity<br />

instruments granted<br />

4.23.3 ABIL Broad-based Black Economic<br />

Empowerment (B-BBEE) share ownership<br />

programme<br />

4.24 Borrowing costs<br />

4.25 Leased assets<br />

4.26 Translation of foreign currencies<br />

4.26.1 Foreign currency transactions and balances<br />

4.26.2 Net investment in a non-South <strong>African</strong><br />

operation<br />

4.27 Employee benefits<br />

4.27.1 Post employment benefits<br />

4.27.2 Short term benefits<br />

4.28 Contingent liabilities and commitments<br />

4.28.1 Contingent liabilities<br />

4.28.2 Commitments<br />

4.29 Segmental <strong>report</strong>ing<br />

4.30 Comparative figures<br />

The significant accounting policies set out below have been applied in the preparation and presentation of the <strong>African</strong><br />

<strong>Bank</strong> Investments Limited (ABIL) group financial statements as well as the ABIL company <strong>annual</strong> financial statements in<br />

dealing with items that are considered material by all the companies within the ABIL group during this <strong>report</strong>ing period.<br />

4.1 Statement of compliance<br />

The group and company <strong>annual</strong> financial statements are prepared in accordance with, and comply with, the<br />

International Financial Reporting Standards (IFRS) adopted by the International Accounting Standards Board<br />

<strong>African</strong> <strong>Bank</strong> Investments Limited | Integrated Report for the year ended 30 September 2012 233