Full annual report - African Bank - Investoreports

Full annual report - African Bank - Investoreports

Full annual report - African Bank - Investoreports

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

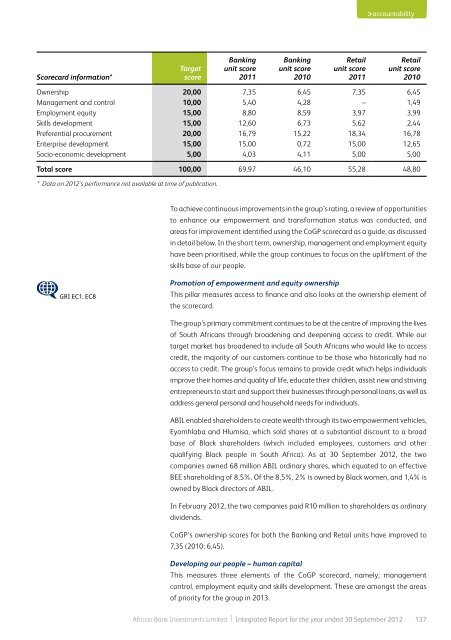

Scorecard information*<br />

Target<br />

score<br />

<strong>Bank</strong>ing<br />

unit score<br />

2011<br />

<strong>Bank</strong>ing<br />

unit score<br />

2010<br />

Retail<br />

unit score<br />

2011<br />

>accountability<br />

Retail<br />

unit score<br />

2010<br />

Ownership 20,00 7,35 6,45 7,35 6,45<br />

Management and control 10,00 5,40 4,28 – 1,49<br />

Employment equity 15,00 8,80 8,59 3,97 3,99<br />

Skills development 15,00 12,60 6,73 5,62 2,44<br />

Preferential procurement 20,00 16,79 15,22 18,34 16,78<br />

Enterprise development 15,00 15,00 0,72 15,00 12,65<br />

Socio-economic development 5,00 4,03 4,11 5,00 5,00<br />

Total score 100,00 69,97 46,10 55,28 48,80<br />

* Data on 2012’s performance not available at time of publication.<br />

GRI EC1, EC8<br />

To achieve continuous improvements in the group’s rating, a review of opportunities<br />

to enhance our empowerment and transformation status was conducted, and<br />

areas for improvement identified using the CoGP scorecard as a guide, as discussed<br />

in detail below. In the short term, ownership, management and employment equity<br />

have been prioritised, while the group continues to focus on the upliftment of the<br />

skills base of our people.<br />

Promotion of empowerment and equity ownership<br />

This pillar measures access to finance and also looks at the ownership element of<br />

the scorecard.<br />

The group’s primary commitment continues to be at the centre of improving the lives<br />

of South <strong>African</strong>s through broadening and deepening access to credit. While our<br />

target market has broadened to include all South <strong>African</strong>s who would like to access<br />

credit, the majority of our customers continue to be those who historically had no<br />

access to credit. The group’s focus remains to provide credit which helps individuals<br />

improve their homes and quality of life, educate their children, assist new and striving<br />

entrepreneurs to start and support their businesses through personal loans, as well as<br />

address general personal and household needs for individuals.<br />

ABIL enabled shareholders to create wealth through its two empowerment vehicles,<br />

Eyomhlaba and Hlumisa, which sold shares at a substantial discount to a broad<br />

base of Black shareholders (which included employees, customers and other<br />

qualifying Black people in South Africa). As at 30 September 2012, the two<br />

companies owned 68 million ABIL ordinary shares, which equated to an effective<br />

BEE shareholding of 8,5%. Of the 8,5%, 2% is owned by Black women, and 1,4% is<br />

owned by Black directors of ABIL.<br />

In February 2012, the two companies paid R10 million to shareholders as ordinary<br />

dividends.<br />

CoGP’s ownership scores for both the <strong>Bank</strong>ing and Retail units have improved to<br />

7,35 (2010: 6,45).<br />

Developing our people – human capital<br />

This measures three elements of the CoGP scorecard, namely; management<br />

control, employment equity and skills development. These are amongst the areas<br />

of priority for the group in 2013.<br />

<strong>African</strong> <strong>Bank</strong> Investments Limited | Integrated Report for the year ended 30 September 2012 137