Full annual report - African Bank - Investoreports

Full annual report - African Bank - Investoreports

Full annual report - African Bank - Investoreports

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

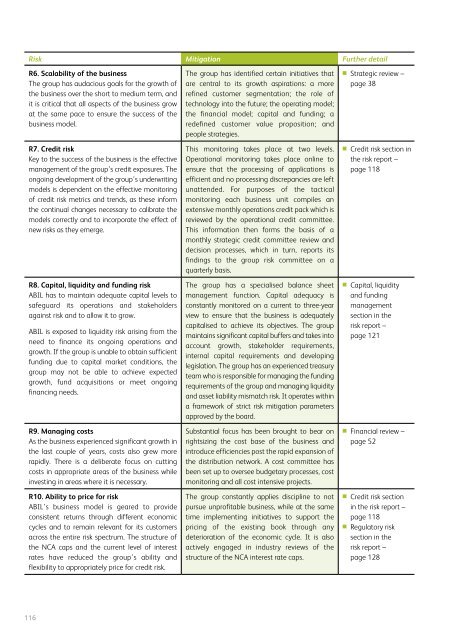

Risk Mitigation Further detail<br />

R6. Scalability of the business<br />

The group has audacious goals for the growth of<br />

the business over the short to medium term, and<br />

it is critical that all aspects of the business grow<br />

at the same pace to ensure the success of the<br />

business model.<br />

R7. Credit risk<br />

Key to the success of the business is the effective<br />

management of the group’s credit exposures. The<br />

ongoing development of the group’s underwriting<br />

models is dependent on the effective monitoring<br />

of credit risk metrics and trends, as these inform<br />

the continual changes necessary to calibrate the<br />

models correctly and to incorporate the effect of<br />

new risks as they emerge.<br />

R8. Capital, liquidity and funding risk<br />

ABIL has to maintain adequate capital levels to<br />

safeguard its operations and stakeholders<br />

against risk and to allow it to grow.<br />

ABIL is exposed to liquidity risk arising from the<br />

need to finance its ongoing operations and<br />

growth. If the group is unable to obtain sufficient<br />

funding due to capital market conditions, the<br />

group may not be able to achieve expected<br />

growth, fund acquisitions or meet ongoing<br />

financing needs.<br />

R9. Managing costs<br />

As the business experienced significant growth in<br />

the last couple of years, costs also grew more<br />

rapidly. There is a deliberate focus on cutting<br />

costs in appropriate areas of the business while<br />

investing in areas where it is necessary.<br />

R10. Ability to price for risk<br />

ABIL’s business model is geared to provide<br />

consistent returns through different economic<br />

cycles and to remain relevant for its customers<br />

across the entire risk spectrum. The structure of<br />

the NCA caps and the current level of interest<br />

rates have reduced the group’s ability and<br />

flexibility to appropriately price for credit risk.<br />

116<br />

The group has identified certain initiatives that<br />

are central to its growth aspirations: a more<br />

refined customer segmentation; the role of<br />

technology into the future; the operating model;<br />

the financial model; capital and funding; a<br />

redefined customer value proposition; and<br />

people strategies.<br />

This monitoring takes place at two levels.<br />

Operational monitoring takes place online to<br />

ensure that the processing of applications is<br />

efficient and no processing discrepancies are left<br />

unattended. For purposes of the tactical<br />

monitoring each business unit compiles an<br />

extensive monthly operations credit pack which is<br />

reviewed by the operational credit committee.<br />

This information then forms the basis of a<br />

monthly strategic credit committee review and<br />

decision processes, which in turn, <strong>report</strong>s its<br />

findings to the group risk committee on a<br />

quarterly basis.<br />

The group has a specialised balance sheet<br />

management function. Capital adequacy is<br />

constantly monitored on a current to three-year<br />

view to ensure that the business is adequately<br />

capitalised to achieve its objectives. The group<br />

maintains significant capital buffers and takes into<br />

account growth, stakeholder requirements,<br />

internal capital requirements and developing<br />

legislation. The group has an experienced treasury<br />

team who is responsible for managing the funding<br />

requirements of the group and managing liquidity<br />

and asset liability mismatch risk. It operates within<br />

a framework of strict risk mitigation parameters<br />

approved by the board.<br />

Substantial focus has been brought to bear on<br />

rightsizing the cost base of the business and<br />

introduce efficiencies post the rapid expansion of<br />

the distribution network. A cost committee has<br />

been set up to oversee budgetary processes, cost<br />

monitoring and all cost intensive projects.<br />

The group constantly applies discipline to not<br />

pursue unprofitable business, while at the same<br />

time implementing initiatives to support the<br />

pricing of the existing book through any<br />

deterioration of the economic cycle. It is also<br />

actively engaged in industry reviews of the<br />

structure of the NCA interest rate caps.<br />

■ Strategic review –<br />

page 38<br />

■ Credit risk section in<br />

the risk <strong>report</strong> –<br />

page 118<br />

■ Capital, liquidity<br />

and funding<br />

management<br />

section in the<br />

risk <strong>report</strong> –<br />

page 121<br />

■ Financial review –<br />

page 52<br />

■ Credit risk section<br />

in the risk <strong>report</strong> –<br />

page 118<br />

■ Regulatory risk<br />

section in the<br />

risk <strong>report</strong> –<br />

page 128