- Page 1 and 2:

Responsible credit with passion, co

- Page 3 and 4:

ABIL group - shareholders, funders,

- Page 5 and 6:

Contents Group profi le 2 Operating

- Page 7 and 8:

Operating structure >ABIL in perspe

- Page 9 and 10:

Our values We pledge to live by the

- Page 11 and 12:

‘03 ABIL achieves investment grad

- Page 13 and 14:

African Bank Investments Limited Fi

- Page 15 and 16:

African Bank Investments Limited Fi

- Page 17 and 18:

Shareholders’ profile Top fund ma

- Page 19 and 20:

2007 2006 2005 2004 2003 >ABIL in p

- Page 21 and 22:

2007 2006 2005 2004 2003 >ABIL in p

- Page 23 and 24:

Robert John (Johnny) Symmonds (53)

- Page 25 and 26:

Mojankunyane Florence (Mojanku) Gum

- Page 27 and 28:

Contents Letter to stakeholders 24

- Page 29 and 30:

Incwadi eya kubabambiqhaza Isingeni

- Page 31 and 32:

Ulwazi oluhambelanayo lungatholakal

- Page 33 and 34:

Umhlaba oncintisanayo Ukukhula okuk

- Page 35 and 36:

labele izidingongqangi ezikhulayo e

- Page 37 and 38:

Ukuze uthole olunye ulwazi ngemizam

- Page 39 and 40:

ngo-1994. Wenze ukufaka isandla oku

- Page 41 and 42:

usiness overview Material issue Why

- Page 43 and 44:

For more information on people rela

- Page 45 and 46:

egistered some short term gains and

- Page 47 and 48:

What sets us apart Quality of our p

- Page 49 and 50:

Active engagement with our people i

- Page 51 and 52:

Our customers Engagement methods St

- Page 53 and 54:

ABIL engaged with a wide group of l

- Page 55 and 56:

The most important of these are dis

- Page 57 and 58:

The risk base of the group is not c

- Page 59 and 60:

Return on equity in line with targe

- Page 61 and 62:

Retail unit Consolidation adjustmen

- Page 63 and 64:

Retail unit Consolidation adjustmen

- Page 65 and 66:

Share based payment reserve Other O

- Page 67 and 68:

Financial returns >business overvie

- Page 69 and 70:

Gross profit margin % 46 44 42 41 3

- Page 71 and 72:

were launched in October. The virtu

- Page 73 and 74:

Number of employees - Banking unit

- Page 75 and 76:

Of the credit cards issued in 2012,

- Page 77 and 78:

Disbursement features Disbursements

- Page 79 and 80:

Vintage graph - African Bank (More

- Page 81 and 82:

Liabilities Funding >business overv

- Page 83 and 84:

Capital management >business overvi

- Page 85 and 86:

The changes to capital adequacy on

- Page 87 and 88:

Contents Corporate governance repor

- Page 89 and 90:

Corporate governance structure Grou

- Page 91 and 92:

Board meetings and attendance >acco

- Page 93 and 94:

Conflict of interest All directors

- Page 95 and 96:

The office of the group compliance

- Page 97 and 98:

Introduction and report objectives

- Page 99 and 100:

■ Ensuring that there is an adequ

- Page 101 and 102:

Component Summary Benefits Benefits

- Page 103 and 104:

Exposure to existing long term ince

- Page 105 and 106:

The components of executive directo

- Page 107 and 108:

LTIPs awarded to executive director

- Page 109 and 110:

accountability the annual general m

- Page 111 and 112:

Risk management objectives >account

- Page 113 and 114:

Three levels of defence as applied

- Page 115 and 116:

Case volumes received: Year-on-year

- Page 117 and 118:

For more detail, see the group’s

- Page 119 and 120:

accountability Risk Mitigation Furt

- Page 121 and 122:

accountability Risk Mitigation Furt

- Page 123 and 124:

expectation that losses will occur

- Page 125 and 126:

Refer to page 74 and 76 in the inte

- Page 127 and 128:

ABIL - capital adequacy ratio % 25

- Page 129 and 130:

Liquidity and funding The group man

- Page 131 and 132:

deposits at highly competitive rate

- Page 133 and 134:

Regulatory risk South Africa’s cu

- Page 135 and 136:

Regulatory issue Description Risk/I

- Page 137 and 138:

Regulatory issue Description Risk/I

- Page 139 and 140:

Dear Sir/Madam In the year 2009 I e

- Page 141 and 142:

Scorecard information* Target score

- Page 143 and 144:

GRI SO1 For a detailed report on CS

- Page 145 and 146:

accountability Overall employee tur

- Page 147 and 148:

The Banking unit has increased the

- Page 149 and 150:

accountability Transformation and e

- Page 151 and 152:

Union membership 2012 47,8% 52,0% 0

- Page 153 and 154:

Employee turnover % 45 40 35 30 25

- Page 155 and 156:

Union membership % 70 60 50 40 30 2

- Page 157 and 158:

Transformation and employment equit

- Page 159 and 160:

■ C = Collect; ■ A = Advise;

- Page 161 and 162:

GRI PR7 GRI PR8 GRI PR9 Customer ex

- Page 163 and 164:

GRI PR1, PR2 >accountability condit

- Page 165 and 166:

GRI EC8, EC9, S01 >accountability l

- Page 167 and 168:

Number of projects 9% 5% ■ KwaZul

- Page 169 and 170:

Ilembe schools connectivity project

- Page 171 and 172:

For more information on CSI visit h

- Page 173 and 174:

accountability and measured against

- Page 175 and 176:

GRI EN18 Weaknesses and shortfalls

- Page 177 and 178:

GRI EN2 >accountability Paper savin

- Page 179 and 180:

GRI EN30 Community engagement >acco

- Page 181 and 182:

Case studies Cato Ridge Epping The

- Page 183 and 184:

est practice) gasses are absent and

- Page 185 and 186:

Findings Based on our review of the

- Page 187 and 188:

Description Explanation 2.7 Markets

- Page 189 and 190:

Description Explanation 4.8 Interna

- Page 191 and 192:

Description Explanation EC4 Signifi

- Page 193 and 194:

Description Explanation Emissions,

- Page 195 and 196:

Description Explanation Occupationa

- Page 197 and 198:

Description Explanation Freedom of

- Page 199 and 200:

Description Explanation Customer he

- Page 201 and 202:

Annual financial statements 197-320

- Page 203 and 204:

45.1 Operating segments 285 45.2 Se

- Page 205 and 206:

Dividend cover (times) Dividend cov

- Page 207 and 208:

Acronyms and abbreviations ABIL Afr

- Page 209 and 210:

Nine-year summarised group income s

- Page 211 and 212:

Currency adjusted group income stat

- Page 213 and 214:

Directors’ responsibility stateme

- Page 215 and 216:

Audit committee report The audit co

- Page 217 and 218:

Domestic Medium Term Note (DMTN) Pr

- Page 219 and 220:

Interest of directors of the compan

- Page 221 and 222:

■ Granting the general approval t

- Page 223 and 224:

Group income statement for the year

- Page 225 and 226:

Share based payment reserve Cash fl

- Page 227 and 228:

Notes to the group annual financial

- Page 229 and 230:

IFRS/IFRIC Title and details Expect

- Page 231 and 232:

IFRS/IFRIC Title and details Expect

- Page 233 and 234:

3. Critical accounting judgements a

- Page 235 and 236:

3.2.2 Impairment of advances >annua

- Page 237 and 238:

annual financial statements practic

- Page 239 and 240:

Business combinations >annual finan

- Page 241 and 242:

annual financial statements payment

- Page 243 and 244:

4.10.3 Subsequent measurement >annu

- Page 245 and 246:

annual financial statements A finan

- Page 247 and 248:

annual financial statements Bank or

- Page 249 and 250:

annual financial statements For the

- Page 251 and 252:

annual financial statements Ordinar

- Page 253 and 254:

4.20 Cost of sales 4.19.3.4 Deliver

- Page 255 and 256:

annual financial statements The sha

- Page 257 and 258:

annual financial statements the exp

- Page 259 and 260: annual financial statements R milli

- Page 261 and 262: 9. Net advances continued 9.1 Credi

- Page 263 and 264: 9. Net advances continued 9.1 Credi

- Page 265 and 266: R million Opening balance Recognise

- Page 267 and 268: R million Carrying value at the beg

- Page 269 and 270: R million Balance at the beginning

- Page 271 and 272: annual financial statements R milli

- Page 273 and 274: 2012 2011 Unamortised discount Net

- Page 275 and 276: 2012 2011 Unamortised discount Net

- Page 277 and 278: Foreign currency translation Foreig

- Page 279 and 280: Interest capitalised 2012 2011 Unam

- Page 281 and 282: annual financial statements 2012 20

- Page 283 and 284: annual financial statements R milli

- Page 285 and 286: annual financial statements R milli

- Page 287 and 288: annual financial statements 2012 20

- Page 289 and 290: annual financial statements R milli

- Page 291 and 292: annual financial statements 46. Fin

- Page 293 and 294: R million Up to 1 month Greater tha

- Page 295 and 296: annual financial statements 46. Fin

- Page 297 and 298: annual financial statements 46. Fin

- Page 299 and 300: annual financial statements Index t

- Page 301 and 302: R million Carrying value at year en

- Page 303 and 304: annual financial statements 49. Int

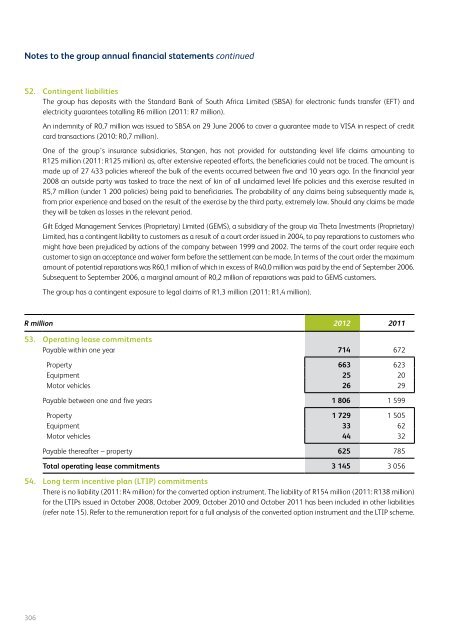

- Page 305 and 306: annual financial statements 50. Lon

- Page 307 and 308: 51. Analysis of financial assets an

- Page 309: annual financial statements 51. Ana

- Page 313 and 314: annual financial statements 58. Res

- Page 315 and 316: Company statement of comprehensive

- Page 317 and 318: Notes to the company annual financi

- Page 319 and 320: annual financial statements R milli

- Page 321 and 322: annual financial statements R milli

- Page 323 and 324: Prefsure (Botswana) Limited Insuran

- Page 325 and 326: Contents Shareholder information Di

- Page 327 and 328: Dividend timetable >shareholder inf

- Page 329 and 330: JSE statistics >shareholder informa

- Page 331 and 332: Analysis of ordinary shareholders a

- Page 333 and 334: Contents Annual general meeting Not

- Page 335 and 336: 3. Ordinary resolution 3 - Election

- Page 337 and 338: annual general meeting As the revis

- Page 339 and 340: annual general meeting 9.1 immediat

- Page 341 and 342: annual general meeting 11.3.3 repur

- Page 343 and 344: Motivation for ordinary resolution

- Page 345 and 346: annual general meeting message util

- Page 347 and 348: Leonidas (Leon) Kirkinis Chief exec

- Page 349 and 350: higher. Qualifying participants are

- Page 351 and 352: (iv) Directors’ interests in secu

- Page 353 and 354: Application form: Electronic partic

- Page 355 and 356: Form of proxy African Bank Investme

- Page 357 and 358: annual general meeting Summary of s

- Page 359 and 360: Corporate information Board of dire