Torp Computing Group ASA

Torp Computing Group ASA

Torp Computing Group ASA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Torp</strong> <strong>Computing</strong> <strong>Group</strong> <strong>ASA</strong><br />

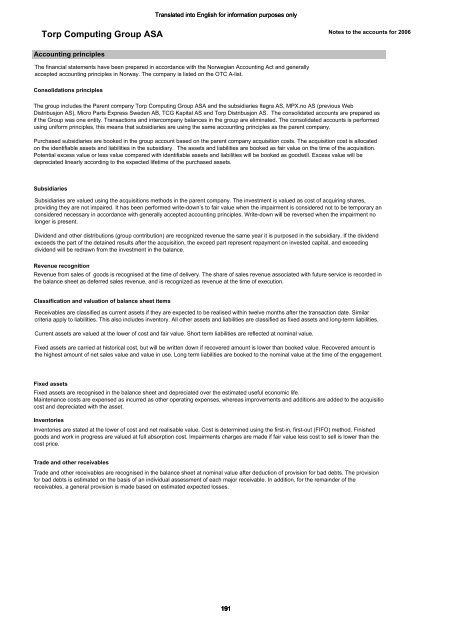

Accounting principles<br />

The financial statements have been prepared in accordance with the Norwegian Accounting Act and generally<br />

accepted accounting principles in Norway. The company is listed on the OTC A-list.<br />

Consolidations principles<br />

Classification and valuation of balance sheet items<br />

Translated into English for information purposes only<br />

Notes to the accounts for 2006<br />

The group includes the Parent company <strong>Torp</strong> <strong>Computing</strong> <strong>Group</strong> <strong>ASA</strong> and the subsidiaries Itegra AS, MPX.no AS (previous Web<br />

Distribusjon AS), Micro Parts Express Sweden AB, TCG Kapital AS and <strong>Torp</strong> Distribusjon AS. The consolidated accounts are prepared as<br />

if the <strong>Group</strong> was one entity. Transactions and intercompany balances in the group are eliminated. The consolidated accounts is performed<br />

using uniform principles, this means that subsidiaries are using the same accounting principles as the parent company.<br />

Purchased subsidiaries are booked in the group account based on the parent company acquisition costs. The acquisition cost is allocated<br />

on the identifiable assets and liabilities in the subsidiary. The assets and liabilities are booked as fair value on the time of the acquisition.<br />

Potential excess value or less value compared with identifiable assets and liabilities will be booked as goodwill. Excess value will be<br />

depreciated linearly according to the expected lifetime of the purchased assets.<br />

Subsidiaries<br />

Subsidiaries are valued using the acquisitions methods in the parent company. The investment is valued as cost of acquiring shares,<br />

providing they are not impaired. It has been performed write-down’s to fair value when the impairment is considered not to be temporary an<br />

considered necessary in accordance with generally accepted accounting principles. Write-down will be reversed when the impairment no<br />

longer is present.<br />

Dividend and other distributions (group contribution) are recognized revenue the same year it is purposed in the subsidiary. If the dividend<br />

exceeds the part of the detained results after the acquisition, the exceed part represent repayment on invested capital, and exceeding<br />

dividend will be redrawn from the investment in the balance.<br />

Revenue recognition<br />

Revenue from sales of goods is recognised at the time of delivery. The share of sales revenue associated with future service is recorded in<br />

the balance sheet as deferred sales revenue, and is recognized as revenue at the time of execution.<br />

Receivables are classified as current assets if they are expected to be realised within twelve months after the transaction date. Similar<br />

criteria apply to liabilities. This also includes inventory. All other assets and liabilities are classified as fixed assets and long-term liabilities.<br />

Current assets are valued at the lower of cost and fair value. Short term liabilities are reflected at nominal value.<br />

Fixed assets are carried at historical cost, but will be written down if recovered amount is lower than booked value. Recovered amount is<br />

the highest amount of net sales value and value in use. Long term liabilities are booked to the nominal value at the time of the engagement.<br />

Fixed assets<br />

Fixed assets are recognised in the balance sheet and depreciated over the estimated useful economic life.<br />

Maintenance costs are expensed as incurred as other operating expenses, whereas improvements and additions are added to the acquisitio<br />

cost and depreciated with the asset.<br />

Inventories<br />

Inventories are stated at the lower of cost and net realisable value. Cost is determined using the first-in, first-out (FIFO) method. Finished<br />

goods and work in progress are valued at full absorption cost. Impairments charges are made if fair value less cost to sell is lower than the<br />

cost price.<br />

Trade and other receivables<br />

Trade and other receivables are recognised in the balance sheet at nominal value after deduction of provision for bad debts. The provision<br />

for bad debts is estimated on the basis of an individual assessment of each major receivable. In addition, for the remainder of the<br />

receivables, a general provision is made based on estimated expected losses.<br />

191