Torp Computing Group ASA

Torp Computing Group ASA

Torp Computing Group ASA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Torp</strong> <strong>Computing</strong> <strong>Group</strong> <strong>ASA</strong><br />

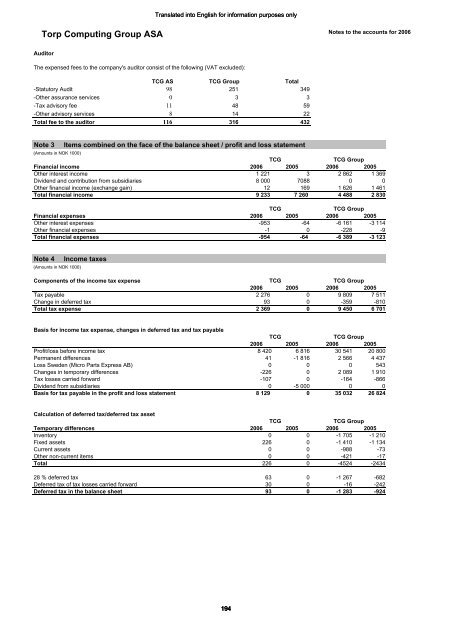

Auditor<br />

The expensed fees to the company's auditor consist of the following (VAT excluded):<br />

TCG AS TCG <strong>Group</strong> Total<br />

-Statutory Audit 98 251 349<br />

-Other assurance services 0 3 3<br />

-Tax advisory fee 11 48 59<br />

-Other advisory services 8 14 22<br />

Total fee to the auditor 116 316 432<br />

Notes to the accounts for 2006<br />

Note 3 Items combined on the face of the balance sheet / profit and loss statement<br />

(Amounts in NOK 1000)<br />

TCG<br />

TCG <strong>Group</strong><br />

Financial income 2006 2005 2006 2005<br />

Other interest income 1 221<br />

3 2 862 1 369<br />

Dividend and contribution from subsidiaries 8 000 7088 0 0<br />

Other financial income (exchange gain) 12<br />

169 1 626 1 461<br />

Total financial income 9 233 7 260<br />

4 488 2 830<br />

TCG<br />

TCG <strong>Group</strong><br />

Financial expenses 2006 2005 2006 2005<br />

Other interest expenses -953<br />

-64 -6 161 -3 114<br />

Other financial expenses -1<br />

0 -228 -9<br />

Total financial expenses -954<br />

-64 -6 389 -3 123<br />

Note 4 Income taxes<br />

(Amounts in NOK 1000)<br />

Translated into English for information purposes only<br />

Components of the income tax expense<br />

TCG TCG <strong>Group</strong><br />

2006 2005 2006 2005<br />

Tax payable 2 276<br />

0 9 809 7 511<br />

Change in deferred tax 93<br />

0 -359 -810<br />

Total tax expense 2 369<br />

0 9 450 6 701<br />

Basis for income tax expense, changes in deferred tax and tax payable<br />

TCG TCG <strong>Group</strong><br />

2006 2005 2006 2005<br />

Profit/loss before income tax 8 420 6 816 30 541 20 800<br />

Permanent differences 41 -1 816 2 566 4 437<br />

Loss Sweden (Micro Parts Express AB) 0 0 0 543<br />

Changes in temporary differences -226 0 2 089 1 910<br />

Tax losses carried forward -107 0 -164 -866<br />

Dividend from subsidiaries 0 -5 000 0 0<br />

Basis for tax payable in the profit and loss statement 8 129<br />

0 35 032 26 824<br />

Calculation of deferred tax/deferred tax asset<br />

TCG<br />

TCG <strong>Group</strong><br />

Temporary differences 2006 2005 2006 2005<br />

Inventory 0 0 -1 705 -1 210<br />

Fixed assets 226 0 -1 410 -1 134<br />

Current assets 0 0 -988 -73<br />

Other non-current items 0 0 -421 -17<br />

Total 226 0 -4524 -2434<br />

28 % deferred tax 63 0 -1 267 -682<br />

Deferred tax of tax losses carried forward 30 0 -16 -242<br />

Deferred tax in the balance sheet 93 0 -1 283 -924<br />

194