in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Investments and Securities<br />

Investments and securities <strong>in</strong>clude securities held as fixed<br />

assets, securities held as current assets and <strong>in</strong>vestments on<br />

behalf <strong>of</strong> <strong>in</strong>surance holders. They amounted to 4,237 million<br />

euros at June 30, <strong>2003</strong>, compared with 19,662 million euros at<br />

December 31, 2002. The decrease <strong>of</strong> 15,425 million euros stems<br />

ma<strong>in</strong>ly from disposal <strong>of</strong> <strong>the</strong> Group’s <strong>in</strong>surance activities.<br />

Net Deferred Tax Assets<br />

Net deferred tax assets at June 30, <strong>2003</strong> totaled 2,082 million<br />

euros, compared with a positive balance <strong>of</strong> 2,263 million euros<br />

at December 31, 2002.<br />

11 Operat<strong>in</strong>g Performance and F<strong>in</strong>ancial Position <strong>of</strong> <strong>the</strong> Fiat Group and Fiat S.p.A.<br />

<strong>in</strong> <strong>the</strong> <strong>First</strong> <strong>Half</strong> <strong>of</strong> <strong>2003</strong><br />

Stockholders’ Equity<br />

Consolidated stockholders’ equity before m<strong>in</strong>ority <strong>in</strong>terest<br />

decreased by 1,222 million euros, decl<strong>in</strong><strong>in</strong>g from 8,679 million euros<br />

at December 31, 2002 to 7,457 million euros at June 30, <strong>2003</strong> due to<br />

<strong>the</strong> net loss (-737 million euros) posted for <strong>the</strong> first half <strong>of</strong> <strong>2003</strong>,<br />

<strong>the</strong> currency conversion differences caused by appreciation <strong>of</strong><br />

<strong>the</strong> euro (-328 million euros), while <strong>the</strong> rema<strong>in</strong><strong>in</strong>g amount <strong>of</strong> <strong>the</strong><br />

decrease (-157 million euros) is ma<strong>in</strong>ly due to <strong>the</strong> sale <strong>of</strong> IPI and<br />

Toro Assicurazioni correspond<strong>in</strong>g to <strong>the</strong> m<strong>in</strong>ority <strong>in</strong>terest.<br />

The Group’s <strong>in</strong>terest <strong>in</strong> stockholders’ equity decreased from<br />

7,641 million euros at December 31, 2002 to 6,641 million euros<br />

at June 30, <strong>2003</strong>, as a result <strong>of</strong> <strong>the</strong> net loss for <strong>the</strong> period (-708<br />

million euros) and <strong>the</strong> currency conversion differences caused<br />

by <strong>the</strong> appreciation <strong>of</strong> <strong>the</strong> euro (about -300 million euros).<br />

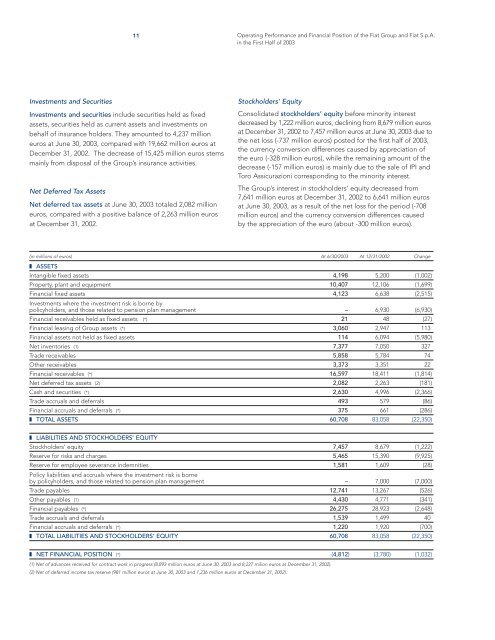

(<strong>in</strong> millions <strong>of</strong> euros) At 6/30/<strong>2003</strong> At 12/31/2002 Change<br />

❚ ASSETS<br />

Intangible fixed assets 4,198 5,200 (1,002)<br />

Property, plant and equipment 10,407 12,106 (1,699)<br />

F<strong>in</strong>ancial fixed assets<br />

Investments where <strong>the</strong> <strong>in</strong>vestment risk is borne by<br />

4,123 6,638 (2,515)<br />

policyholders, and those related to pension plan management – 6,930 (6,930)<br />

F<strong>in</strong>ancial receivables held as fixed assets (*) 21 48 (27)<br />

F<strong>in</strong>ancial leas<strong>in</strong>g <strong>of</strong> Group assets (*) 3,060 2,947 113<br />

F<strong>in</strong>ancial assets not held as fixed assets 114 6,094 (5,980)<br />

Net <strong>in</strong>ventories (1) 7,377 7,050 327<br />

Trade receivables 5,858 5,784 74<br />

O<strong>the</strong>r receivables 3,373 3,351 22<br />

F<strong>in</strong>ancial receivables (*) 16,597 18,411 (1,814)<br />

Net deferred tax assets (2) 2,082 2,263 (181)<br />

Cash and securities (*) 2,630 4,996 (2,366)<br />

Trade accruals and deferrals 493 579 (86)<br />

F<strong>in</strong>ancial accruals and deferrals (*) 375 661 (286)<br />

❚ TOTAL ASSETS 60,708 83,058 (22,350)<br />

❚ LIABILITIES AND STOCKHOLDERS’ EQUITY<br />

Stockholders’ equity 7,457 8,679 (1,222)<br />

Reserve for risks and charges 5,465 15,390 (9,925)<br />

Reserve for employee severance <strong>in</strong>demnities<br />

Policy liabilities and accruals where <strong>the</strong> <strong>in</strong>vestment risk is borne<br />

1,581 1,609 (28)<br />

by policyholders, and those related to pension plan management – 7,000 (7,000)<br />

Trade payables 12,741 13,267 (526)<br />

O<strong>the</strong>r payables (1) 4,430 4,771 (341)<br />

F<strong>in</strong>ancial payables (*) 26,275 28,923 (2,648)<br />

Trade accruals and deferrals 1,539 1,499 40<br />

F<strong>in</strong>ancial accruals and deferrals (*) 1,220 1,920 (700)<br />

❚ TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY 60,708 83,058 (22,350)<br />

❚ NET FINANCIAL POSITION (*) (4,812) (3,780) (1,032)<br />

(1) Net <strong>of</strong> advances received for contract work <strong>in</strong> progress (8,893 million euros at June 30, <strong>2003</strong> and 8,227 milion euros at December 31, 2002).<br />

(2) Net <strong>of</strong> deferred <strong>in</strong>come tax reserve (981 million euros at June 30, <strong>2003</strong> and 1,236 million euros at December 31, 2002).