in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

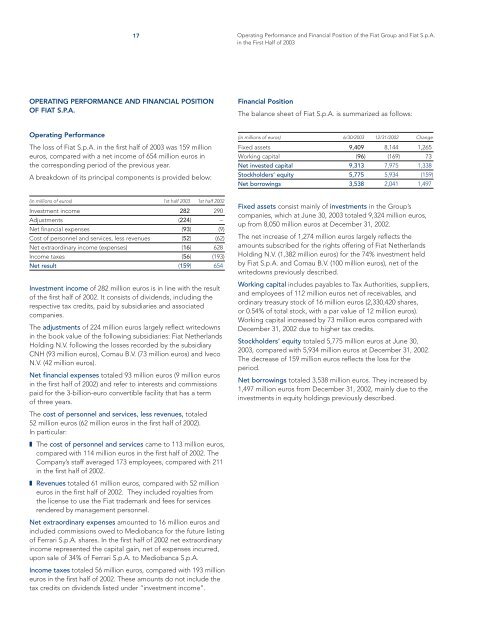

OPERATING PERFORMANCE AND FINANCIAL POSITION<br />

OF <strong>FIAT</strong> S.P.A.<br />

Operat<strong>in</strong>g Performance<br />

The loss <strong>of</strong> Fiat S.p.A. <strong>in</strong> <strong>the</strong> first half <strong>of</strong> <strong>2003</strong> was 159 million<br />

euros, compared with a net <strong>in</strong>come <strong>of</strong> 654 million euros <strong>in</strong><br />

<strong>the</strong> correspond<strong>in</strong>g period <strong>of</strong> <strong>the</strong> previous year.<br />

A breakdown <strong>of</strong> its pr<strong>in</strong>cipal components is provided below:<br />

(<strong>in</strong> millions <strong>of</strong> euros) 1st half <strong>2003</strong> 1st half 2002<br />

Investment <strong>in</strong>come 282 290<br />

Adjustments (224) –<br />

Net f<strong>in</strong>ancial expenses (93) (9)<br />

Cost <strong>of</strong> personnel and services, less revenues (52) (62)<br />

Net extraord<strong>in</strong>ary <strong>in</strong>come (expenses) (16) 628<br />

Income taxes (56) (193)<br />

Net result (159) 654<br />

Investment <strong>in</strong>come <strong>of</strong> 282 million euros is <strong>in</strong> l<strong>in</strong>e with <strong>the</strong> result<br />

<strong>of</strong> <strong>the</strong> first half <strong>of</strong> 2002. It consists <strong>of</strong> dividends, <strong>in</strong>clud<strong>in</strong>g <strong>the</strong><br />

respective tax credits, paid by subsidiaries and associated<br />

companies.<br />

The adjustments <strong>of</strong> 224 million euros largely reflect writedowns<br />

<strong>in</strong> <strong>the</strong> book value <strong>of</strong> <strong>the</strong> follow<strong>in</strong>g subsidiaries: Fiat Ne<strong>the</strong>rlands<br />

Hold<strong>in</strong>g N.V. follow<strong>in</strong>g <strong>the</strong> losses recorded by <strong>the</strong> subsidiary<br />

CNH (93 million euros), Comau B.V. (73 million euros) and Iveco<br />

N.V. (42 million euros).<br />

Net f<strong>in</strong>ancial expenses totaled 93 million euros (9 million euros<br />

<strong>in</strong> <strong>the</strong> first half <strong>of</strong> 2002) and refer to <strong>in</strong>terests and commissions<br />

paid for <strong>the</strong> 3-billion-euro convertible facility that has a term<br />

<strong>of</strong> three years.<br />

The cost <strong>of</strong> personnel and services, less revenues, totaled<br />

52 million euros (62 million euros <strong>in</strong> <strong>the</strong> first half <strong>of</strong> 2002).<br />

In particular:<br />

❚ The cost <strong>of</strong> personnel and services came to 113 million euros,<br />

compared with 114 million euros <strong>in</strong> <strong>the</strong> first half <strong>of</strong> 2002. The<br />

Company’s staff averaged 173 employees, compared with 211<br />

<strong>in</strong> <strong>the</strong> first half <strong>of</strong> 2002.<br />

❚ Revenues totaled 61 million euros, compared with 52 million<br />

euros <strong>in</strong> <strong>the</strong> first half <strong>of</strong> 2002. They <strong>in</strong>cluded royalties from<br />

<strong>the</strong> license to use <strong>the</strong> Fiat trademark and fees for services<br />

rendered by management personnel.<br />

Net extraord<strong>in</strong>ary expenses amounted to 16 million euros and<br />

<strong>in</strong>cluded commissions owed to Mediobanca for <strong>the</strong> future list<strong>in</strong>g<br />

<strong>of</strong> Ferrari S.p.A. shares. In <strong>the</strong> first half <strong>of</strong> 2002 net extraord<strong>in</strong>ary<br />

<strong>in</strong>come represented <strong>the</strong> capital ga<strong>in</strong>, net <strong>of</strong> expenses <strong>in</strong>curred,<br />

upon sale <strong>of</strong> 34% <strong>of</strong> Ferrari S.p.A. to Mediobanca S.p.A.<br />

Income taxes totaled 56 million euros, compared with 193 million<br />

euros <strong>in</strong> <strong>the</strong> first half <strong>of</strong> 2002. These amounts do not <strong>in</strong>clude <strong>the</strong><br />

tax credits on dividends listed under “<strong>in</strong>vestment <strong>in</strong>come”.<br />

17 Operat<strong>in</strong>g Performance and F<strong>in</strong>ancial Position <strong>of</strong> <strong>the</strong> Fiat Group and Fiat S.p.A.<br />

<strong>in</strong> <strong>the</strong> <strong>First</strong> <strong>Half</strong> <strong>of</strong> <strong>2003</strong><br />

F<strong>in</strong>ancial Position<br />

The balance sheet <strong>of</strong> Fiat S.p.A. is summarized as follows:<br />

(<strong>in</strong> millions <strong>of</strong> euros) 6/30/<strong>2003</strong> 12/31/2002 Change<br />

Fixed assets 9,409 8,144 1,265<br />

Work<strong>in</strong>g capital (96) (169) 73<br />

Net <strong>in</strong>vested capital 9,313 7,975 1,338<br />

Stockholders’ equity 5,775 5,934 (159)<br />

Net borrow<strong>in</strong>gs 3,538 2,041 1,497<br />

Fixed assets consist ma<strong>in</strong>ly <strong>of</strong> <strong>in</strong>vestments <strong>in</strong> <strong>the</strong> Group’s<br />

companies, which at June 30, <strong>2003</strong> totaled 9,324 million euros,<br />

up from 8,050 million euros at December 31, 2002.<br />

The net <strong>in</strong>crease <strong>of</strong> 1,274 million euros largely reflects <strong>the</strong><br />

amounts subscribed for <strong>the</strong> rights <strong>of</strong>fer<strong>in</strong>g <strong>of</strong> Fiat Ne<strong>the</strong>rlands<br />

Hold<strong>in</strong>g N.V. (1,382 million euros) for <strong>the</strong> 74% <strong>in</strong>vestment held<br />

by Fiat S.p.A. and Comau B.V. (100 million euros), net <strong>of</strong> <strong>the</strong><br />

writedowns previously described.<br />

Work<strong>in</strong>g capital <strong>in</strong>cludes payables to Tax Authorities, suppliers,<br />

and employees <strong>of</strong> 112 million euros net <strong>of</strong> receivables, and<br />

ord<strong>in</strong>ary treasury stock <strong>of</strong> 16 million euros (2,330,420 shares,<br />

or 0.54% <strong>of</strong> total stock, with a par value <strong>of</strong> 12 million euros).<br />

Work<strong>in</strong>g capital <strong>in</strong>creased by 73 million euros compared with<br />

December 31, 2002 due to higher tax credits.<br />

Stockholders’ equity totaled 5,775 million euros at June 30,<br />

<strong>2003</strong>, compared with 5,934 million euros at December 31, 2002.<br />

The decrease <strong>of</strong> 159 million euros reflects <strong>the</strong> loss for <strong>the</strong><br />

period.<br />

Net borrow<strong>in</strong>gs totaled 3,538 million euros. They <strong>in</strong>creased by<br />

1,497 million euros from December 31, 2002, ma<strong>in</strong>ly due to <strong>the</strong><br />

<strong>in</strong>vestments <strong>in</strong> equity hold<strong>in</strong>gs previously described.