in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

customary conditions precedent), and <strong>the</strong> f<strong>in</strong>anc<strong>in</strong>g secured<br />

by <strong>the</strong> agreements with EDF <strong>in</strong> connection with <strong>the</strong> Italenergia<br />

transaction (1,150 million euros).<br />

The level <strong>of</strong> gross <strong>in</strong>debtedness is lower than <strong>the</strong> figure<br />

reported at December 31, 2002: <strong>the</strong> target <strong>of</strong> reduc<strong>in</strong>g it to<br />

23.6 billion euros is expected to be achieved upon conclusion<br />

<strong>of</strong> <strong>the</strong> transfer to Fidis Retail Italia (51% <strong>of</strong> which has been sold<br />

to <strong>the</strong> lend<strong>in</strong>g banks) <strong>of</strong> <strong>the</strong> <strong>in</strong>vestments <strong>in</strong> <strong>the</strong> o<strong>the</strong>r f<strong>in</strong>ancial<br />

companies covered by <strong>the</strong> agreement and for which <strong>the</strong><br />

requested authorization is pend<strong>in</strong>g.<br />

In <strong>the</strong> first six months <strong>of</strong> <strong>2003</strong> <strong>the</strong> pr<strong>in</strong>cipal rat<strong>in</strong>g agencies<br />

lowered Fiat’s credit rat<strong>in</strong>g below <strong>in</strong>vestment grade level<br />

and should this condition persist, <strong>in</strong> July 2004 <strong>the</strong> Banks may<br />

proceed <strong>in</strong> advance with <strong>the</strong> conversion <strong>of</strong> debt <strong>in</strong>to capital<br />

for an amount up to 2 billion euros.<br />

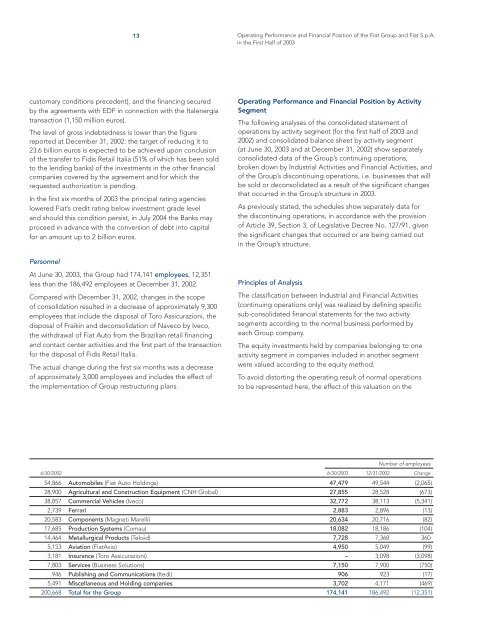

Personnel<br />

At June 30, <strong>2003</strong>, <strong>the</strong> Group had 174,141 employees, 12,351<br />

less than <strong>the</strong> 186,492 employees at December 31, 2002.<br />

Compared with December 31, 2002, changes <strong>in</strong> <strong>the</strong> scope<br />

<strong>of</strong> consolidation resulted <strong>in</strong> a decrease <strong>of</strong> approximately 9,300<br />

employees that <strong>in</strong>clude <strong>the</strong> disposal <strong>of</strong> Toro Assicurazioni, <strong>the</strong><br />

disposal <strong>of</strong> Fraik<strong>in</strong> and deconsolidation <strong>of</strong> Naveco by Iveco,<br />

<strong>the</strong> withdrawal <strong>of</strong> Fiat Auto from <strong>the</strong> Brazilian retail f<strong>in</strong>anc<strong>in</strong>g<br />

and contact center activities and <strong>the</strong> first part <strong>of</strong> <strong>the</strong> transaction<br />

for <strong>the</strong> disposal <strong>of</strong> Fidis Retail Italia.<br />

The actual change dur<strong>in</strong>g <strong>the</strong> first six months was a decrease<br />

<strong>of</strong> approximately 3,000 employees and <strong>in</strong>cludes <strong>the</strong> effect <strong>of</strong><br />

<strong>the</strong> implementation <strong>of</strong> Group restructur<strong>in</strong>g plans.<br />

13 Operat<strong>in</strong>g Performance and F<strong>in</strong>ancial Position <strong>of</strong> <strong>the</strong> Fiat Group and Fiat S.p.A.<br />

<strong>in</strong> <strong>the</strong> <strong>First</strong> <strong>Half</strong> <strong>of</strong> <strong>2003</strong><br />

Operat<strong>in</strong>g Performance and F<strong>in</strong>ancial Position by Activity<br />

Segment<br />

The follow<strong>in</strong>g analyses <strong>of</strong> <strong>the</strong> consolidated statement <strong>of</strong><br />

operations by activity segment (for <strong>the</strong> first half <strong>of</strong> <strong>2003</strong> and<br />

2002) and consolidated balance sheet by activity segment<br />

(at June 30, <strong>2003</strong> and at December 31, 2002) show separately<br />

consolidated data <strong>of</strong> <strong>the</strong> Group’s cont<strong>in</strong>u<strong>in</strong>g operations,<br />

broken down by Industrial Activities and F<strong>in</strong>ancial Activities, and<br />

<strong>of</strong> <strong>the</strong> Group’s discont<strong>in</strong>u<strong>in</strong>g operations, i.e. bus<strong>in</strong>esses that will<br />

be sold or deconsolidated as a result <strong>of</strong> <strong>the</strong> significant changes<br />

that occurred <strong>in</strong> <strong>the</strong> Group’s structure <strong>in</strong> <strong>2003</strong>.<br />

As previously stated, <strong>the</strong> schedules show separately data for<br />

<strong>the</strong> discont<strong>in</strong>u<strong>in</strong>g operations, <strong>in</strong> accordance with <strong>the</strong> provision<br />

<strong>of</strong> Article 39, Section 3, <strong>of</strong> Legislative Decree No. 127/91, given<br />

<strong>the</strong> significant changes that occurred or are be<strong>in</strong>g carried out<br />

<strong>in</strong> <strong>the</strong> Group’s structure.<br />

Pr<strong>in</strong>ciples <strong>of</strong> Analysis<br />

The classification between Industrial and F<strong>in</strong>ancial Activities<br />

(cont<strong>in</strong>u<strong>in</strong>g operations only) was realized by def<strong>in</strong><strong>in</strong>g specific<br />

sub-consolidated f<strong>in</strong>ancial statements for <strong>the</strong> two activity<br />

segments accord<strong>in</strong>g to <strong>the</strong> normal bus<strong>in</strong>ess performed by<br />

each Group company.<br />

The equity <strong>in</strong>vestments held by companies belong<strong>in</strong>g to one<br />

activity segment <strong>in</strong> companies <strong>in</strong>cluded <strong>in</strong> ano<strong>the</strong>r segment<br />

were valued accord<strong>in</strong>g to <strong>the</strong> equity method.<br />

To avoid distort<strong>in</strong>g <strong>the</strong> operat<strong>in</strong>g result <strong>of</strong> normal operations<br />

to be represented here, <strong>the</strong> effect <strong>of</strong> this valuation on <strong>the</strong><br />

Number <strong>of</strong> employees<br />

6/30/2002 6/30/<strong>2003</strong> 12/31/2002 Change<br />

54,866 Automobiles (Fiat Auto Hold<strong>in</strong>gs) 47,479 49,544 (2,065)<br />

28,900 Agricultural and Construction Equipment (CNH Global) 27,855 28,528 (673)<br />

38,857 Commercial Vehicles (Iveco) 32,772 38,113 (5,341)<br />

2,739 Ferrari 2,883 2,896 (13)<br />

20,583 Components (Magneti Marelli) 20,634 20,716 (82)<br />

17,685 Production Systems (Comau) 18,082 18,186 (104)<br />

14,464 Metallurgical Products (Teksid) 7,728 7,368 360<br />

5,153 Aviation (FiatAvio) 4,950 5,049 (99)<br />

3,181 Insurance (Toro Assicurazioni) – 3,098 (3,098)<br />

7,803 Services (Bus<strong>in</strong>ess Solutions) 7,150 7,900 (750)<br />

946 Publish<strong>in</strong>g and Communications (Itedi) 906 923 (17)<br />

5,491 Miscellaneous and Hold<strong>in</strong>g companies 3,702 4,171 (469)<br />

200,668 Total for <strong>the</strong> Group 174,141 186,492 (12,351)