in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Discont<strong>in</strong>u<strong>in</strong>g Operations<br />

The revenues from discont<strong>in</strong>u<strong>in</strong>g operations totaled 2,648<br />

million euros <strong>in</strong> <strong>the</strong> first half <strong>of</strong> <strong>2003</strong> and <strong>the</strong>y <strong>in</strong>cluded <strong>the</strong><br />

contribution <strong>of</strong> FiatAvio for <strong>the</strong> six months (625 million euros;<br />

768 million euros <strong>in</strong> <strong>the</strong> correspond<strong>in</strong>g period <strong>of</strong> 2002), Toro<br />

Assicurazioni for <strong>the</strong> first four months <strong>of</strong> <strong>2003</strong> (1,654 million<br />

euros; 2,446 million euros <strong>in</strong> <strong>the</strong> first half <strong>of</strong> 2002), Fidis Retail<br />

Italia activities for five months (110 million euros; 147 million<br />

euros <strong>in</strong> <strong>the</strong> first half <strong>of</strong> 2002), Brazilian retail f<strong>in</strong>anc<strong>in</strong>g activities<br />

<strong>of</strong> Fiat Auto for <strong>the</strong> first quarter (55 million euros; 216 million<br />

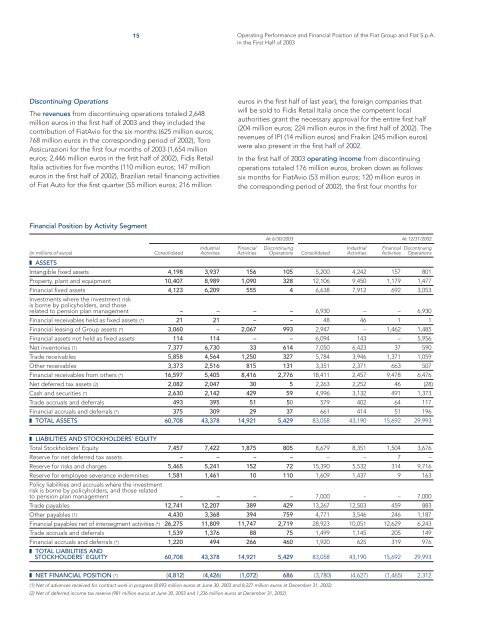

F<strong>in</strong>ancial Position by Activity Segment<br />

15 Operat<strong>in</strong>g Performance and F<strong>in</strong>ancial Position <strong>of</strong> <strong>the</strong> Fiat Group and Fiat S.p.A.<br />

<strong>in</strong> <strong>the</strong> <strong>First</strong> <strong>Half</strong> <strong>of</strong> <strong>2003</strong><br />

euros <strong>in</strong> <strong>the</strong> first half <strong>of</strong> last year), <strong>the</strong> foreign companies that<br />

will be sold to Fidis Retail Italia once <strong>the</strong> competent local<br />

authorities grant <strong>the</strong> necessary approval for <strong>the</strong> entire first half<br />

(204 million euros; 224 million euros <strong>in</strong> <strong>the</strong> first half <strong>of</strong> 2002). The<br />

revenues <strong>of</strong> IPI (14 million euros) and Fraik<strong>in</strong> (245 million euros)<br />

were also present <strong>in</strong> <strong>the</strong> first half <strong>of</strong> 2002.<br />

In <strong>the</strong> first half <strong>of</strong> <strong>2003</strong> operat<strong>in</strong>g <strong>in</strong>come from discont<strong>in</strong>u<strong>in</strong>g<br />

operations totaled 176 million euros, broken down as follows:<br />

six months for FiatAvio (53 million euros; 120 million euros <strong>in</strong><br />

<strong>the</strong> correspond<strong>in</strong>g period <strong>of</strong> 2002), <strong>the</strong> first four months for<br />

At 6/30/<strong>2003</strong> At 12/31/2002<br />

(<strong>in</strong> millions <strong>of</strong> euros)<br />

❚ ASSETS<br />

Consolidated<br />

Industrial<br />

Activities<br />

F<strong>in</strong>ancial<br />

Activities<br />

Discont<strong>in</strong>u<strong>in</strong>g<br />

Operations Consolidated<br />

Industrial<br />

Activities<br />

F<strong>in</strong>ancial Discont<strong>in</strong>u<strong>in</strong>g<br />

Activities Operations<br />

Intangible fixed assets 4,198 3,937 156 105 5,200 4,242 157 801<br />

Property, plant and equipment 10,407 8,989 1,090 328 12,106 9,450 1,179 1,477<br />

F<strong>in</strong>ancial fixed assets<br />

Investments where <strong>the</strong> <strong>in</strong>vestment risk<br />

4,123 6,209 555 4 6,638 7,912 692 3,053<br />

is borne by policyholders, and those<br />

related to pension plan management – – – – 6,930 – – 6,930<br />

F<strong>in</strong>ancial receivables held as fixed assets (*) 21 21 – – 48 46 1 1<br />

F<strong>in</strong>ancial leas<strong>in</strong>g <strong>of</strong> Group assets (*) 3,060 – 2,067 993 2,947 – 1,462 1,485<br />

F<strong>in</strong>ancial assets not held as fixed assets 114 114 – – 6,094 143 – 5,956<br />

Net <strong>in</strong>ventories (1) 7,377 6,730 33 614 7,050 6,423 37 590<br />

Trade receivables 5,858 4,564 1,250 327 5,784 3,946 1,371 1,059<br />

O<strong>the</strong>r receivables 3,373 2,516 815 131 3,351 2,371 663 507<br />

F<strong>in</strong>ancial receivables from o<strong>the</strong>rs (*) 16,597 5,405 8,416 2,776 18,411 2,457 9,478 6,476<br />

Net deferred tax assets (2) 2,082 2,047 30 5 2,263 2,252 46 (28)<br />

Cash and securities (*) 2,630 2,142 429 59 4,996 3,132 491 1,373<br />

Trade accruals and deferrals 493 395 51 50 579 402 64 117<br />

F<strong>in</strong>ancial accruals and deferrals (*) 375 309 29 37 661 414 51 196<br />

❚ TOTAL ASSETS 60,708 43,378 14,921 5,429 83,058 43,190 15,692 29,993<br />

❚ LIABILITIES AND STOCKHOLDERS' EQUITY<br />

Total Stockholders’ Equity 7,457 7,422 1,875 805 8,679 8,351 1,504 3,676<br />

Reserve for net deferred tax assets – – – – – – 7 –<br />

Reserve for risks and charges 5,465 5,241 152 72 15,390 5,532 314 9,716<br />

Reserve for employee severance <strong>in</strong>demnities<br />

Policy liabilities and accruals where <strong>the</strong> <strong>in</strong>vestment<br />

1,581 1,461 10 110 1,609 1,437 9 163<br />

risk is borne by policyholders, and those related<br />

to pension plan management – – – – 7,000 – – 7,000<br />

Trade payables 12,741 12,207 389 429 13,267 12,503 459 883<br />

O<strong>the</strong>r payables (1) 4,430 3,368 394 759 4,771 3,546 246 1,187<br />

F<strong>in</strong>ancial payables net <strong>of</strong> <strong>in</strong>tersegment activities (*) 26,275 11,809 11,747 2,719 28,923 10,051 12,629 6,243<br />

Trade accruals and deferrals 1,539 1,376 88 75 1,499 1,145 205 149<br />

F<strong>in</strong>ancial accruals and deferrals (*) 1,220 494 266 460 1,920 625 319 976<br />

❚ TOTAL LIABILITIES AND<br />

STOCKHOLDERS’ EQUITY 60,708 43,378 14,921 5,429 83,058 43,190 15,692 29,993<br />

❚ NET FINANCIAL POSITION (*) (4,812) (4,426) (1,072) 686 (3,780) (4,627) (1,465) 2,312<br />

(1) Net <strong>of</strong> advances received for contract work <strong>in</strong> progress (8,893 million euros at June 30, <strong>2003</strong> and 8,227 million euros at December 31, 2002).<br />

(2) Net <strong>of</strong> deferred <strong>in</strong>come tax reserve (981 million euros at June 30, <strong>2003</strong> and 1,236 million euros at December 31, 2002).