in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>the</strong> period. The <strong>in</strong>creases dur<strong>in</strong>g <strong>the</strong> period (268 million euros) stem ma<strong>in</strong>ly from <strong>the</strong> expenses for capitalization <strong>of</strong> acquisition<br />

<strong>of</strong> licenses for <strong>the</strong> development <strong>of</strong> technologies and products by FiatAvio S.p.A., capital <strong>in</strong>creases, and s<strong>of</strong>tware.<br />

Goodwill and Consolidation differences <strong>in</strong>cluded <strong>in</strong> this item totaled 2,794 million euros (3,600 million euros at December 31, 2002).<br />

The decrease <strong>of</strong> 806 million euros from <strong>the</strong> figure at December 31, 2002 is due to <strong>the</strong> Change <strong>in</strong> <strong>the</strong> scope <strong>of</strong> consolidation follow<strong>in</strong>g<br />

<strong>the</strong> sale <strong>of</strong> <strong>the</strong> Toro Assicurazioni Group (458 million euros), <strong>the</strong> Fraik<strong>in</strong> Group (88 million euros), and o<strong>the</strong>r m<strong>in</strong>or items (12 million<br />

euros); Amortization charged dur<strong>in</strong>g <strong>the</strong> period (-105 million euros); <strong>the</strong> negative Foreign exchange effect (-207 million euros), and<br />

o<strong>the</strong>r changes (64 million euros).<br />

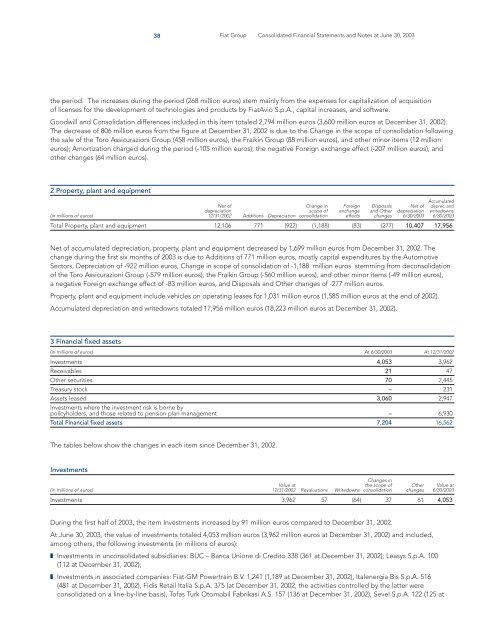

2 Property, plant and equipment<br />

Net <strong>of</strong> Change <strong>in</strong> Foreign Disposals Net <strong>of</strong><br />

Accumulated<br />

deprec. and<br />

depreciation scope <strong>of</strong> exchange and O<strong>the</strong>r depreciation writedowns<br />

(<strong>in</strong> millions <strong>of</strong> euros) 12/31/2002 Additions Depreciation consolidation effects changes 6/30/<strong>2003</strong> 6/30/<strong>2003</strong><br />

Total Property, plant and equipment 12,106 771 (922) (1,188) (83) (277) 10,407 17,956<br />

Net <strong>of</strong> accumulated depreciation, property, plant and equipment decreased by 1,699 million euros from December 31, 2002. The<br />

change dur<strong>in</strong>g <strong>the</strong> first six months <strong>of</strong> <strong>2003</strong> is due to Additions <strong>of</strong> 771 million euros, mostly capital expenditures by <strong>the</strong> Automotive<br />

Sectors, Depreciation <strong>of</strong> -922 million euros, Change <strong>in</strong> scope <strong>of</strong> consolidation <strong>of</strong> -1,188 million euros stemm<strong>in</strong>g from deconsolidation<br />

<strong>of</strong> <strong>the</strong> Toro Assicurazioni Group (-579 million euros), <strong>the</strong> Fraik<strong>in</strong> Group (-560 million euros), and o<strong>the</strong>r m<strong>in</strong>or items (-49 million euros),<br />

a negative Foreign exchange effect <strong>of</strong> -83 million euros, and Disposals and O<strong>the</strong>r changes <strong>of</strong> -277 million euros.<br />

Property, plant and equipment <strong>in</strong>clude vehicles on operat<strong>in</strong>g leases for 1,031 million euros (1,585 million euros at <strong>the</strong> end <strong>of</strong> 2002).<br />

Accumulated depreciation and writedowns totaled 17,956 million euros (18,223 million euros at December 31, 2002).<br />

3 F<strong>in</strong>ancial fixed assets<br />

(<strong>in</strong> millions <strong>of</strong> euros) At 6/30/<strong>2003</strong> At 12/31/2002<br />

Investments 4,053 3,962<br />

Receivables 21 47<br />

O<strong>the</strong>r securities 70 2,445<br />

Treasury stock – 231<br />

Assets leased 3,060 2,947<br />

Investments where <strong>the</strong> <strong>in</strong>vestment risk is borne by<br />

policyholders, and those related to pension plan management – 6,930<br />

Total F<strong>in</strong>ancial fixed assets 7,204 16,562<br />

The tables below show <strong>the</strong> changes <strong>in</strong> each item s<strong>in</strong>ce December 31, 2002.<br />

Investments<br />

38 Fiat Group Consolidated F<strong>in</strong>ancial Statements and Notes at June 30, <strong>2003</strong><br />

Changes <strong>in</strong><br />

Value at <strong>the</strong> scope <strong>of</strong> O<strong>the</strong>r Value at<br />

(<strong>in</strong> millions <strong>of</strong> euros) 12/31/2002 Revaluations Writedowns consolidation changes 6/30/<strong>2003</strong><br />

Investments 3,962 57 (64) 37 61 4,053<br />

Dur<strong>in</strong>g <strong>the</strong> first half <strong>of</strong> <strong>2003</strong>, <strong>the</strong> item Investments <strong>in</strong>creased by 91 million euros compared to December 31, 2002.<br />

At June 30, <strong>2003</strong>, <strong>the</strong> value <strong>of</strong> <strong>in</strong>vestments totaled 4,053 million euros (3,962 million euros at December 31, 2002) and <strong>in</strong>cluded,<br />

among o<strong>the</strong>rs, <strong>the</strong> follow<strong>in</strong>g <strong>in</strong>vestments (<strong>in</strong> millions <strong>of</strong> euros):<br />

❚ Investments <strong>in</strong> unconsolidated subsidiaries: BUC – Banca Unione di Credito 338 (361 at December 31, 2002); Leasys S.p.A. 100<br />

(112 at December 31, 2002);<br />

❚ Investments <strong>in</strong> associated companies: Fiat-GM Powertra<strong>in</strong> B.V. 1,241 (1,189 at December 31, 2002), Italenergia Bis S.p.A. 516<br />

(481 at December 31, 2002), Fidis Retail Italia S.p.A. 375 (at December 31, 2002, <strong>the</strong> activities controlled by <strong>the</strong> latter were<br />

consolidated on a l<strong>in</strong>e-by-l<strong>in</strong>e basis), T<strong>of</strong>as Turk Otomobil Fabrikasi A.S. 157 (136 at December 31, 2002), Sevel S.p.A. 122 (125 at