in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

44 Fiat Group Consolidated F<strong>in</strong>ancial Statements and Notes at June 30, <strong>2003</strong><br />

F<strong>in</strong>ancial accrued expenses and deferred <strong>in</strong>come <strong>in</strong>clude <strong>in</strong>terest expenses on f<strong>in</strong>ancial payables for <strong>the</strong> part attributable to <strong>the</strong> first<br />

six months <strong>of</strong> <strong>2003</strong>, and deferred <strong>in</strong>terest <strong>in</strong>come on <strong>the</strong> receivables portfolio <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial services companies. The 700 million<br />

euro decrease with respect to December 31, 2002 <strong>in</strong>cludes -521 million euros stemm<strong>in</strong>g from deconsolidation <strong>of</strong> <strong>the</strong> Brazilian<br />

f<strong>in</strong>anc<strong>in</strong>g companies and Fidis Retail Italia S.p.A.<br />

12 Memorandum accounts<br />

Guarantees granted<br />

At June 30, <strong>2003</strong>, <strong>the</strong> Group had provided guarantees total<strong>in</strong>g 7,175 million euros (5,642 million euros at December 31, 2002), most<br />

<strong>of</strong> which are to guarantee <strong>the</strong> successful completion <strong>of</strong> contracts and projects <strong>in</strong> progress.<br />

Suretyships totaled 3,342 million euros at June 30, <strong>2003</strong> (1,638 million euros at December 31, 2002). The 1,704 million euro <strong>in</strong>crease<br />

stems ma<strong>in</strong>ly from deconsolidation <strong>of</strong> <strong>the</strong> activities <strong>of</strong> Fidis Retail Italia and consequently <strong>the</strong> <strong>in</strong>clusion <strong>in</strong> <strong>the</strong> Consolidated F<strong>in</strong>ancial<br />

Statements <strong>of</strong> <strong>the</strong> suretyships (1,252 million euros) secur<strong>in</strong>g <strong>the</strong> Sava Notes granted <strong>in</strong> favor <strong>of</strong> Fiat Sava, which were previously<br />

elim<strong>in</strong>ated as <strong>in</strong>tercompany relationships.<br />

O<strong>the</strong>r Unsecured guarantees <strong>in</strong>clude commitments for receivables and bills discounted with recourse total<strong>in</strong>g 2,311 million euros<br />

(2,518 million euros at December 31, 2002), which refer to trade receivables and o<strong>the</strong>r receivables for 2,295 million euros (2,505<br />

million euros at December 31, 2002) and f<strong>in</strong>ancial receivables for 16 million euros (13 million euros at December 31, 2002). The<br />

volume <strong>of</strong> receivables and bills discounted with recourse dur<strong>in</strong>g <strong>the</strong> first half <strong>of</strong> <strong>2003</strong> was 8,544 million euros (20,743 million euros<br />

<strong>in</strong> fiscal 2002).<br />

Although not <strong>in</strong>cluded <strong>in</strong> <strong>the</strong> Memorandum accounts, <strong>the</strong> Group discounted receivables and bills without recourse hav<strong>in</strong>g due<br />

dates beyond June 30, <strong>2003</strong> amount<strong>in</strong>g to 9,879 million euros (13,794 million euros at December 31, 2002, with due dates beyond<br />

that date), and refer to trade receivables and o<strong>the</strong>r receivables for 4,081 million euros (4,537 million euros at December 31, 2002)<br />

and f<strong>in</strong>ancial receivables for 5,798 million euros (9,257 million euros at December 31, 2002). The discount<strong>in</strong>g <strong>of</strong> f<strong>in</strong>ancial receivables<br />

pr<strong>in</strong>cipally refers to securitization transactions <strong>in</strong>volv<strong>in</strong>g accounts receivable from <strong>the</strong> end (retail) customers <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial services<br />

companies. The volume <strong>of</strong> receivables and bills discounted without recourse dur<strong>in</strong>g <strong>the</strong> first six months <strong>of</strong> <strong>2003</strong> was 15,873 million<br />

euros (30,502 million euros <strong>in</strong> fiscal 2002).<br />

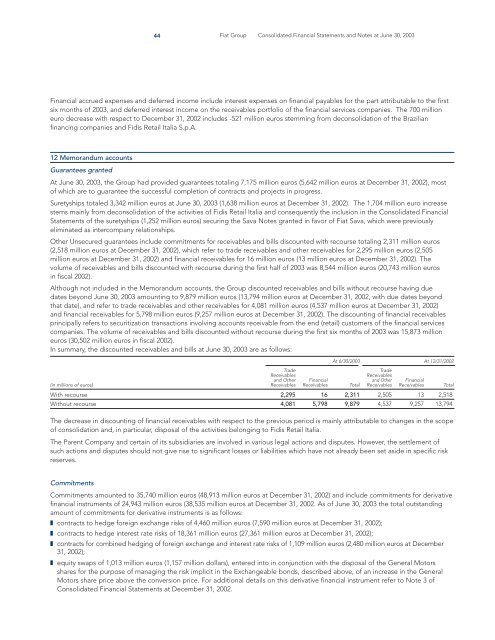

In summary, <strong>the</strong> discounted receivables and bills at June 30, <strong>2003</strong> are as follows:<br />

At 6/30/<strong>2003</strong> At 12/31/2002<br />

Trade Trade<br />

(<strong>in</strong> millions <strong>of</strong> euros)<br />

Receivables<br />

and O<strong>the</strong>r<br />

Receivables<br />

F<strong>in</strong>ancial<br />

Receivables Total<br />

Receivables<br />

and O<strong>the</strong>r<br />

Receivables<br />

F<strong>in</strong>ancial<br />

Receivables Total<br />

With recourse 2,295 16 2,311 2,505 13 2,518<br />

Without recourse 4,081 5,798 9,879 4,537 9,257 13,794<br />

The decrease <strong>in</strong> discount<strong>in</strong>g <strong>of</strong> f<strong>in</strong>ancial receivables with respect to <strong>the</strong> previous period is ma<strong>in</strong>ly attributable to changes <strong>in</strong> <strong>the</strong> scope<br />

<strong>of</strong> consolidation and, <strong>in</strong> particular, disposal <strong>of</strong> <strong>the</strong> activities belong<strong>in</strong>g to Fidis Retail Italia.<br />

The Parent Company and certa<strong>in</strong> <strong>of</strong> its subsidiaries are <strong>in</strong>volved <strong>in</strong> various legal actions and disputes. However, <strong>the</strong> settlement <strong>of</strong><br />

such actions and disputes should not give rise to significant losses or liabilities which have not already been set aside <strong>in</strong> specific risk<br />

reserves.<br />

Commitments<br />

Commitments amounted to 35,740 million euros (48,913 million euros at December 31, 2002) and <strong>in</strong>clude commitments for derivative<br />

f<strong>in</strong>ancial <strong>in</strong>struments <strong>of</strong> 24,943 million euros (38,535 million euros at December 31, 2002. As <strong>of</strong> June 30, <strong>2003</strong> <strong>the</strong> total outstand<strong>in</strong>g<br />

amount <strong>of</strong> commitments for derivative <strong>in</strong>struments is as follows:<br />

❚ contracts to hedge foreign exchange risks <strong>of</strong> 4,460 million euros (7,590 million euros at December 31, 2002);<br />

❚ contracts to hedge <strong>in</strong>terest rate risks <strong>of</strong> 18,361 million euros (27,361 million euros at December 31, 2002);<br />

❚ contracts for comb<strong>in</strong>ed hedg<strong>in</strong>g <strong>of</strong> foreign exchange and <strong>in</strong>terest rate risks <strong>of</strong> 1,109 million euros (2,480 million euros at December<br />

31, 2002);<br />

❚ equity swaps <strong>of</strong> 1,013 million euros (1,157 million dollars), entered <strong>in</strong>to <strong>in</strong> conjunction with <strong>the</strong> disposal <strong>of</strong> <strong>the</strong> General Motors<br />

shares for <strong>the</strong> purpose <strong>of</strong> manag<strong>in</strong>g <strong>the</strong> risk implicit <strong>in</strong> <strong>the</strong> Exchangeable bonds, described above, <strong>of</strong> an <strong>in</strong>crease <strong>in</strong> <strong>the</strong> General<br />

Motors share price above <strong>the</strong> conversion price. For additional details on this derivative f<strong>in</strong>ancial <strong>in</strong>strument refer to Note 3 <strong>of</strong><br />

Consolidated F<strong>in</strong>ancial Statements at December 31, 2002.