in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

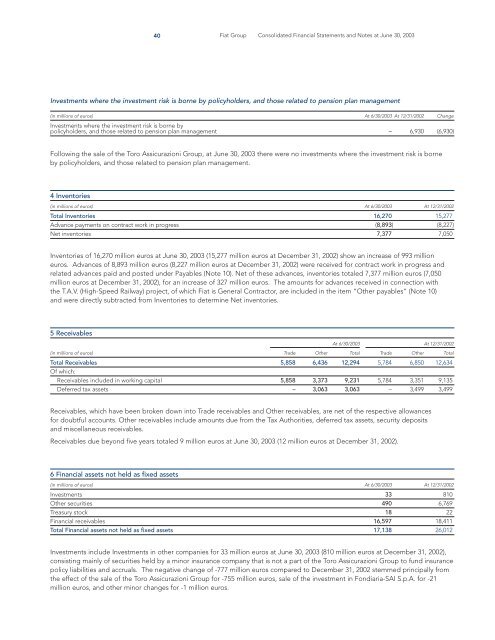

Investments where <strong>the</strong> <strong>in</strong>vestment risk is borne by policyholders, and those related to pension plan management<br />

(<strong>in</strong> millions <strong>of</strong> euros) At 6/30/<strong>2003</strong> At 12/31/2002 Change<br />

Investments where <strong>the</strong> <strong>in</strong>vestment risk is borne by<br />

policyholders, and those related to pension plan management – 6,930 (6,930)<br />

Follow<strong>in</strong>g <strong>the</strong> sale <strong>of</strong> <strong>the</strong> Toro Assicurazioni Group, at June 30, <strong>2003</strong> <strong>the</strong>re were no <strong>in</strong>vestments where <strong>the</strong> <strong>in</strong>vestment risk is borne<br />

by policyholders, and those related to pension plan management.<br />

4 Inventories<br />

(<strong>in</strong> millions <strong>of</strong> euros) At 6/30/<strong>2003</strong> At 12/31/2002<br />

Total Inventories 16,270 15,277<br />

Advance payments on contract work <strong>in</strong> progress (8,893) (8,227)<br />

Net <strong>in</strong>ventories 7,377 7,050<br />

Inventories <strong>of</strong> 16,270 million euros at June 30, <strong>2003</strong> (15,277 million euros at December 31, 2002) show an <strong>in</strong>crease <strong>of</strong> 993 million<br />

euros. Advances <strong>of</strong> 8,893 million euros (8,227 million euros at December 31, 2002) were received for contract work <strong>in</strong> progress and<br />

related advances paid and posted under Payables (Note 10). Net <strong>of</strong> <strong>the</strong>se advances, <strong>in</strong>ventories totaled 7,377 million euros (7,050<br />

million euros at December 31, 2002), for an <strong>in</strong>crease <strong>of</strong> 327 million euros. The amounts for advances received <strong>in</strong> connection with<br />

<strong>the</strong> T.A.V. (High-Speed Railway) project, <strong>of</strong> which Fiat is General Contractor, are <strong>in</strong>cluded <strong>in</strong> <strong>the</strong> item “O<strong>the</strong>r payables” (Note 10)<br />

and were directly subtracted from Inventories to determ<strong>in</strong>e Net <strong>in</strong>ventories.<br />

5 Receivables<br />

At 6/30/<strong>2003</strong> At 12/31/2002<br />

(<strong>in</strong> millions <strong>of</strong> euros) Trade O<strong>the</strong>r Total Trade O<strong>the</strong>r Total<br />

Total Receivables 5,858 6,436 12,294 5,784 6,850 12,634<br />

Of which:<br />

Receivables <strong>in</strong>cluded <strong>in</strong> work<strong>in</strong>g capital 5,858 3,373 9,231 5,784 3,351 9,135<br />

Deferred tax assets – 3,063 3,063 – 3,499 3,499<br />

Receivables, which have been broken down <strong>in</strong>to Trade receivables and O<strong>the</strong>r receivables, are net <strong>of</strong> <strong>the</strong> respective allowances<br />

for doubtful accounts. O<strong>the</strong>r receivables <strong>in</strong>clude amounts due from <strong>the</strong> Tax Authorities, deferred tax assets, security deposits<br />

and miscellaneous receivables.<br />

Receivables due beyond five years totaled 9 million euros at June 30, <strong>2003</strong> (12 million euros at December 31, 2002).<br />

6 F<strong>in</strong>ancial assets not held as fixed assets<br />

40 Fiat Group Consolidated F<strong>in</strong>ancial Statements and Notes at June 30, <strong>2003</strong><br />

(<strong>in</strong> millions <strong>of</strong> euros) At 6/30/<strong>2003</strong> At 12/31/2002<br />

Investments 33 810<br />

O<strong>the</strong>r securities 490 6,769<br />

Treasury stock 18 22<br />

F<strong>in</strong>ancial receivables 16,597 18,411<br />

Total F<strong>in</strong>ancial assets not held as fixed assets 17,138 26,012<br />

Investments <strong>in</strong>clude Investments <strong>in</strong> o<strong>the</strong>r companies for 33 million euros at June 30, <strong>2003</strong> (810 million euros at December 31, 2002),<br />

consist<strong>in</strong>g ma<strong>in</strong>ly <strong>of</strong> securities held by a m<strong>in</strong>or <strong>in</strong>surance company that is not a part <strong>of</strong> <strong>the</strong> Toro Assicurazioni Group to fund <strong>in</strong>surance<br />

policy liabilities and accruals. The negative change <strong>of</strong> -777 million euros compared to December 31, 2002 stemmed pr<strong>in</strong>cipally from<br />

<strong>the</strong> effect <strong>of</strong> <strong>the</strong> sale <strong>of</strong> <strong>the</strong> Toro Assicurazioni Group for -755 million euros, sale <strong>of</strong> <strong>the</strong> <strong>in</strong>vestment <strong>in</strong> Fondiaria-SAI S.p.A. for -21<br />

million euros, and o<strong>the</strong>r m<strong>in</strong>or changes for -1 million euros.