in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

euros, change <strong>in</strong> <strong>the</strong> scope <strong>of</strong> consolidation for -26 million euros, and 84 million euros from application <strong>of</strong> deferred tax assets posted<br />

on <strong>the</strong> basis <strong>of</strong> tax losses through a carry back <strong>of</strong> taxes paid <strong>in</strong> previous fiscal years.<br />

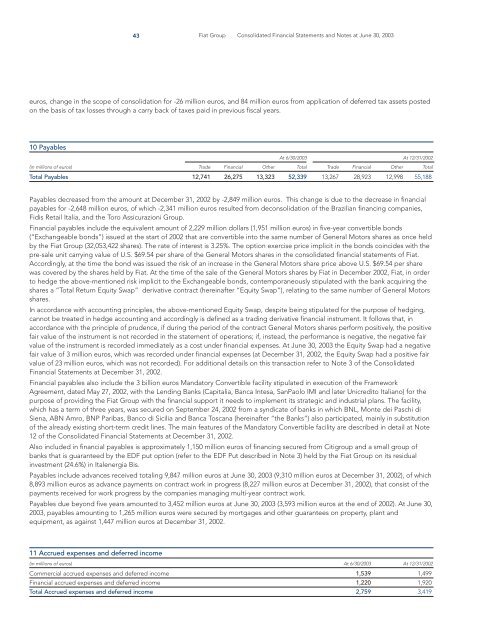

10 Payables<br />

At 6/30/<strong>2003</strong> At 12/31/2002<br />

(<strong>in</strong> millions <strong>of</strong> euros) Trade F<strong>in</strong>ancial O<strong>the</strong>r Total Trade F<strong>in</strong>ancial O<strong>the</strong>r Total<br />

Total Payables 12,741 26,275 13,323 52,339 13,267 28,923 12,998 55,188<br />

Payables decreased from <strong>the</strong> amount at December 31, 2002 by -2,849 million euros. This change is due to <strong>the</strong> decrease <strong>in</strong> f<strong>in</strong>ancial<br />

payables for -2,648 million euros, <strong>of</strong> which -2,341 million euros resulted from deconsolidation <strong>of</strong> <strong>the</strong> Brazilian f<strong>in</strong>anc<strong>in</strong>g companies,<br />

Fidis Retail Italia, and <strong>the</strong> Toro Assicurazioni Group.<br />

F<strong>in</strong>ancial payables <strong>in</strong>clude <strong>the</strong> equivalent amount <strong>of</strong> 2,229 million dollars (1,951 million euros) <strong>in</strong> five-year convertible bonds<br />

(“Exchangeable bonds”) issued at <strong>the</strong> start <strong>of</strong> 2002 that are convertible <strong>in</strong>to <strong>the</strong> same number <strong>of</strong> General Motors shares as once held<br />

by <strong>the</strong> Fiat Group (32,053,422 shares). The rate <strong>of</strong> <strong>in</strong>terest is 3.25%. The option exercise price implicit <strong>in</strong> <strong>the</strong> bonds co<strong>in</strong>cides with <strong>the</strong><br />

pre-sale unit carry<strong>in</strong>g value <strong>of</strong> U.S. $69.54 per share <strong>of</strong> <strong>the</strong> General Motors shares <strong>in</strong> <strong>the</strong> consolidated f<strong>in</strong>ancial statements <strong>of</strong> Fiat.<br />

Accord<strong>in</strong>gly, at <strong>the</strong> time <strong>the</strong> bond was issued <strong>the</strong> risk <strong>of</strong> an <strong>in</strong>crease <strong>in</strong> <strong>the</strong> General Motors share price above U.S. $69.54 per share<br />

was covered by <strong>the</strong> shares held by Fiat. At <strong>the</strong> time <strong>of</strong> <strong>the</strong> sale <strong>of</strong> <strong>the</strong> General Motors shares by Fiat <strong>in</strong> December 2002, Fiat, <strong>in</strong> order<br />

to hedge <strong>the</strong> above-mentioned risk implicit to <strong>the</strong> Exchangeable bonds, contemporaneously stipulated with <strong>the</strong> bank acquir<strong>in</strong>g <strong>the</strong><br />

shares a “Total Return Equity Swap” derivative contract (here<strong>in</strong>after “Equity Swap”), relat<strong>in</strong>g to <strong>the</strong> same number <strong>of</strong> General Motors<br />

shares.<br />

In accordance with account<strong>in</strong>g pr<strong>in</strong>ciples, <strong>the</strong> above-mentioned Equity Swap, despite be<strong>in</strong>g stipulated for <strong>the</strong> purpose <strong>of</strong> hedg<strong>in</strong>g,<br />

cannot be treated <strong>in</strong> hedge account<strong>in</strong>g and accord<strong>in</strong>gly is def<strong>in</strong>ed as a trad<strong>in</strong>g derivative f<strong>in</strong>ancial <strong>in</strong>strument. It follows that, <strong>in</strong><br />

accordance with <strong>the</strong> pr<strong>in</strong>ciple <strong>of</strong> prudence, if dur<strong>in</strong>g <strong>the</strong> period <strong>of</strong> <strong>the</strong> contract General Motors shares perform positively, <strong>the</strong> positive<br />

fair value <strong>of</strong> <strong>the</strong> <strong>in</strong>strument is not recorded <strong>in</strong> <strong>the</strong> statement <strong>of</strong> operations; if, <strong>in</strong>stead, <strong>the</strong> performance is negative, <strong>the</strong> negative fair<br />

value <strong>of</strong> <strong>the</strong> <strong>in</strong>strument is recorded immediately as a cost under f<strong>in</strong>ancial expenses. At June 30, <strong>2003</strong> <strong>the</strong> Equity Swap had a negative<br />

fair value <strong>of</strong> 3 million euros, which was recorded under f<strong>in</strong>ancial expenses (at December 31, 2002, <strong>the</strong> Equity Swap had a positive fair<br />

value <strong>of</strong> 23 million euros, which was not recorded). For additional details on this transaction refer to Note 3 <strong>of</strong> <strong>the</strong> Consolidated<br />

F<strong>in</strong>ancial Statements at December 31, 2002.<br />

F<strong>in</strong>ancial payables also <strong>in</strong>clude <strong>the</strong> 3 billion euros Mandatory Convertible facility stipulated <strong>in</strong> execution <strong>of</strong> <strong>the</strong> Framework<br />

Agreement, dated May 27, 2002, with <strong>the</strong> Lend<strong>in</strong>g Banks (Capitalia, Banca Intesa, SanPaolo IMI and later Unicredito Italiano) for <strong>the</strong><br />

purpose <strong>of</strong> provid<strong>in</strong>g <strong>the</strong> Fiat Group with <strong>the</strong> f<strong>in</strong>ancial support it needs to implement its strategic and <strong>in</strong>dustrial plans. The facility,<br />

which has a term <strong>of</strong> three years, was secured on September 24, 2002 from a syndicate <strong>of</strong> banks <strong>in</strong> which BNL, Monte dei Paschi di<br />

Siena, ABN Amro, BNP Paribas, Banco di Sicilia and Banca Toscana (here<strong>in</strong>after “<strong>the</strong> Banks”) also participated, ma<strong>in</strong>ly <strong>in</strong> substitution<br />

<strong>of</strong> <strong>the</strong> already exist<strong>in</strong>g short-term credit l<strong>in</strong>es. The ma<strong>in</strong> features <strong>of</strong> <strong>the</strong> Mandatory Convertible facility are described <strong>in</strong> detail at Note<br />

12 <strong>of</strong> <strong>the</strong> Consolidated F<strong>in</strong>ancial Statements at December 31, 2002.<br />

Also <strong>in</strong>cluded <strong>in</strong> f<strong>in</strong>ancial payables is approximately 1,150 million euros <strong>of</strong> f<strong>in</strong>anc<strong>in</strong>g secured from Citigroup and a small group <strong>of</strong><br />

banks that is guaranteed by <strong>the</strong> EDF put option (refer to <strong>the</strong> EDF Put described <strong>in</strong> Note 3) held by <strong>the</strong> Fiat Group on its residual<br />

<strong>in</strong>vestment (24.6%) <strong>in</strong> Italenergia Bis.<br />

Payables <strong>in</strong>clude advances received total<strong>in</strong>g 9,847 million euros at June 30, <strong>2003</strong> (9,310 million euros at December 31, 2002), <strong>of</strong> which<br />

8,893 million euros as advance payments on contract work <strong>in</strong> progress (8,227 million euros at December 31, 2002), that consist <strong>of</strong> <strong>the</strong><br />

payments received for work progress by <strong>the</strong> companies manag<strong>in</strong>g multi-year contract work.<br />

Payables due beyond five years amounted to 3,452 million euros at June 30, <strong>2003</strong> (3,593 million euros at <strong>the</strong> end <strong>of</strong> 2002). At June 30,<br />

<strong>2003</strong>, payables amount<strong>in</strong>g to 1,265 million euros were secured by mortgages and o<strong>the</strong>r guarantees on property, plant and<br />

equipment, as aga<strong>in</strong>st 1,447 million euros at December 31, 2002.<br />

11 Accrued expenses and deferred <strong>in</strong>come<br />

43 Fiat Group Consolidated F<strong>in</strong>ancial Statements and Notes at June 30, <strong>2003</strong><br />

(<strong>in</strong> millions <strong>of</strong> euros) At 6/30/<strong>2003</strong> At 12/31/2002<br />

Commercial accrued expenses and deferred <strong>in</strong>come 1,539 1,499<br />

F<strong>in</strong>ancial accrued expenses and deferred <strong>in</strong>come 1,220 1,920<br />

Total Accrued expenses and deferred <strong>in</strong>come 2,759 3,419