in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Toro Assicurazioni (35 million euros; 79 million euros <strong>in</strong> <strong>the</strong> first<br />

half <strong>of</strong> 2002), five months for <strong>the</strong> Fidis Retail Italia activities (39<br />

million euros; 15 million euros <strong>in</strong> <strong>the</strong> first six months <strong>of</strong> 2002),<br />

<strong>the</strong> first quarter for <strong>the</strong> Brazilian retail f<strong>in</strong>anc<strong>in</strong>g operations <strong>of</strong><br />

Fiat Auto (7 million euros; 49 million euros <strong>in</strong> <strong>the</strong> first half <strong>of</strong><br />

2002), <strong>the</strong> entire first half for <strong>the</strong> foreign companies that will be<br />

sold to Fidis Retail Italia once <strong>the</strong> competent local authorities<br />

grant <strong>the</strong> necessary approval (42 million euros; 43 million euros<br />

<strong>in</strong> <strong>the</strong> correspond<strong>in</strong>g period <strong>of</strong> 2002). The contribution <strong>of</strong> IPI (16<br />

16 Operat<strong>in</strong>g Performance and F<strong>in</strong>ancial Position <strong>of</strong> <strong>the</strong> Fiat Group and Fiat S.p.A.<br />

<strong>in</strong> <strong>the</strong> <strong>First</strong> <strong>Half</strong> <strong>of</strong> <strong>2003</strong><br />

million euros) and Fraik<strong>in</strong> (10 million euros) was also <strong>in</strong>cluded<br />

<strong>in</strong> <strong>the</strong> first half <strong>of</strong> 2002.<br />

Cash and cash equivalents collected by <strong>the</strong> centralized treasury<br />

<strong>in</strong> <strong>the</strong> course <strong>of</strong> its activities have been recorded at <strong>the</strong> item<br />

“F<strong>in</strong>ancial payables net <strong>of</strong> <strong>in</strong>tersegment activities” <strong>in</strong> <strong>the</strong><br />

Industrial Activities column.<br />

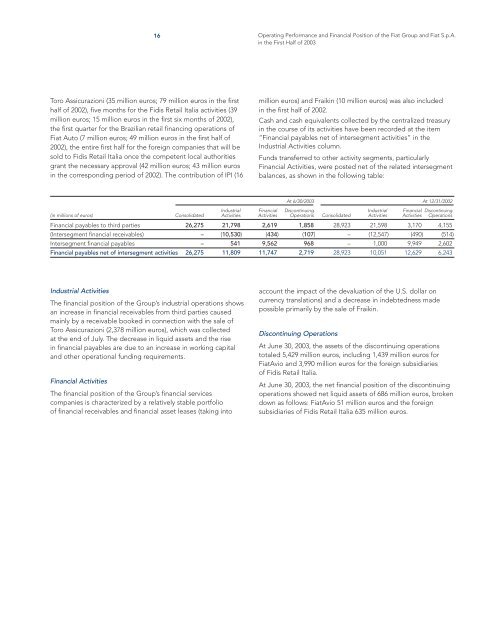

Funds transferred to o<strong>the</strong>r activity segments, particularly<br />

F<strong>in</strong>ancial Activities, were posted net <strong>of</strong> <strong>the</strong> related <strong>in</strong>tersegment<br />

balances, as shown <strong>in</strong> <strong>the</strong> follow<strong>in</strong>g table:<br />

At 6/30/<strong>2003</strong> At 12/31/2002<br />

(<strong>in</strong> millions <strong>of</strong> euros) Consolidated<br />

Industrial<br />

Activities<br />

F<strong>in</strong>ancial<br />

Activities<br />

Discont<strong>in</strong>u<strong>in</strong>g<br />

Operations Consolidated<br />

Industrial<br />

Activities<br />

F<strong>in</strong>ancial Discont<strong>in</strong>u<strong>in</strong>g<br />

Activities Operations<br />

F<strong>in</strong>ancial payables to third parties 26,275 21,798 2,619 1,858 28,923 21,598 3,170 4,155<br />

(Intersegment f<strong>in</strong>ancial receivables) – (10,530) (434) (107) – (12,547) (490) (514)<br />

Intersegment f<strong>in</strong>ancial payables – 541 9,562 968 – 1,000 9,949 2,602<br />

F<strong>in</strong>ancial payables net <strong>of</strong> <strong>in</strong>tersegment activities 26,275 11,809 11,747 2,719 28,923 10,051 12,629 6,243<br />

Industrial Activities<br />

The f<strong>in</strong>ancial position <strong>of</strong> <strong>the</strong> Group’s <strong>in</strong>dustrial operations shows<br />

an <strong>in</strong>crease <strong>in</strong> f<strong>in</strong>ancial receivables from third parties caused<br />

ma<strong>in</strong>ly by a receivable booked <strong>in</strong> connection with <strong>the</strong> sale <strong>of</strong><br />

Toro Assicurazioni (2,378 million euros), which was collected<br />

at <strong>the</strong> end <strong>of</strong> July. The decrease <strong>in</strong> liquid assets and <strong>the</strong> rise<br />

<strong>in</strong> f<strong>in</strong>ancial payables are due to an <strong>in</strong>crease <strong>in</strong> work<strong>in</strong>g capital<br />

and o<strong>the</strong>r operational fund<strong>in</strong>g requirements.<br />

F<strong>in</strong>ancial Activities<br />

The f<strong>in</strong>ancial position <strong>of</strong> <strong>the</strong> Group’s f<strong>in</strong>ancial services<br />

companies is characterized by a relatively stable portfolio<br />

<strong>of</strong> f<strong>in</strong>ancial receivables and f<strong>in</strong>ancial asset leases (tak<strong>in</strong>g <strong>in</strong>to<br />

account <strong>the</strong> impact <strong>of</strong> <strong>the</strong> devaluation <strong>of</strong> <strong>the</strong> U.S. dollar on<br />

currency translations) and a decrease <strong>in</strong> <strong>in</strong>debtedness made<br />

possible primarily by <strong>the</strong> sale <strong>of</strong> Fraik<strong>in</strong>.<br />

Discont<strong>in</strong>u<strong>in</strong>g Operations<br />

At June 30, <strong>2003</strong>, <strong>the</strong> assets <strong>of</strong> <strong>the</strong> discont<strong>in</strong>u<strong>in</strong>g operations<br />

totaled 5,429 million euros, <strong>in</strong>clud<strong>in</strong>g 1,439 million euros for<br />

FiatAvio and 3,990 million euros for <strong>the</strong> foreign subsidiaries<br />

<strong>of</strong> Fidis Retail Italia.<br />

At June 30, <strong>2003</strong>, <strong>the</strong> net f<strong>in</strong>ancial position <strong>of</strong> <strong>the</strong> discont<strong>in</strong>u<strong>in</strong>g<br />

operations showed net liquid assets <strong>of</strong> 686 million euros, broken<br />

down as follows: FiatAvio 51 million euros and <strong>the</strong> foreign<br />

subsidiaries <strong>of</strong> Fidis Retail Italia 635 million euros.