in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

O<strong>the</strong>r securities at June 30, <strong>2003</strong> <strong>in</strong>clude securities held by <strong>the</strong> same company to fund <strong>in</strong>surance policy liabilities and accruals as well.<br />

The decrease <strong>of</strong> -6,279 million euros compared to December 31, 2002 was largely due to deconsolidation <strong>of</strong> <strong>the</strong> Toro Assicurazioni<br />

Group.<br />

Treasury stock consists <strong>of</strong> 2,598,241 Fiat ord<strong>in</strong>ary shares held by Fiat S.p.A. and Fiat Ge.Va. S.p.A. with a total par value <strong>of</strong> 18 million<br />

euros, net <strong>of</strong> writedowns recorded dur<strong>in</strong>g <strong>the</strong> first half total<strong>in</strong>g 4 million euros.<br />

F<strong>in</strong>ancial receivables at June 30, <strong>2003</strong> totaled 16,597 million euros (18,411 million euros at December 31, 2002) and consist <strong>of</strong>: loans<br />

granted to customers and dealers by <strong>the</strong> f<strong>in</strong>ancial services companies for 11,129 million euros (15,615 million euros at December 2002);<br />

<strong>the</strong> f<strong>in</strong>ancial receivable <strong>of</strong> 2,378 million euros connected with <strong>the</strong> sale <strong>of</strong> <strong>the</strong> Toro Assicurazioni Group (which was collected on July 30,<br />

<strong>2003</strong>); and o<strong>the</strong>r f<strong>in</strong>ancial receivables <strong>of</strong> 3,090 million euros (2,796 million euros at December 31, 2002) refer ma<strong>in</strong>ly to receivables from<br />

jo<strong>in</strong>t ventures and from companies engaged <strong>in</strong> <strong>the</strong> real estate bus<strong>in</strong>ess and <strong>in</strong> <strong>the</strong> spare parts distribution bus<strong>in</strong>ess. The decrease<br />

<strong>of</strong> - 4,486 million euros s<strong>in</strong>ce December 31, 2002 <strong>in</strong> loans granted by <strong>the</strong> f<strong>in</strong>ancial services companies consists <strong>of</strong> -3,733 million euros<br />

from deconsolidation <strong>of</strong> <strong>the</strong> retail f<strong>in</strong>anc<strong>in</strong>g activity <strong>in</strong> Brazil and <strong>the</strong> activities <strong>of</strong> Fidis Retail Italia S.p.A., -231 million euros for <strong>the</strong><br />

performance <strong>of</strong> currencies, and -522 million euros from lower volumes <strong>of</strong> activity. The 294-million-euro <strong>in</strong>crease <strong>in</strong> <strong>the</strong> o<strong>the</strong>r f<strong>in</strong>ancial<br />

receivables refers ma<strong>in</strong>ly to <strong>the</strong> higher levels <strong>of</strong> disbursed f<strong>in</strong>anc<strong>in</strong>g.<br />

Receivables due beyond five years amounted to 252 million euros at June 30, <strong>2003</strong> (935 million euros at December 31, 2002).<br />

The decrease <strong>of</strong> -683 million euros is largely accounted for by <strong>the</strong> deconsolidation <strong>of</strong> Fidis Retail Italia S.p.A.<br />

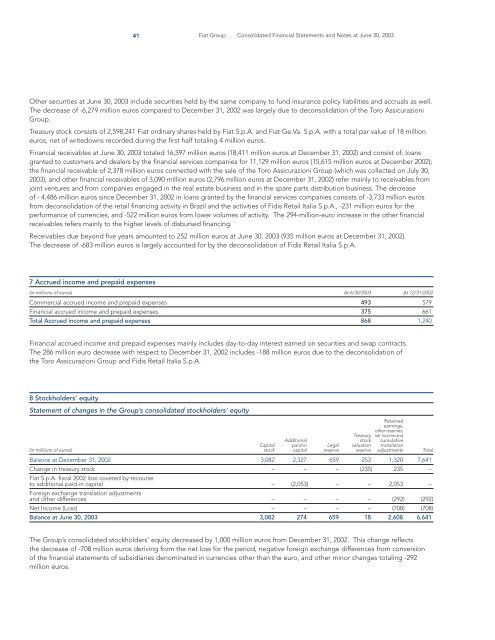

7 Accrued <strong>in</strong>come and prepaid expenses<br />

41 Fiat Group Consolidated F<strong>in</strong>ancial Statements and Notes at June 30, <strong>2003</strong><br />

(<strong>in</strong> millions <strong>of</strong> euros) At 6/30/<strong>2003</strong> At 12/31/2002<br />

Commercial accrued <strong>in</strong>come and prepaid expenses 493 579<br />

F<strong>in</strong>ancial accrued <strong>in</strong>come and prepaid expenses 375 661<br />

Total Accrued <strong>in</strong>come and prepaid expenses 868 1,240<br />

F<strong>in</strong>ancial accrued <strong>in</strong>come and prepaid expenses ma<strong>in</strong>ly <strong>in</strong>cludes day-to-day <strong>in</strong>terest earned on securities and swap contracts.<br />

The 286 million euro decrease with respect to December 31, 2002 <strong>in</strong>cludes -188 million euros due to <strong>the</strong> deconsolidation <strong>of</strong><br />

<strong>the</strong> Toro Assicurazioni Group and Fidis Retail Italia S.p.A.<br />

8 Stockholders’ equity<br />

Statement <strong>of</strong> changes <strong>in</strong> <strong>the</strong> Group’s consolidated stockholders’ equity<br />

Reta<strong>in</strong>ed<br />

earn<strong>in</strong>gs,<br />

o<strong>the</strong>r reserves,<br />

Treasury net <strong>in</strong>come and<br />

Additional stock cumulative<br />

Capital paid-<strong>in</strong> Legal valuation translation<br />

(<strong>in</strong> millions <strong>of</strong> euros) stock capital reserve reserve adjustments Total<br />

Balance at December 31, 2002 3,082 2,327 659 253 1,320 7,641<br />

Change <strong>in</strong> treasury stock – – – (235) 235 –<br />

Fiat S.p.A. fiscal 2002 loss covered by recourse<br />

to additional paid-<strong>in</strong> capital – (2,053) – – 2,053 –<br />

Foreign exchange translation adjustments<br />

and o<strong>the</strong>r differences – – – – (292) (292)<br />

Net Income (Loss) – – – – (708) (708)<br />

Balance at June 30, <strong>2003</strong> 3,082 274 659 18 2,608 6,641<br />

The Group’s consolidated stockholders’ equity decreased by 1,000 million euros from December 31, 2002. This change reflects<br />

<strong>the</strong> decrease <strong>of</strong> -708 million euros deriv<strong>in</strong>g from <strong>the</strong> net loss for <strong>the</strong> period, negative foreign exchange differences from conversion<br />

<strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial statements <strong>of</strong> subsidiaries denom<strong>in</strong>ated <strong>in</strong> currencies o<strong>the</strong>r than <strong>the</strong> euro, and o<strong>the</strong>r m<strong>in</strong>or changes total<strong>in</strong>g -292<br />

million euros.