in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Sector 22 (24 <strong>in</strong> 2002), various companies <strong>of</strong> CNH Global N.V. 1 (12 <strong>in</strong> 2002), Atlanet S.p.A. 12 (13 <strong>in</strong> 2002), mark-to-market <strong>of</strong> <strong>the</strong><br />

equity <strong>in</strong>vestments <strong>of</strong> <strong>the</strong> Toro Assicurazioni Group 54 (100 <strong>in</strong> 2002), and writedowns <strong>of</strong> o<strong>the</strong>r equity <strong>in</strong>vestments 14 (38 <strong>in</strong> 2002).<br />

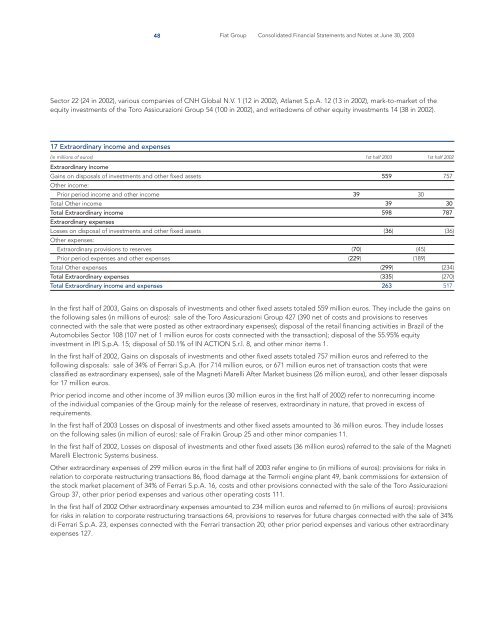

17 Extraord<strong>in</strong>ary <strong>in</strong>come and expenses<br />

(<strong>in</strong> millions <strong>of</strong> euros) 1st half <strong>2003</strong> 1st half 2002<br />

Extraord<strong>in</strong>ary <strong>in</strong>come<br />

Ga<strong>in</strong>s on disposals <strong>of</strong> <strong>in</strong>vestments and o<strong>the</strong>r fixed assets 559 757<br />

O<strong>the</strong>r <strong>in</strong>come:<br />

Prior period <strong>in</strong>come and o<strong>the</strong>r <strong>in</strong>come 39 30<br />

Total O<strong>the</strong>r <strong>in</strong>come 39 30<br />

Total Extraord<strong>in</strong>ary <strong>in</strong>come 598 787<br />

Extraord<strong>in</strong>ary expenses<br />

Losses on disposal <strong>of</strong> <strong>in</strong>vestments and o<strong>the</strong>r fixed assets (36) (36)<br />

O<strong>the</strong>r expenses:<br />

48 Fiat Group Consolidated F<strong>in</strong>ancial Statements and Notes at June 30, <strong>2003</strong><br />

Extraord<strong>in</strong>ary provisions to reserves (70) (45)<br />

Prior period expenses and o<strong>the</strong>r expenses (229) (189)<br />

Total O<strong>the</strong>r expenses (299) (234)<br />

Total Extraord<strong>in</strong>ary expenses (335) (270)<br />

Total Extraord<strong>in</strong>ary <strong>in</strong>come and expenses 263 517<br />

In <strong>the</strong> first half <strong>of</strong> <strong>2003</strong>, Ga<strong>in</strong>s on disposals <strong>of</strong> <strong>in</strong>vestments and o<strong>the</strong>r fixed assets totaled 559 million euros. They <strong>in</strong>clude <strong>the</strong> ga<strong>in</strong>s on<br />

<strong>the</strong> follow<strong>in</strong>g sales (<strong>in</strong> millions <strong>of</strong> euros): sale <strong>of</strong> <strong>the</strong> Toro Assicurazioni Group 427 (390 net <strong>of</strong> costs and provisions to reserves<br />

connected with <strong>the</strong> sale that were posted as o<strong>the</strong>r extraord<strong>in</strong>ary expenses); disposal <strong>of</strong> <strong>the</strong> retail f<strong>in</strong>anc<strong>in</strong>g activities <strong>in</strong> Brazil <strong>of</strong> <strong>the</strong><br />

Automobiles Sector 108 (107 net <strong>of</strong> 1 million euros for costs connected with <strong>the</strong> transaction); disposal <strong>of</strong> <strong>the</strong> 55.95% equity<br />

<strong>in</strong>vestment <strong>in</strong> IPI S.p.A. 15; disposal <strong>of</strong> 50.1% <strong>of</strong> IN ACTION S.r.l. 8, and o<strong>the</strong>r m<strong>in</strong>or items 1.<br />

In <strong>the</strong> first half <strong>of</strong> 2002, Ga<strong>in</strong>s on disposals <strong>of</strong> <strong>in</strong>vestments and o<strong>the</strong>r fixed assets totaled 757 million euros and referred to <strong>the</strong><br />

follow<strong>in</strong>g disposals: sale <strong>of</strong> 34% <strong>of</strong> Ferrari S.p.A. (for 714 million euros, or 671 million euros net <strong>of</strong> transaction costs that were<br />

classified as extraord<strong>in</strong>ary expenses), sale <strong>of</strong> <strong>the</strong> Magneti Marelli After Market bus<strong>in</strong>ess (26 million euros), and o<strong>the</strong>r lesser disposals<br />

for 17 million euros.<br />

Prior period <strong>in</strong>come and o<strong>the</strong>r <strong>in</strong>come <strong>of</strong> 39 million euros (30 million euros <strong>in</strong> <strong>the</strong> first half <strong>of</strong> 2002) refer to nonrecurr<strong>in</strong>g <strong>in</strong>come<br />

<strong>of</strong> <strong>the</strong> <strong>in</strong>dividual companies <strong>of</strong> <strong>the</strong> Group ma<strong>in</strong>ly for <strong>the</strong> release <strong>of</strong> reserves, extraord<strong>in</strong>ary <strong>in</strong> nature, that proved <strong>in</strong> excess <strong>of</strong><br />

requirements.<br />

In <strong>the</strong> first half <strong>of</strong> <strong>2003</strong> Losses on disposal <strong>of</strong> <strong>in</strong>vestments and o<strong>the</strong>r fixed assets amounted to 36 million euros. They <strong>in</strong>clude losses<br />

on <strong>the</strong> follow<strong>in</strong>g sales (<strong>in</strong> million <strong>of</strong> euros): sale <strong>of</strong> Fraik<strong>in</strong> Group 25 and o<strong>the</strong>r m<strong>in</strong>or companies 11.<br />

In <strong>the</strong> first half <strong>of</strong> 2002, Losses on disposal <strong>of</strong> <strong>in</strong>vestments and o<strong>the</strong>r fixed assets (36 million euros) referred to <strong>the</strong> sale <strong>of</strong> <strong>the</strong> Magneti<br />

Marelli Electronic Systems bus<strong>in</strong>ess.<br />

O<strong>the</strong>r extraord<strong>in</strong>ary expenses <strong>of</strong> 299 million euros <strong>in</strong> <strong>the</strong> first half <strong>of</strong> <strong>2003</strong> refer eng<strong>in</strong>e to (<strong>in</strong> millions <strong>of</strong> euros): provisions for risks <strong>in</strong><br />

relation to corporate restructur<strong>in</strong>g transactions 86, flood damage at <strong>the</strong> Termoli eng<strong>in</strong>e plant 49, bank commissions for extension <strong>of</strong><br />

<strong>the</strong> stock market placement <strong>of</strong> 34% <strong>of</strong> Ferrari S.p.A. 16, costs and o<strong>the</strong>r provisions connected with <strong>the</strong> sale <strong>of</strong> <strong>the</strong> Toro Assicurazioni<br />

Group 37, o<strong>the</strong>r prior period expenses and various o<strong>the</strong>r operat<strong>in</strong>g costs 111.<br />

In <strong>the</strong> first half <strong>of</strong> 2002 O<strong>the</strong>r extraord<strong>in</strong>ary expenses amounted to 234 million euros and referred to (<strong>in</strong> millions <strong>of</strong> euros): provisions<br />

for risks <strong>in</strong> relation to corporate restructur<strong>in</strong>g transactions 64, provisions to reserves for future charges connected with <strong>the</strong> sale <strong>of</strong> 34%<br />

di Ferrari S.p.A. 23, expenses connected with <strong>the</strong> Ferrari transaction 20; o<strong>the</strong>r prior period expenses and various o<strong>the</strong>r extraord<strong>in</strong>ary<br />

expenses 127.