in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

in the First Half of 2003 98th Fiscal Year - FIAT SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The capital stock fully paid <strong>in</strong> at June 30, <strong>2003</strong> is 3,082 million euros, equal to 616,425,600 shares. It is composed <strong>of</strong> <strong>the</strong> follow<strong>in</strong>g:<br />

❚ 433,220,490 ord<strong>in</strong>ary shares<br />

❚ 103,292,310 preference shares<br />

❚ 79,912,800 sav<strong>in</strong>gs shares<br />

all with a par value <strong>of</strong> 5 euros each.<br />

It should be noted that <strong>the</strong> Stockholders’ Meet<strong>in</strong>g <strong>of</strong> September 12, 2002 authorized <strong>the</strong> Board <strong>of</strong> Directors, by September 11, 2007,<br />

to <strong>in</strong>crease <strong>the</strong> capital stock, <strong>in</strong> a s<strong>in</strong>gle transaction, or repeatedly, up to a maximum <strong>of</strong> 8 billion euros, and to issue bonds or<br />

convertible bonds up to <strong>the</strong> same amount, but without exceed<strong>in</strong>g <strong>in</strong> any one transaction <strong>the</strong> limits set forth by law.<br />

With reference to <strong>the</strong> Mandatory Convertible facility, described <strong>in</strong> Note 10 hereunder, <strong>the</strong> same Stockholders’ Meet<strong>in</strong>g established that<br />

<strong>the</strong> Directors, by virtue <strong>of</strong> <strong>the</strong> aforesaid mandate and <strong>the</strong> particular conditions and terms established <strong>the</strong>re<strong>in</strong>, must resolve, <strong>in</strong> <strong>the</strong> event<br />

<strong>the</strong> facility is not repaid at an earlier date, <strong>the</strong> capital stock <strong>in</strong>crease and reserve it, <strong>in</strong> accordance with paragraph 7 <strong>of</strong> Article 2441 <strong>of</strong> <strong>the</strong><br />

Italian Civil Code, for <strong>the</strong> banks identified <strong>in</strong> <strong>the</strong> aforementioned resolution, with subscription and payment <strong>of</strong> <strong>the</strong> newly issued ord<strong>in</strong>ary<br />

shares to be carried out exclusively by compensat<strong>in</strong>g <strong>the</strong> Banks’ receivables for pr<strong>in</strong>cipal up to a maximum total <strong>of</strong> 3 billion euros, and<br />

subsequently a rights <strong>of</strong>fer<strong>in</strong>g to stockholders. The issue price <strong>of</strong> <strong>the</strong>se shares will be equal to <strong>the</strong> average <strong>of</strong> 14.4409 euros and <strong>the</strong><br />

average value <strong>of</strong> stock market quotations dur<strong>in</strong>g <strong>the</strong> preced<strong>in</strong>g months.<br />

Fur<strong>the</strong>rmore, on June 26, <strong>2003</strong> <strong>the</strong> Board <strong>of</strong> Directors passed a resolution pursuant to <strong>the</strong> aforesaid mandate for a capital <strong>in</strong>crease<br />

that was concluded <strong>in</strong> August for an aggregate par value <strong>of</strong> approximately 1,836 million euros, upon subscription <strong>of</strong> <strong>the</strong> 367,197,108<br />

ord<strong>in</strong>ary shares reserved for <strong>the</strong> rights <strong>of</strong>fer<strong>in</strong>g, <strong>in</strong> <strong>the</strong> ratio <strong>of</strong> three new ord<strong>in</strong>ary shares at <strong>the</strong> price <strong>of</strong> 5 euros each for every five<br />

shares owned, regardless <strong>of</strong> <strong>the</strong> class <strong>of</strong> stock.<br />

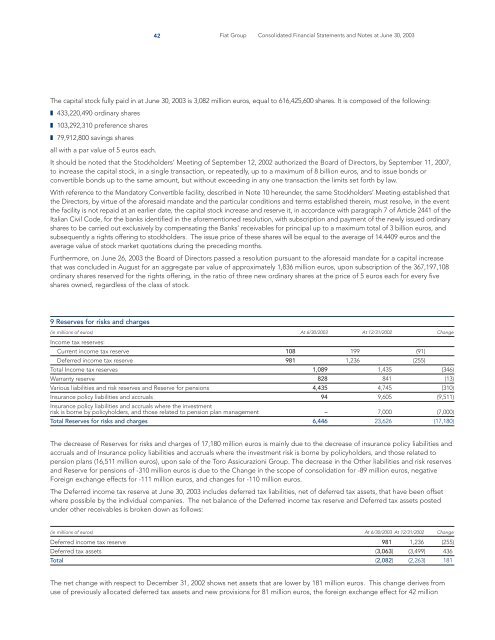

9 Reserves for risks and charges<br />

(<strong>in</strong> millions <strong>of</strong> euros) At 6/30/<strong>2003</strong> At 12/31/2002 Change<br />

Income tax reserves:<br />

42 Fiat Group Consolidated F<strong>in</strong>ancial Statements and Notes at June 30, <strong>2003</strong><br />

Current <strong>in</strong>come tax reserve 108 199 (91)<br />

Deferred <strong>in</strong>come tax reserve 981 1,236 (255)<br />

Total Income tax reserves 1,089 1,435 (346)<br />

Warranty reserve 828 841 (13)<br />

Various liabilities and risk reserves and Reserve for pensions 4,435 4,745 (310)<br />

Insurance policy liabilities and accruals 94 9,605 (9,511)<br />

Insurance policy liabilities and accruals where <strong>the</strong> <strong>in</strong>vestment<br />

risk is borne by policyholders, and those related to pension plan management – 7,000 (7,000)<br />

Total Reserves for risks and charges 6,446 23,626 (17,180)<br />

The decrease <strong>of</strong> Reserves for risks and charges <strong>of</strong> 17,180 million euros is ma<strong>in</strong>ly due to <strong>the</strong> decrease <strong>of</strong> <strong>in</strong>surance policy liabilities and<br />

accruals and <strong>of</strong> Insurance policy liabilities and accruals where <strong>the</strong> <strong>in</strong>vestment risk is borne by policyholders, and those related to<br />

pension plans (16,511 million euros), upon sale <strong>of</strong> <strong>the</strong> Toro Assicurazioni Group. The decrease <strong>in</strong> <strong>the</strong> O<strong>the</strong>r liabilities and risk reserves<br />

and Reserve for pensions <strong>of</strong> -310 million euros is due to <strong>the</strong> Change <strong>in</strong> <strong>the</strong> scope <strong>of</strong> consolidation for -89 million euros, negative<br />

Foreign exchange effects for -111 million euros, and changes for -110 million euros.<br />

The Deferred <strong>in</strong>come tax reserve at June 30, <strong>2003</strong> <strong>in</strong>cludes deferred tax liabilities, net <strong>of</strong> deferred tax assets, that have been <strong>of</strong>fset<br />

where possible by <strong>the</strong> <strong>in</strong>dividual companies. The net balance <strong>of</strong> <strong>the</strong> Deferred <strong>in</strong>come tax reserve and Deferred tax assets posted<br />

under o<strong>the</strong>r receivables is broken down as follows:<br />

(<strong>in</strong> millions <strong>of</strong> euros) At 6/30/<strong>2003</strong> At 12/31/2002 Change<br />

Deferred <strong>in</strong>come tax reserve 981 1,236 (255)<br />

Deferred tax assets (3,063) (3,499) 436<br />

Total (2,082) (2,263) 181<br />

The net change with respect to December 31, 2002 shows net assets that are lower by 181 million euros. This change derives from<br />

use <strong>of</strong> previously allocated deferred tax assets and new provisions for 81 million euros, <strong>the</strong> foreign exchange effect for 42 million