Annual Report 1997/1998 - Munich Re

Annual Report 1997/1998 - Munich Re

Annual Report 1997/1998 - Munich Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Munich</strong> <strong>Re</strong> <strong><strong>Re</strong>port</strong> of the Board of Management<br />

Insurance markets<br />

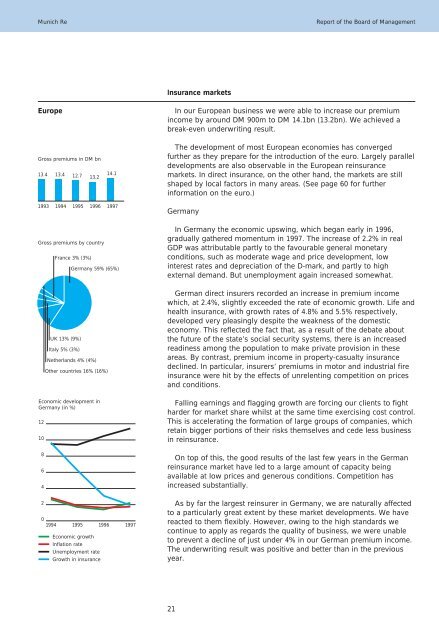

Europe In our European business we were able to increase our premium<br />

income by around DM 900m to DM 14.1bn (13.2bn). We achieved a<br />

break-even underwriting result.<br />

Gross premiums in DM bn<br />

13.4 13.4<br />

12.7<br />

13.2<br />

1993 1994 1995 1996 <strong>1997</strong><br />

Gross premiums by country<br />

France 3% (3%)<br />

UK 13% (9%)<br />

Italy 5% (3%)<br />

14.1<br />

Germany 59% (65%)<br />

Netherlands 4% (4%)<br />

Other countries 16% (16%)<br />

Economic development in<br />

Germany (in %)<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

1994 1995 1996 <strong>1997</strong><br />

Economic growth<br />

Inflation rate<br />

Unemployment rate<br />

Growth in insurance<br />

The development of most European economies has converged<br />

further as they prepare for the introduction of the euro. Largely parallel<br />

developments are also observable in the European reinsurance<br />

markets. In direct insurance, on the other hand, the markets are still<br />

shaped by local factors in many areas. (See page 60 for further<br />

information on the euro.)<br />

Germany<br />

In Germany the economic upswing, which began early in 1996,<br />

gradually gathered momentum in <strong>1997</strong>. The increase of 2.2% in real<br />

GDP was attributable partly to the favourable general monetary<br />

conditions, such as moderate wage and price development, low<br />

interest rates and depreciation of the D-mark, and partly to high<br />

external demand. But unemployment again increased somewhat.<br />

German direct insurers recorded an increase in premium income<br />

which, at 2.4%, slightly exceeded the rate of economic growth. Life and<br />

health insurance, with growth rates of 4.8% and 5.5% respectively,<br />

developed very pleasingly despite the weakness of the domestic<br />

economy. This reflected the fact that, as a result of the debate about<br />

the future of the state’s social security systems, there is an increased<br />

readiness among the population to make private provision in these<br />

areas. By contrast, premium income in property-casualty insurance<br />

declined. In particular, insurers’ premiums in motor and industrial fire<br />

insurance were hit by the effects of unrelenting competition on prices<br />

and conditions.<br />

Falling earnings and flagging growth are forcing our clients to fight<br />

harder for market share whilst at the same time exercising cost control.<br />

This is accelerating the formation of large groups of companies, which<br />

retain bigger portions of their risks themselves and cede less business<br />

in reinsurance.<br />

On top of this, the good results of the last few years in the German<br />

reinsurance market have led to a large amount of capacity being<br />

available at low prices and generous conditions. Competition has<br />

increased substantially.<br />

As by far the largest reinsurer in Germany, we are naturally affected<br />

to a particularly great extent by these market developments. We have<br />

reacted to them flexibly. However, owing to the high standards we<br />

continue to apply as regards the quality of business, we were unable<br />

to prevent a decline of just under 4% in our German premium income.<br />

The underwriting result was positive and better than in the previous<br />

year.<br />

21