Annual Report 1997/1998 - Munich Re

Annual Report 1997/1998 - Munich Re

Annual Report 1997/1998 - Munich Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Munich</strong> <strong>Re</strong> <strong><strong>Re</strong>port</strong> of the Board of Management<br />

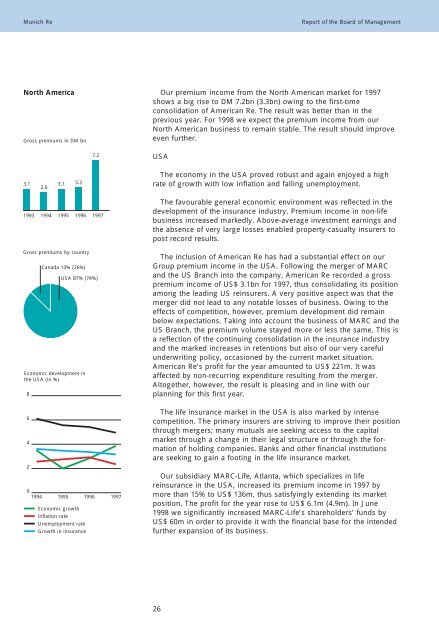

North America Our premium income from the North American market for <strong>1997</strong><br />

shows a big rise to DM 7.2bn (3.3bn) owing to the first-time<br />

consolidation of American <strong>Re</strong>. The result was better than in the<br />

previous year. For <strong>1998</strong> we expect the premium income from our<br />

North American business to remain stable. The result should improve<br />

even further.<br />

Gross premiums in DM bn<br />

3.1<br />

2.6<br />

3.1<br />

3.3<br />

1993 1994 1995 1996 <strong>1997</strong><br />

Gross premiums by country<br />

Canada 13% (26%)<br />

7.2<br />

USA 87% (74%)<br />

Economic development in<br />

the USA (in %)<br />

8<br />

6<br />

4<br />

2<br />

0<br />

1994 1995 1996 <strong>1997</strong><br />

Economic growth<br />

Inflation rate<br />

Unemployment rate<br />

Growth in insurance<br />

USA<br />

The economy in the USA proved robust and again enjoyed a high<br />

rate of growth with low inflation and falling unemployment.<br />

The favourable general economic environment was reflected in the<br />

development of the insurance industry. Premium income in non-life<br />

business increased markedly. Above-average investment earnings and<br />

the absence of very large losses enabled property-casualty insurers to<br />

post record results.<br />

The inclusion of American <strong>Re</strong> has had a substantial effect on our<br />

Group premium income in the USA. Following the merger of MARC<br />

and the US Branch into the company, American <strong>Re</strong> recorded a gross<br />

premium income of US$ 3.1bn for <strong>1997</strong>, thus consolidating its position<br />

among the leading US reinsurers. A very positive aspect was that the<br />

merger did not lead to any notable losses of business. Owing to the<br />

effects of competition, however, premium development did remain<br />

below expectations. Taking into account the business of MARC and the<br />

US Branch, the premium volume stayed more or less the same. This is<br />

a reflection of the continuing consolidation in the insurance industry<br />

and the marked increases in retentions but also of our very careful<br />

underwriting policy, occasioned by the current market situation.<br />

American <strong>Re</strong>’s profit for the year amounted to US$ 221m. It was<br />

affected by non-recurring expenditure resulting from the merger.<br />

Altogether, however, the result is pleasing and in line with our<br />

planning for this first year.<br />

The life insurance market in the USA is also marked by intense<br />

competition. The primary insurers are striving to improve their position<br />

through mergers; many mutuals are seeking access to the capital<br />

market through a change in their legal structure or through the formation<br />

of holding companies. Banks and other financial institutions<br />

are seeking to gain a footing in the life insurance market.<br />

Our subsidiary MARC-Life, Atlanta, which specializes in life<br />

reinsurance in the USA, increased its premium income in <strong>1997</strong> by<br />

more than 15% to US$ 136m, thus satisfyingly extending its market<br />

position. The profit for the year rose to US$ 6.1m (4.9m). In June<br />

<strong>1998</strong> we significantly increased MARC-Life’s shareholders’ funds by<br />

US$ 60m in order to provide it with the financial base for the intended<br />

further expansion of its business.<br />

26