constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Central revenue and the subventions to some <strong>of</strong> the Provinces were fixed by an Order-in-Council, which,<br />

subject to a modification during the war, continued till 15th August,1947.<br />

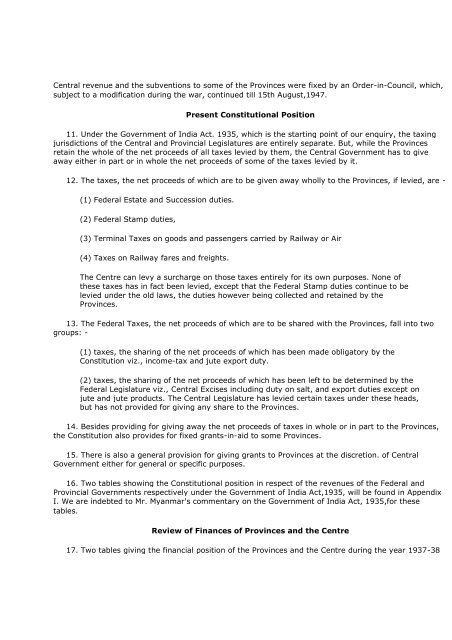

Present Constitutional Position<br />

11. Under the Government <strong>of</strong> India Act. 1935, which is the starting point <strong>of</strong> our enquiry, the taxing<br />

jurisdictions <strong>of</strong> the Central and Provincial Legislatures are entirely separate. But, while the Provinces<br />

retain the whole <strong>of</strong> the net proceeds <strong>of</strong> all taxes levied by them, the Central Government has to give<br />

away either in part or in whole the net proceeds <strong>of</strong> some <strong>of</strong> the taxes levied by it.<br />

12. The taxes, the net proceeds <strong>of</strong> which are to be given away wholly to the Provinces, if levied, are -<br />

(1) Federal Estate and Succession duties.<br />

(2) Federal Stamp duties,<br />

(3) Terminal Taxes on goods and passengers carried by Railway or Air<br />

(4) Taxes on Railway fares and freights.<br />

The Centre can levy a surcharge on those taxes entirely for its own purposes. None <strong>of</strong><br />

these taxes has in fact been levied, except that the Federal Stamp duties continue to be<br />

levied under the old laws, the duties however being collected and retained by the<br />

Provinces.<br />

13. The Federal Taxes, the net proceeds <strong>of</strong> which are to be shared with the Provinces, fall into two<br />

groups: -<br />

(1) taxes, the sharing <strong>of</strong> the net proceeds <strong>of</strong> which has been made obligatory by the<br />

Constitution viz., income-tax and jute export duty.<br />

(2) taxes, the sharing <strong>of</strong> the net proceeds <strong>of</strong> which has been left to be determined by the<br />

Federal Legislature viz., Central Excises including duty on salt, and export duties except on<br />

jute and jute products. The Central Legislature has levied certain taxes under these heads,<br />

but has not provided for giving any share to the Provinces.<br />

14. Besides providing for giving away the net proceeds <strong>of</strong> taxes in whole or in part to the Provinces,<br />

the Constitution also provides for fixed grants-in-aid to some Provinces.<br />

15. There is also a general provision for giving grants to Provinces at the discretion. <strong>of</strong> Central<br />

Government either for general or specific purposes.<br />

16. Two tables showing the Constitutional position in respect <strong>of</strong> the revenues <strong>of</strong> the Federal and<br />

Provincial Governments respectively under the Government <strong>of</strong> India Act,1935, will be found in Appendix<br />

I. We are indebted to Mr. Myanmar's commentary on the Government <strong>of</strong> India Act, 1935,for these<br />

tables.<br />

Review <strong>of</strong> Finances <strong>of</strong> Provinces and the Centre<br />

17. Two tables giving the financial position <strong>of</strong> the Provinces and the Centre during the year 1937-38

![gÉÉŌ A.]ÉŌ. xÉÉxÉÉ](https://img.yumpu.com/8015720/1/190x245/geeo-aeo-xeexee.jpg?quality=85)