constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

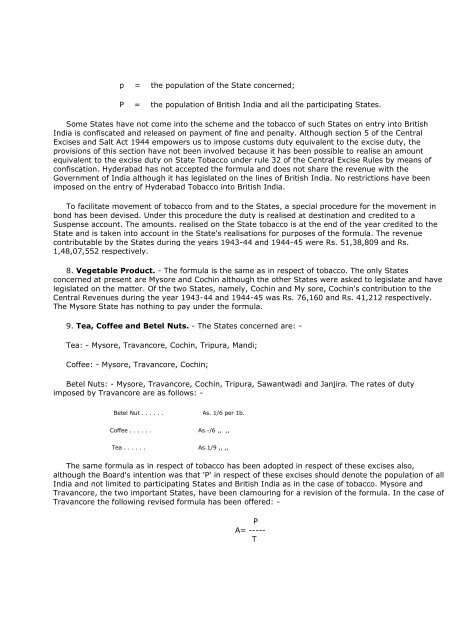

p = the population <strong>of</strong> the State concerned;<br />

P = the population <strong>of</strong> British India and all the participating States.<br />

Some States have not come into the scheme and the tobacco <strong>of</strong> such States on entry into British<br />

India is confiscated and released on payment <strong>of</strong> fine and penalty. Although section 5 <strong>of</strong> the Central<br />

Excises and Salt Act 1944 empowers us to impose customs duty equivalent to the excise duty, the<br />

provisions <strong>of</strong> this section have not been involved because it has been possible to realise an amount<br />

equivalent to the excise duty on State Tobacco under rule 32 <strong>of</strong> the Central Excise Rules by means <strong>of</strong><br />

confiscation. Hyderabad has not accepted the formula and does not share the revenue with the<br />

Government <strong>of</strong> India although it has legislated on the lines <strong>of</strong> British India. No restrictions have been<br />

imposed on the entry <strong>of</strong> Hyderabad Tobacco into British India.<br />

To facilitate movement <strong>of</strong> tobacco from and to the States, a special procedure for the movement in<br />

bond has been devised. Under this procedure the duty is realised at destination and credited to a<br />

Suspense account. The amounts. realised on the State tobacco is at the end <strong>of</strong> the year credited to the<br />

State and is taken into account in the State's realisations for purposes <strong>of</strong> the formula. The revenue<br />

contributable by the States during the years 1943-44 and 1944-45 were Rs. 51,38,809 and Rs.<br />

1,48,07,552 respectively.<br />

8. Vegetable Product. - The formula is the same as in respect <strong>of</strong> tobacco. The only States<br />

concerned at present are Mysore and Cochin although the other States were asked to legislate and have<br />

legislated on the matter. Of the two States, namely, Cochin and My sore, Cochin's contribution to the<br />

Central Revenues during the year 1943-44 and 1944-45 was Rs. 76,160 and Rs. 41,212 respectively.<br />

The Mysore State has nothing to pay under the formula.<br />

9. Tea, C<strong>of</strong>fee and Betel Nuts. - The States concerned are: -<br />

Tea: - Mysore, Travancore, Cochin, Tripura, Mandi;<br />

C<strong>of</strong>fee: - Mysore, Travancore, Cochin;<br />

Betel Nuts: - Mysore, Travancore, Cochin, Tripura, Sawantwadi and Janjira. The rates <strong>of</strong> duty<br />

imposed by Travancore are as follows: -<br />

Betel Nut . . . . . . As. 1/6 per 1b.<br />

C<strong>of</strong>fee . . . . . . As.-/6 ,, ,,<br />

Tea . . . . . . As.1/9 ,, ,,<br />

The same formula as in respect <strong>of</strong> tobacco has been adopted in respect <strong>of</strong> these excises also,<br />

although the Board's intention was that 'P' in respect <strong>of</strong> these excises should denote the population <strong>of</strong> all<br />

India and not limited to participating States and British India as in the case <strong>of</strong> tobacco. Mysore and<br />

Travancore, the two important States, have been clamouring for a revision <strong>of</strong> the formula. In the case <strong>of</strong><br />

Travancore the following revised formula has been <strong>of</strong>fered: -<br />

P<br />

A= -----<br />

T

![gÉÉŌ A.]ÉŌ. xÉÉxÉÉ](https://img.yumpu.com/8015720/1/190x245/geeo-aeo-xeexee.jpg?quality=85)