constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

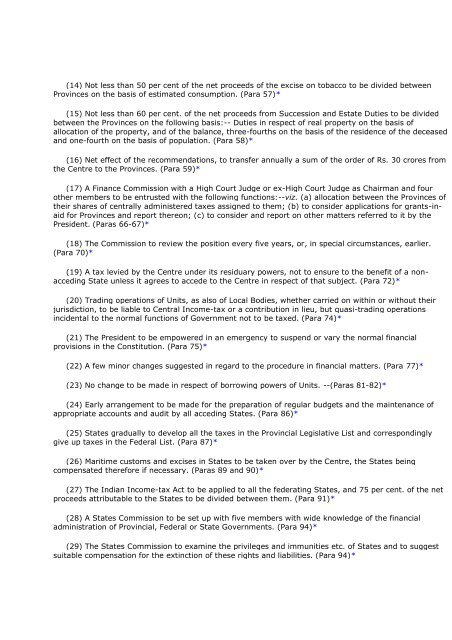

(14) Not less than 50 per cent <strong>of</strong> the net proceeds <strong>of</strong> the excise on tobacco to be divided between<br />

Provinces on the basis <strong>of</strong> estimated consumption. (Para 57)*<br />

(15) Not less than 60 per cent. <strong>of</strong> the net proceeds from Succession and Estate Duties to be divided<br />

between the Provinces on the following basis:-- Duties in respect <strong>of</strong> real property on the basis <strong>of</strong><br />

allocation <strong>of</strong> the property, and <strong>of</strong> the balance, three-fourths on the basis <strong>of</strong> the residence <strong>of</strong> the deceased<br />

and one-fourth on the basis <strong>of</strong> population. (Para 58)*<br />

(16) Net effect <strong>of</strong> the recommendations, to transfer annually a sum <strong>of</strong> the order <strong>of</strong> Rs. 30 crores from<br />

the Centre to the Provinces. (Para 59)*<br />

(17) A Finance Commission with a High Court Judge or ex-High Court Judge as Chairman and four<br />

other members to be entrusted with the following functions:--viz. (a) allocation between the Provinces <strong>of</strong><br />

their shares <strong>of</strong> centrally administered taxes assigned to them; (b) to consider applications for grants-inaid<br />

for Provinces and report thereon; (c) to consider and report on other matters referred to it by the<br />

President. (Paras 66-67)*<br />

(18) The Commission to review the position every five years, or, in special circumstances, earlier.<br />

(Para 70)*<br />

(19) A tax levied by the Centre under its residuary powers, not to ensure to the benefit <strong>of</strong> a nonacceding<br />

State unless it agrees to accede to the Centre in respect <strong>of</strong> that subject. (Para 72)*<br />

(20) Trading operations <strong>of</strong> Units, as also <strong>of</strong> Local Bodies, whether carried on within or without their<br />

jurisdiction, to be liable to Central Income-tax or a contribution in lieu, but quasi-trading operations<br />

incidental to the normal functions <strong>of</strong> Government not to be taxed. (Para 74)*<br />

(21) The President to be empowered in an emergency to suspend or vary the normal financial<br />

provisions in the Constitution. (Para 75)*<br />

(22) A few minor changes suggested in regard to the procedure in financial matters. (Para 77)*<br />

(23) No change to be made in respect <strong>of</strong> borrowing powers <strong>of</strong> Units. --(Paras 81-82)*<br />

(24) Early arrangement to be made for the preparation <strong>of</strong> regular budgets and the maintenance <strong>of</strong><br />

appropriate accounts and audit by all acceding States. (Para 86)*<br />

(25) States gradually to develop all the taxes in the Provincial Legislative List and correspondingly<br />

give up taxes in the Federal List. (Para 87)*<br />

(26) Maritime customs and excises in States to be taken over by the Centre, the States being<br />

compensated therefore if necessary. (Paras 89 and 90)*<br />

(27) The Indian Income-tax Act to be applied to all the federating States, and 75 per cent. <strong>of</strong> the net<br />

proceeds attributable to the States to be divided between them. (Para 91)*<br />

(28) A States Commission to be set up with five members with wide knowledge <strong>of</strong> the financial<br />

administration <strong>of</strong> Provincial, Federal or State Governments. (Para 94)*<br />

(29) The States Commission to examine the privileges and immunities etc. <strong>of</strong> States and to suggest<br />

suitable compensation for the extinction <strong>of</strong> these rights and liabilities. (Para 94)*

![gÉÉŌ A.]ÉŌ. xÉÉxÉÉ](https://img.yumpu.com/8015720/1/190x245/geeo-aeo-xeexee.jpg?quality=85)