constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

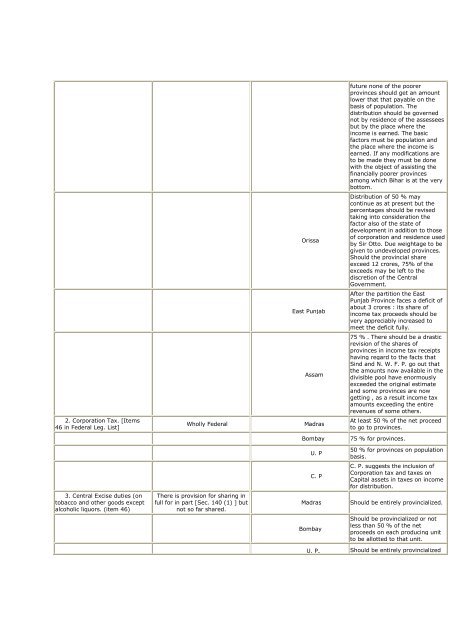

2. Corporation Tax. [Items<br />

46 in Federal Leg. List]<br />

3. Central Excise duties (on<br />

tobacco and other goods except<br />

alcoholic liquors. (item 46)<br />

Orissa<br />

East Punjab<br />

Assam<br />

Wholly Federal Madras<br />

There is provision for sharing in<br />

full for in part [Sec. 140 (1) ] but<br />

not so far shared.<br />

future none <strong>of</strong> the poorer<br />

provinces should get an amount<br />

lower that that payable on the<br />

basis <strong>of</strong> population. The<br />

distribution should be governed<br />

not by residence <strong>of</strong> the assessees<br />

but by the place where the<br />

income is earned. The basic<br />

factors must be population and<br />

the place where the income is<br />

earned. If any modifications are<br />

to be made they must be done<br />

with the object <strong>of</strong> assisting the<br />

financially poorer provinces<br />

among which Bihar is at the very<br />

bottom.<br />

Distribution <strong>of</strong> 50 % may<br />

continue as at present but the<br />

percentages should be revised<br />

taking into consideration the<br />

factor also <strong>of</strong> the state <strong>of</strong><br />

development in addition to those<br />

<strong>of</strong> corporation and residence used<br />

by Sir Otto. Due weightage to be<br />

given to undeveloped provinces.<br />

Should the provincial share<br />

exceed 12 crores, 75% <strong>of</strong> the<br />

exceeds may be left to the<br />

discretion <strong>of</strong> the Central<br />

Government.<br />

After the partition the East<br />

Punjab Province faces a deficit <strong>of</strong><br />

about 3 crores : its share <strong>of</strong><br />

income tax proceeds should be<br />

very appreciably increased to<br />

meet the deficit fully.<br />

75 % . There should be a drastic<br />

revision <strong>of</strong> the shares <strong>of</strong><br />

provinces in income tax receipts<br />

having regard to the facts that<br />

Sind and N. W. F. P. go out that<br />

the amounts now available in the<br />

divisible pool have enormously<br />

exceeded the original estimate<br />

and some provinces are now<br />

getting , as a result income tax<br />

amounts exceeding the entire<br />

revenues <strong>of</strong> some others.<br />

At least 50 % <strong>of</strong> the net proceed<br />

to go to provinces.<br />

Bombay 75 % for provinces.<br />

U. P<br />

C. P<br />

50 % for provinces on population<br />

basis.<br />

C. P. suggests the inclusion <strong>of</strong><br />

Corporation tax and taxes on<br />

Capital assets in taxes on income<br />

for distribution.<br />

Madras Should be entirely provincialized.<br />

Bombay<br />

Should be provincialized or not<br />

less than 50 % <strong>of</strong> the net<br />

proceeds on each producing unit<br />

to be allotted to that unit.<br />

U. P. Should be entirely provincialized

![gÉÉŌ A.]ÉŌ. xÉÉxÉÉ](https://img.yumpu.com/8015720/1/190x245/geeo-aeo-xeexee.jpg?quality=85)