constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

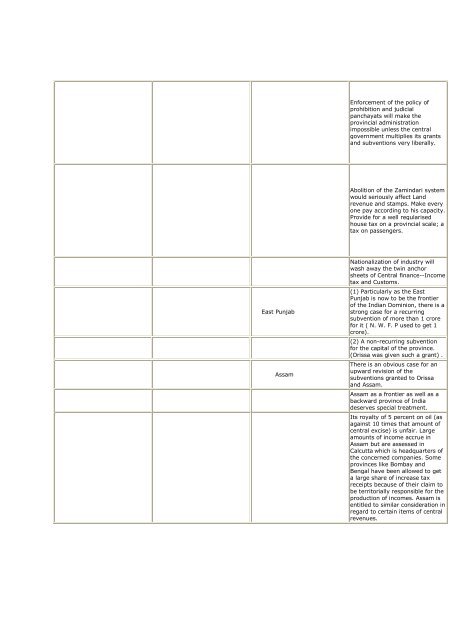

East Punjab<br />

Assam<br />

Enforcement <strong>of</strong> the policy <strong>of</strong><br />

prohibition and judicial<br />

panchayats will make the<br />

provincial administration<br />

impossible unless the central<br />

government multiplies its grants<br />

and subventions very liberally.<br />

Abolition <strong>of</strong> the Zamindari system<br />

would seriously affect Land<br />

revenue and stamps. Make every<br />

one pay according to his capacity.<br />

Provide for a well regularised<br />

house tax on a provincial scale; a<br />

tax on passengers.<br />

Nationalization <strong>of</strong> industry will<br />

wash away the twin anchor<br />

sheets <strong>of</strong> Central finance--Income<br />

tax and Customs.<br />

(1) Particularly as the East<br />

Punjab is now to be the frontier<br />

<strong>of</strong> the Indian Dominion, there is a<br />

strong case for a recurring<br />

subvention <strong>of</strong> more than 1 crore<br />

for it ( N. W. F. P used to get 1<br />

crore).<br />

(2) A non-recurring subvention<br />

for the capital <strong>of</strong> the province.<br />

(Orissa was given such a grant) .<br />

There is an obvious case for an<br />

upward revision <strong>of</strong> the<br />

subventions granted to Orissa<br />

and Assam.<br />

Assam as a frontier as well as a<br />

backward province <strong>of</strong> India<br />

deserves special treatment.<br />

Its royalty <strong>of</strong> 5 percent on oil (as<br />

against 10 times that amount <strong>of</strong><br />

central excise) is unfair. Large<br />

amounts <strong>of</strong> income accrue in<br />

Assam but are assessed in<br />

Calcutta which is headquarters <strong>of</strong><br />

the concerned companies. Some<br />

provinces like Bombay and<br />

Bengal have been allowed to get<br />

a large share <strong>of</strong> increase tax<br />

receipts because <strong>of</strong> their claim to<br />

be territorially responsible for the<br />

production <strong>of</strong> incomes. Assam is<br />

entitled to similar consideration in<br />

regard to certain items <strong>of</strong> central<br />

revenues.

![gÉÉŌ A.]ÉŌ. xÉÉxÉÉ](https://img.yumpu.com/8015720/1/190x245/geeo-aeo-xeexee.jpg?quality=85)